Understanding the Margin

When buying an option, the buyer only needs to pay the premium amount; there is no margin required as the buyer’s maximum loss is limited to the premium paid.

Conversely, selling an option requires paying the margin, and once the trade is executed, the ledger will be credited with the premium. It reduces the effective margin of the executed trade.

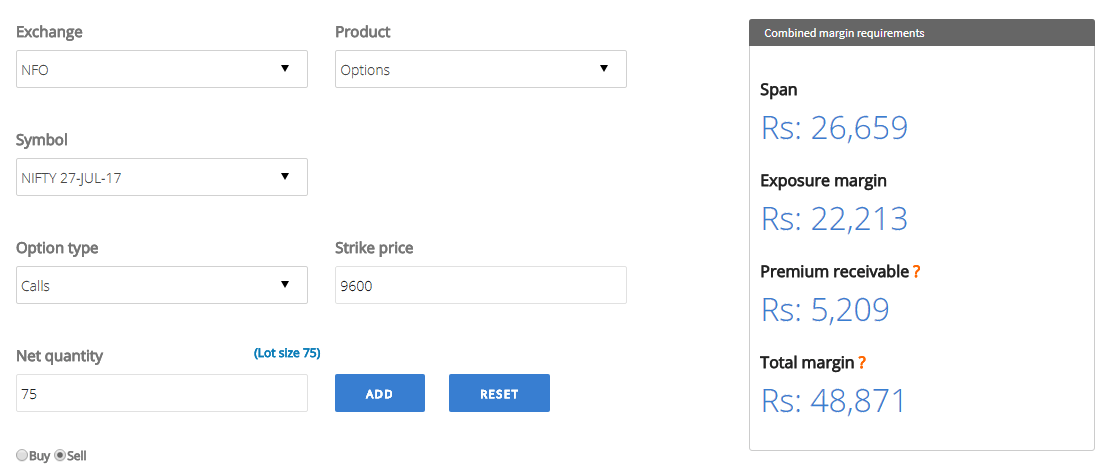

As per the above image, to sell NIFTY July 9600 CE we need a margin of 48,871 INR. Once our trade is executed, 5,209 INR will be credited to our available margin.

In the world of options trading, it is crucial to have a clear understanding of margin requirements and premium payment. While exchanges block the margin required for executing an options trade, the premium is paid by the option buyer directly and immediately. However, not all brokers are reliable, and some may manipulate their own rules to block the premium receivable.

Seller:

Note, If a trade requires a margin of 48,871 INR and the premium is 5,209 INR, the entire 48,871 INR will need to be available to execute the trade, and the premium will be credited immediately by the option buyer.

Let’s say you have a margin of 48,000 INR, you will not be able to execute this trade. However, if you have a margin of 48,872 INR, you can execute the trade, and instead of having just 1 INR as a margin, you will have 5,210 INR as a margin.

This margin can be used for buying another option, buying or selling futures, buying shares for delivery, selling other options, or simply using it as a regular margin.

Buyer:

While it may seem that a margin of 5,209 INR is required to buy a 9600 CE option, it is theoretically wrong. In reality, the margin required is zero, but a minimum balance of 5,209 INR needs to be maintained in the account for the margin to be debited.

It is essential to have a clear understanding of these concepts to avoid confusion and make informed decisions when trading options.

So, when you start trading on the stock and commodity exchanges in India, they usually block margins. These margins have two parts – SPAN margins and Exposure margins. Let me explain a little about SPAN margins.

Span Margin

SPAN margins come from something called SPAN, which stands for Standard Portfolio Analysis of Risk. It’s a way to measure portfolio risk. In the Indian stock market, people also call it VaR margin or initial margin, which is the minimum margin you need to start trading.

Now, here’s the thing – the SPAN margin is different for every security. Why? Well, it depends on how risky the security is (also known as volatility). For example:

The SPAN margin for an Index will be lower than the SPAN margin for a single stock. This is because the risk of a portfolio/index is usually lower than that of a specific stock or security.

Another factor they consider when deciding on SPAN margins is the historic volatility of the underlying. In other words, if a security has a low volatility, the SPAN will be lower, and if it has high volatility, the SPAN margin requirement will be higher.

