Probability of Profit

“Trading is a game of probabilities. The probability of profit is what keeps us going, while the probability of loss is what keeps us humble.”

In options trading, the probability of profit (POP) is a crucial metric that traders use to assess the likelihood of making a profit i.e. minimum of 1 INR on a given trade. It’s a useful metric that’s influenced by various factors such as whether we’re buying or selling options, or if we’re lowering the cost basis of a stock that we’re long or short on.

POP wrt Selling Options

So, imagine you’ve bought a stock, and you’re thinking, “I have a 50-50 chance of making a profit on this”.

When selling options, we can choose strike prices that are out of the money, meaning that the stock price would have to move in the opposite direction for the option to be exercised, increasing the probability of profit.

So what if instead, you sell options that are either at strikes that are at the money (where the stock price is trading) or out of the money (at a better price than where the stock price is trading)?

Well, now your probability of profit is always greater than 50%! Let’s take a look at an example to understand it better.

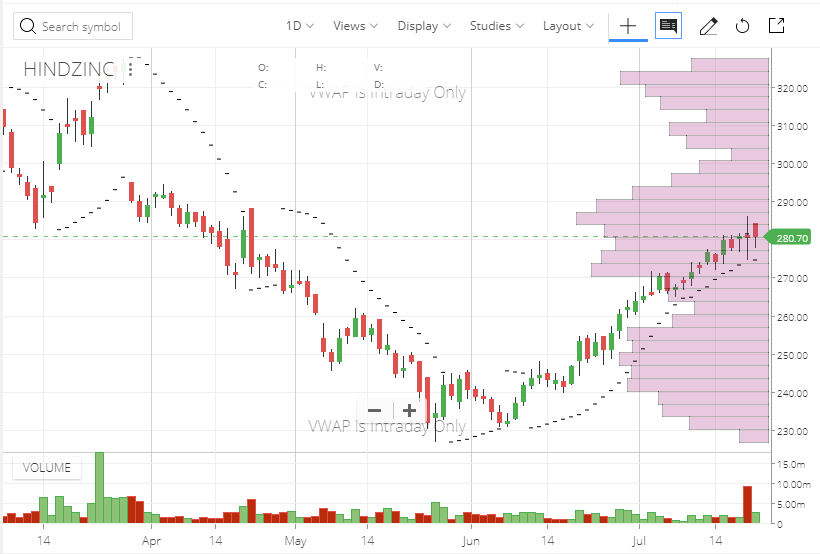

- The CMP of Hindustan Zinc is 280.7.

- The CMP of Hindustan Zinc July Futures is 281.35.

- The CMP of Hindustan Zinc July 280 Call options is 5

We shall discuss pricing of futures later, but at the time of expiry CMP of Hindustan Zinc July Futures which is at 281.35 – 280.7 = 0.65 INR premium. It means if we sell futures, we will be always at 0.65 INR more profit than stocks at the time of expiry..

The CMP of Hindustan Zinc 280 CE is 5 which means if I sell this option our breakeven point is 285.

The lot size of Hindustan Zinc 280CE or Hindustan Zinc futures is 3200. So, if we summarize –

POP of shorting Hindustan Zinc 280CE > POP of shorting Hindustan Zinc July Futures > POP of shorting 3200 qty Hindustan Zinc Shares

If we talk about the case of buying then –

POP of buying Hindustan Zinc July Futures < POP of buying 3200 qty Hindustan Zinc Shares

So, futures contract is mostly a boon for shorters as the premium is positive. However, there are times when it can turn negative too. Nevertheless, options is always have higher probability of profit than both!

Here are few other points that shows Why Option Selling has higher POP –

- When selling options, we can choose strike prices that are out of the money, meaning that the stock price would have to move in the opposite direction for the option to be exercised, increasing the probability of profit.

- Options have a time decay component, which means that as time passes, the value of the option decreases. This benefits the seller, who profits from the decline in value.

- When we sell options, we receive a premium upfront which can act as a buffer against losses on our position. This premium can partially or fully offset losses if the stock moves against us.

POP wrt Buying Options

When it comes to option buying, the probability of profit is inherently lower compared to option selling.

In Option selling we need to lose the premium first to make a loss; In Option buying, we need to earn the premium first to make a profit.

When we talk about probability of profit and buying options, we usually mean buying spreads. If we buy a naked option, it’s the worst thing we can do for our break-even because we don’t hedge the cost of the option in any way (which means hedging to make a sure shot profit to gain back our premium). That’s why we go for spreads.

Our aim is to get a breakeven price that’s very close to where the stock price is trading or slightly better in the best case scenario. This ensures that we have around a 50% probability of profit or a little bit better.