Breakeven Points

Imagine this scenario: You sell a contract for the BN (Bank NIFTY) 6th Sept 28400 CE (call option) and the expiry date is also 6th September.

Now, if on the day of expiry, i.e., Thursday, 6th September, the BN index closes at the strike price of 28400, the price of this particular contract will be valued at 0. The price of “BN 6th Sep 28400 CE” –

- If BN closes at 28399, it will be priced at 0.

- If BN closes at 28398, it will be priced at 0.

- If BN closes below 28400, it will be priced at 0.

- If BN closes at 28401, it will be priced at 1.

- If BN closes at 28402, it will be priced at 2.

- If BN closes at (28400+x), it will be priced at x.

As an options seller, the goal is to collect premiums by selling options contracts, and the higher the premium, the better it is for the seller.

For instance, if a seller sells a “BN 6th Sep 28400 CE” option at a premium of 100, they will not incur any losses unless BankNIFTY expires above (28400+100) = 28500.

The upper breakeven point, in the context of the above example, is the point at which the seller of the “BN 6th Sep 28400 CE” option will begin to incur losses. To put it another way, if BankNIFTY closes above 28500 at expiration, the seller will begin to lose money on the trade.

The higher BankNIFTY closes above 28500, the greater the losses will be for the seller. 28500 is Upper Breakeven Point here.

Similarly, a put option seller will also have a Lower Break-even Point.

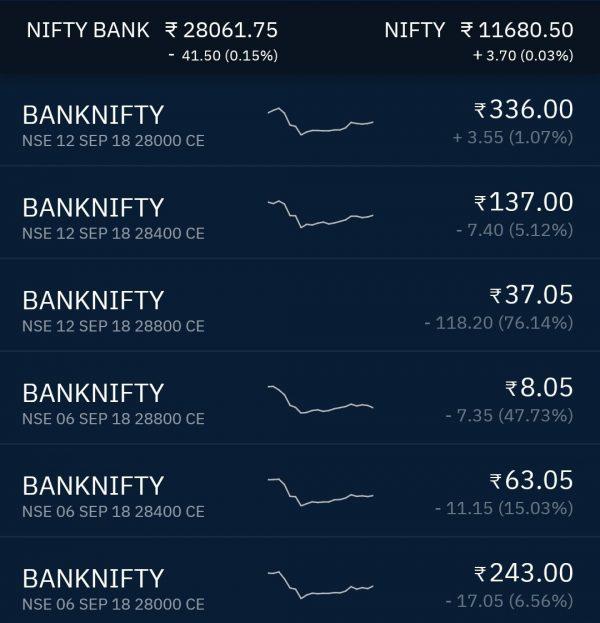

Taking the example of Bank NIFTY 6th Sept 28400 CE at 63.05, options have five components –

- Expiry Date – 6th Sept

- Instrument Name – Bank NIFTY

- Strike Price – 28400

- Direction Bet – Call/Put (Up/Down)

- Cost – 63.05

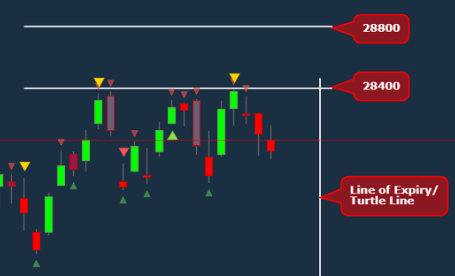

Also, if BankNIFTY goes above 28800. It means it will go above 28400 for certain and by 400 points. So, the price of 28400 CE expiring on 6th Sep is higher than the price of 28800 CE expiring on 6th Sep.

Also, note – the price of 28000 CE expiring on 12th Sep is higher than the price of 28000 CE expiring on 6th Sep.

The higher the time to expiry, the higher the uncertainty. The higher the uncertainty, the higher the premium of the options.