Exposure Margin

In addition to SPAN margin which is collected at the time of initiating trades, an additional margin over and above the SPAN margin is collected which is known as the Exposure margin and is also known as additional margin.

Why do they collect it? Well, it’s to protect the broker’s liability in case the markets go crazy and swing wildly. You know how unpredictable the stock market can be!

Total Margin = SPAN Margin + Exposure Margin – Spread Benefit

- Now, the SPAN margin for a particular security keeps changing depending on how volatile the underlying is.

- But the Exposure margin usually stays the same – its main purpose is to work as an extra safety net.

Exposure margin doesn’t have the same value as SPAN margin.

It’s important to note that the Exposure margin isn’t the same as the SPAN margin. They’re two different things!

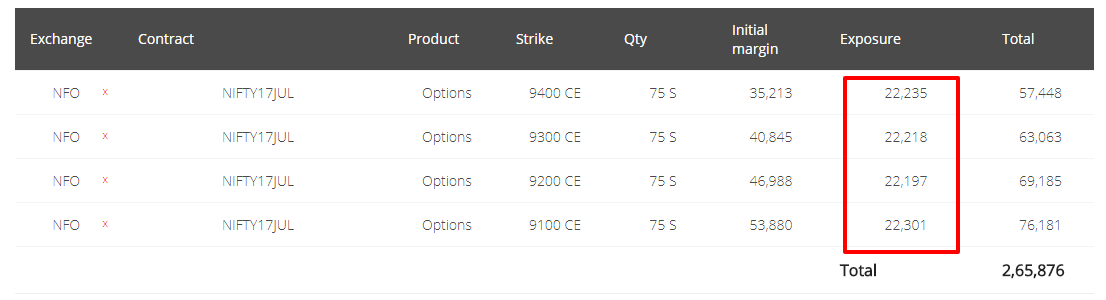

We’ll talk about Spread Benefit later, but for now, let me give you an example. Take a look at the table below – it shows that the Exposure margin stays the same for different strike prices of options of the same underlying (here it is NIFTY).–

