Spend 15 mins a day and Trade options

But if you ask me to pick the best, I will choose a strategy called Price Action. I’m unsure of its name. I learned it during my initial days of Trade Academy.

Still works like a charm.

The main tagline is – ”Spend 15 mins a day and trade options.”. Here goes the strategy –

Look at the daily chart in the last 15 mins of the day, if the candlestick crosses the last swing high buy call options; if the candlestick crosses the last swing low then buy put options.

Risk: Reward ratio is 1:1. Hence target profit and stop loss is both at 30%.

Here is my modification to it. Instead of buying call options sell the put options and instead of buying put options sell the call options.

If you do not know what is a swing high and swing low is –

The strategies on Trade Academy was based on the concept of Swing High and Swing Low. I overcomplicated the basic concept and it took me weeks to figure it out.

A Swing High is a candlestick with at least two lower highs on both the left and right of itself.

A Swing Low is a candlestick with at least two higher lows on both the left and right of itself.

This image solves it all.

There is an indicator in MetaTrader (an awesome trading platform which I use in forex) which identifies the swings automatically – it’s called fractal. But I wanted an indicator which works exactly like the above image. I managed to get an indicator which you can download here which works perfectly as far as I have tested for the H4 chart.

I personally use higher reward and lower risk manually. Also, you can go for long options too. In the daily chart, follow the same and sell At-the-money put options for bullish nature and vice versa.

Here are the backtesting result on July-September trades of Reliance –

Reliance June Trades:

1st June

Bought 900 CE @ Rs. 22.85 | Stoploss – Rs. 16.00 | Target – Rs. 29.70 | Target hit on 2nd June | Profit +30%

11th June

Bought 880 PE @ Rs. 28 | Stoploss – Rs. 19.6 | Target – 36.4 | Stops hit on 12th June | Loss -30%

17th June

Bought 920 CE @ Rs. 39 | Stoploss – Rs. 27.3 | Target – 50.7 | Target hit on 18th June | Profit +30%

Reliance July Trades

15th July

Bought 1000 CE @ Rs. 27.85 | Stoploss – Rs. 19.5 | Target – 36.2 | Target hit on 21st July | Profit +30%

22nd July

Bought 1040 CE @ Rs. 28.30 | – Rs. 19.8 | Target – 36.8 | Target hit on 22nd July | Profit +30%

Reliance August Trades

4th August

Bought 1000 PE @ Rs. 26.35 | StopLoss – Rs. 18.45 | Target – 34.25 | Target hit on 10th August | Profit +30%

20th August

Bought 920 PE @ Rs. 13.65 | StopLoss – Rs. 9.55 | Target – Rs. 17.75 | Target Hit on 21st August | Profit +30%

Reliance September Trades

4th Sept

Bought 840 PE @ 28.05 | StopLoss – Rs. 19.64 | Target – Rs. 36.45

Stops hit on 8th Sept | Loss -30%

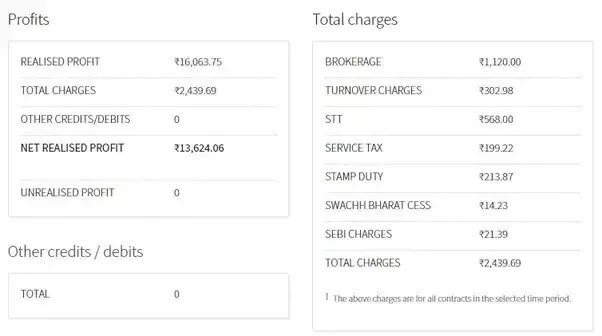

I personally sell options worth of 6,000 INR and booking profit in 2,000 INR. I got 11 profitable trades and 3 loss trades this month.

Though if you do not understand what is an option, swing high or swing low; I strongly recommend you must sign up there and learn the whole course. It’s free. It will take you a night to gallop all the videos up there.

It is indeed a profitable one and easy to understand. If you want to join a group and discuss your strategy, join our trader’s slack channel here.