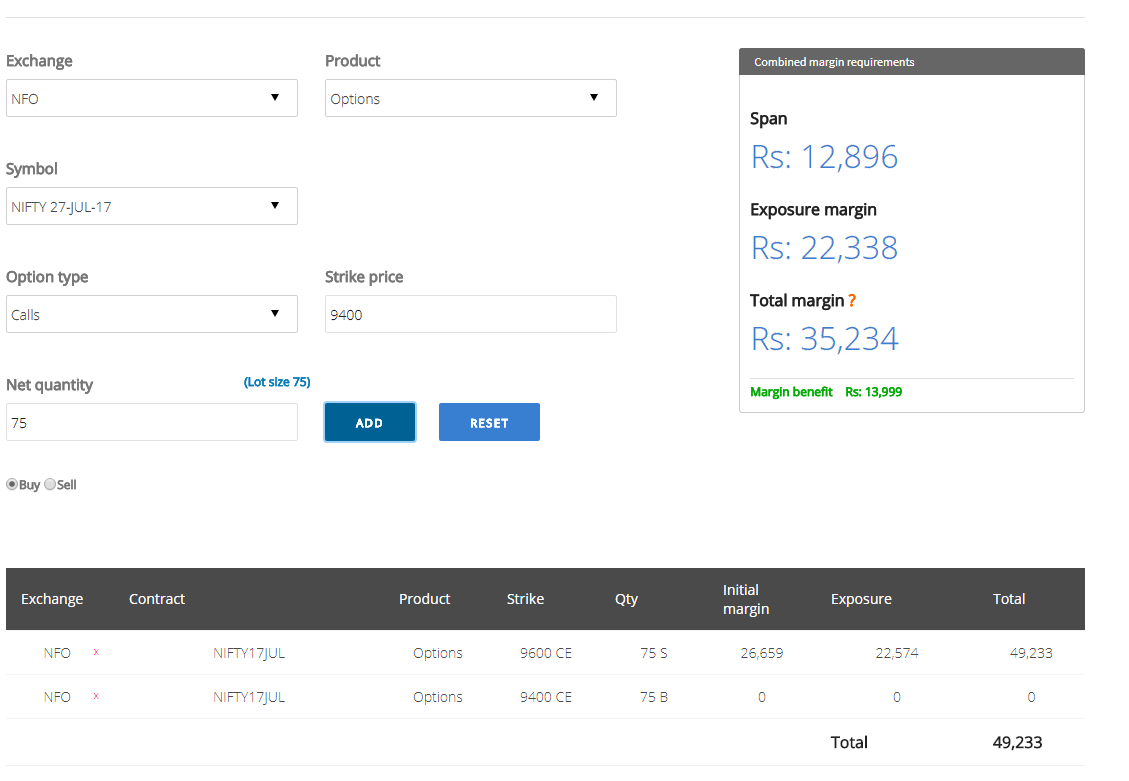

Hey, have you ever wondered why it’s important to know how much margin you need for trading? For example, let’s say you’re thinking of selling 9600 CE, which is OTM (Out of the Money). And let’s say the spot price of NIFTY is 9520.9. In this case, you’d need to know how much margin you’ll need to put up for this trade.

If you’re trading with Zerodha, check out this snapshot below to see how much margin you’d need:

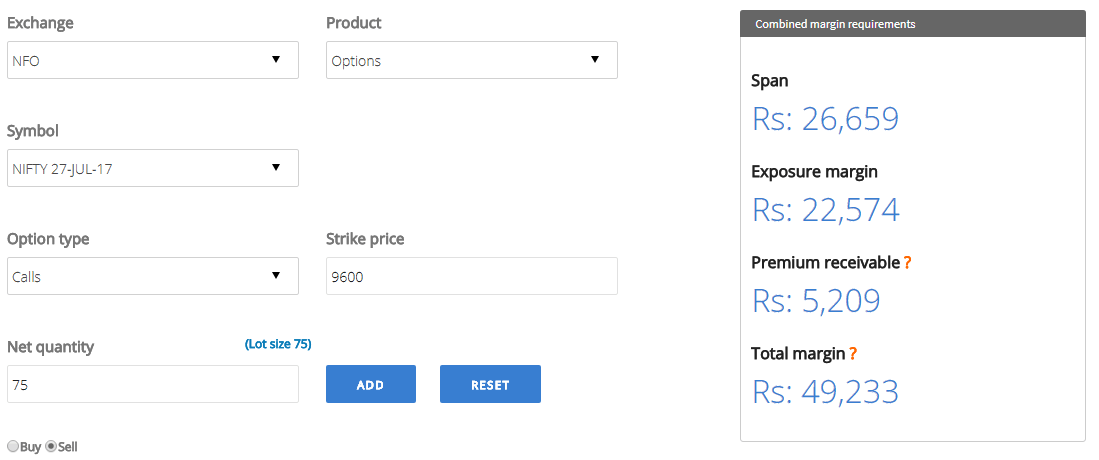

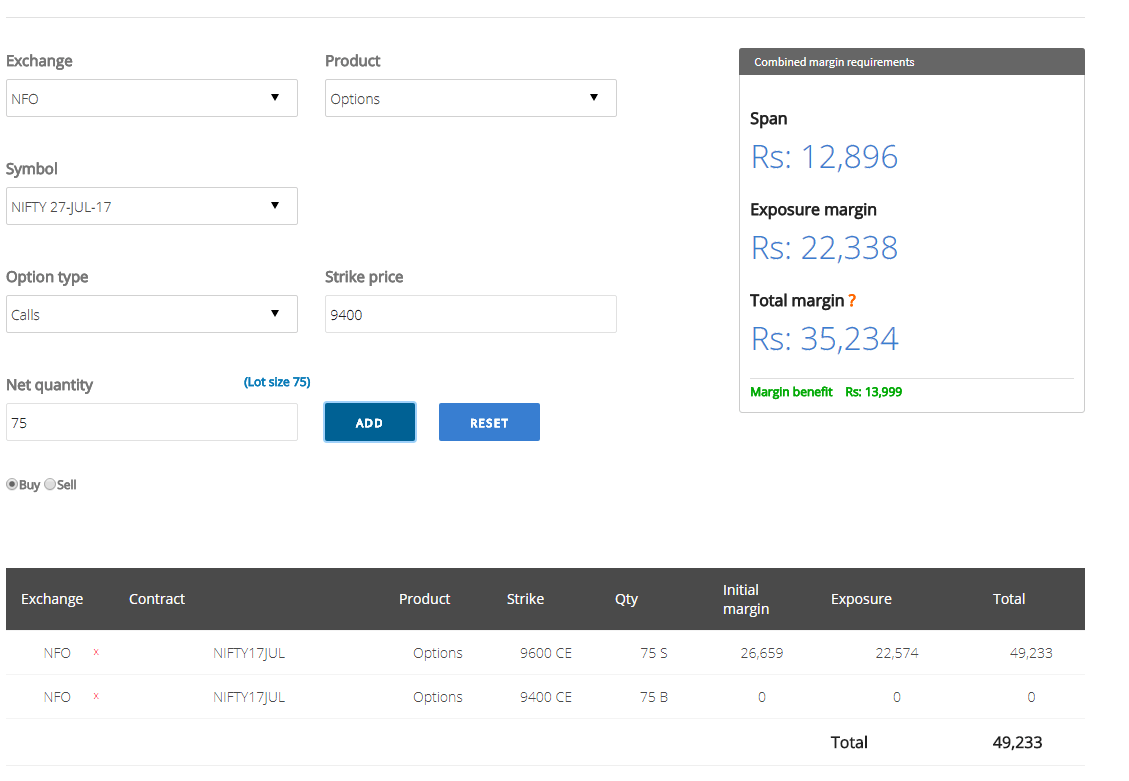

And, Here is a snapshot below of how much margin is needed in Upstox –

When we are going to sell NIFTY 9600 CE Zerodha is taking 49,233 INR as margin and Upstox takes 48,1138.75 INR as margin. Now, What about Options Spreads?

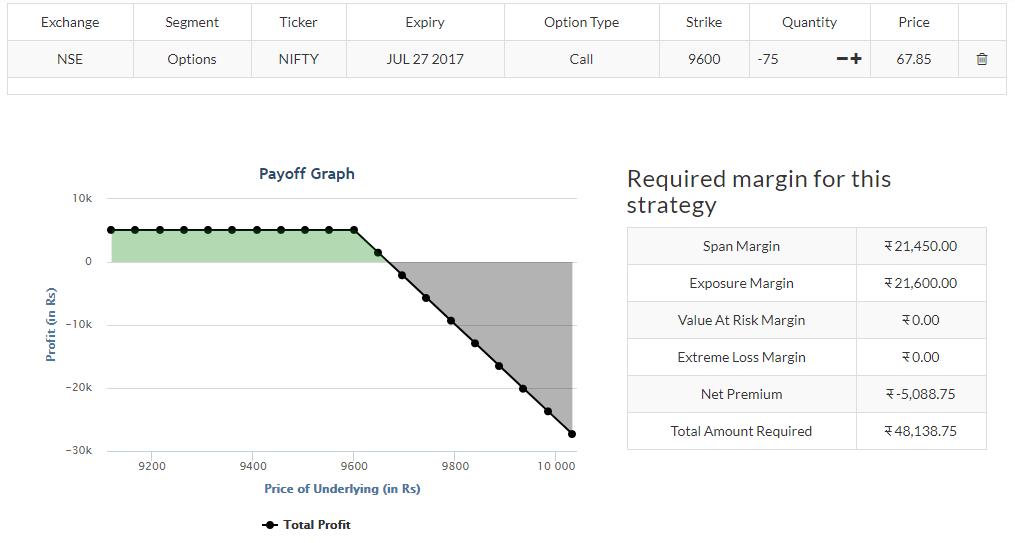

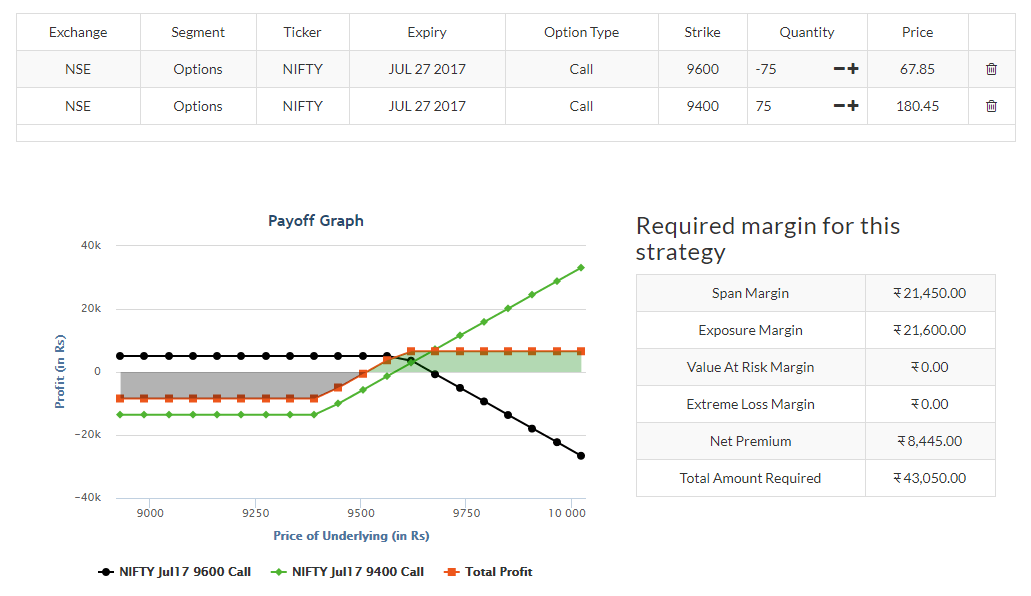

Now let’s construct a bull spread on Upstox and Zerodha both and compare them. We shall do this using selling 9600 CE and buying 9400 CE.

Here are snapshot of both of the brokers below –

se who don’t Upstox is better.

Q. Sorry I didn’t understand, why it is theoretically wrong? If the options margin gets debited from buyer’s account immediately, then why are we calling that required margin is zero as you can’t execute the trade until you pay the full premium?

A. Now suppose you have a NIFTY 9600 CE sell. You won’t need any margin at all while buying NIFTY 9400 CE. In fact, you get more margin back.

Q. So in total when we sell 9600 CE we get the premium which we then use to buy 9400 CE? Is this how we save 10000 INR?

A. We’re getting the premium of 9600 CE anyways with or without buying 9400 CE. We’re saving additional money around 7,816 INR as margin in Zerodha.

Let’s do maths –

Selling 9600 CE takes 49,233 INR as margin and gives 5,209 INR as premium, Net margin consumed (don’t use the word needed as net margin needed is 49,233 INR) = 44,024 INR

Net Margin needed (You don’t get premium here as your premium receivable is used towards your payment of premium for 9400 CE) = 35,234 INR

Theoretically, you get the premium but it is immediately used to pay the premium you are supposed to pay to the option seller who is selling 9400 CE (as you are a buyer here).

Net Benefit = 44,024 – 35,234 = 8,790 INR actually.

Suppose, we have a 9600 CE sell. Now you get a short term intraday opportunity where NIFTY may spike up.

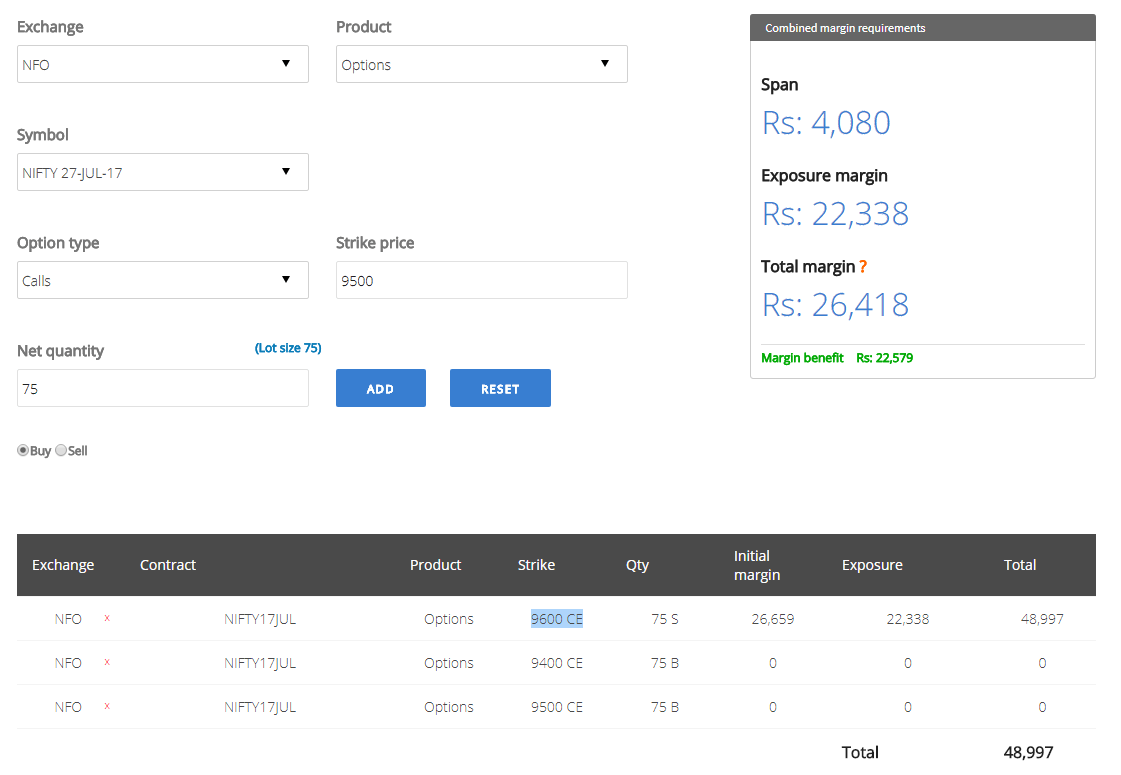

You can buy 9400 CE, 9500 CE without having margin now.

Not only that, you will get the additional margin. Now, we have added 9400 CE, 9500 CE buy now with 9600 CE sell.

Q. Thanks for explaining. I never noticed it earlier. So, when we sell an option because of portfolio & risk we have to pay “Initial” & “Exposure margin”. However, when we are buying other options, our overall risk for portfolio & exposure with the broker reduces, hence, we get the benefit of Margin. Is it right?

A. Yes, bro but it also depends on broker too. Upstox doesn’t give any margin. We will calculate the margin benefits part later until then just know that there is this benefit.

Selling 9600 CE takes 49,233 INR as margin and gives 5,209 INR as premium,

Net margin consumed (don’t use the word needed as net margin needed is 49,233 INR) = 44,024 INR

Current CMP of Nifty July 9400 CE is 186.65

To buy 9400 CE we need to pay the premium of (75*186.65) = 13998.75 INR ~ 13999 INR

So if we take these two trades of selling 9600 CE and buying 9400 CE separately, our net margin to be consumed is 44,024 +13,999 = 58,023 INR

But we are selling NIFTY 9600 CE and buying NIFTY 9400CE; constructing a bull spread; Zerodha is taking 35,234 INR whereas Upstox is taking 43,050 INR. Different broker has different benefits.

| Note –

Hey, did you know that the rules for margins are always changing? It’s true! And recently, SEBI (the regulatory body for Indian securities markets) made an amendment to the rules that allows traders to get a big margin benefit if they have protected options spreads. Now, I should tell you that the examples I’ve given in the above might not be accurate anymore – that’s just how quickly the rules can change. But the point is that the basic concept of span margin and exposure margin will stay the same. |

It’s important to stay up-to-date on the latest margin rules, as it impacts our trading strategies the most.

But no matter what, knowing about span margin and exposure margin is a key part of understanding how margin works in the stock market.

–