Marksans Pharma

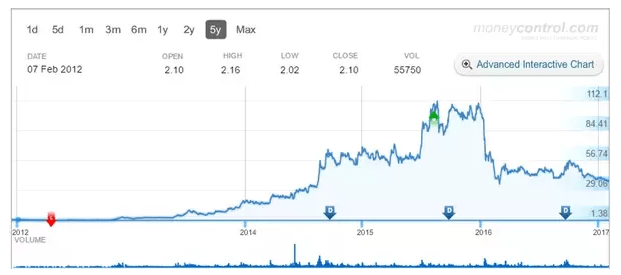

Exactly 5 years ago, if someone had said “ there is a share you can buy at Rs. 2 on 7th Feb 2012 and it will give you 19 times return in exactly 5 years” I would have put in all the money that I can lay my hands on in Marksans Pharma.

If you see the 5-year chart, this stock was trading at Rs. 2 in Feb 2012, rose to hit almost Rs. 115 (a return of almost 57 times), only to crash again and trade at Rs. 38 (for a return of 19 times).

The reasons for this are simple.

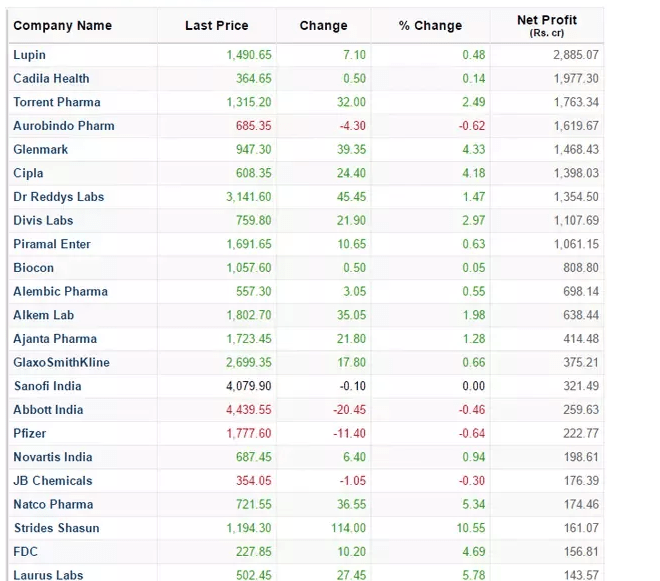

Marksans pharma was being looked at as an option only in 2013 when the pharma sector was re-rated and there was a boom in the investments in this sector. U can see all the pharma stocks – Aurobindo, Lupin, Natco, Dr. Reddys etc were looked upon as a defensive option to the volatile IT and other domestic consumption-oriented sectors.

Also, with the pedigree of Glenmark, it was assumed that Marksans also would become something similar. Hence, high valuations were given, P.E. ‘s went to all time high but the earnings didn’t materialize in the same manner.

Screening Marksan Pharma

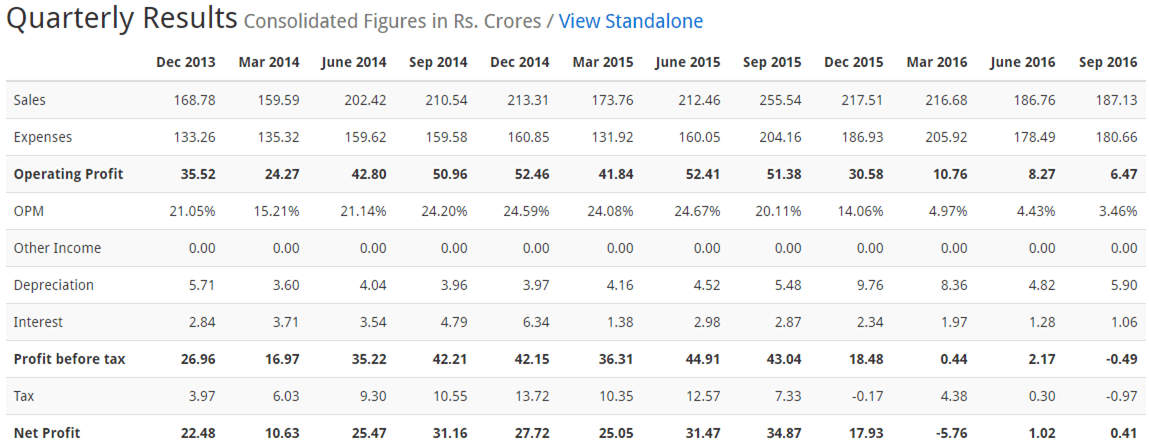

Investors waited patiently, expecting that the EPS would pick up to justify the high growth in the stock price, but the revenues never happened as expected and the EPS didn’t zoom.

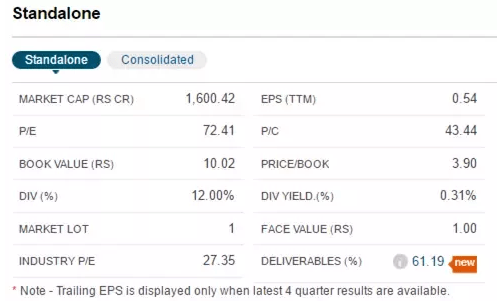

A Rs. 1 face value stock trading at Rs. 38 with an EPS of 0.54 is bad. It means currently the stock price is at Rs. 380 whereas at that price there are better companies like Cadila, Granules India, Suven Life, Dishman Pharma, Indoco remedies etc whose Net profit is in the range of Rs. 50 crore per year.

P/L of other Pharma Stocks

For a full list of all companies in this sector, check here: Top Pharmaceuticals Companies in India, Top Pharmaceuticals Stocks in India by Net Profit, List of Top Pharmaceuticals Stocks in India {2017}

On top of this Marksans has high exposure to the UK Pharma market and with UKMHRA imposing restrictions on the facility for production supply to the UK, the stock tanked. It tanked so hard that 20% down tick became a common thing for almost a week and finally it landed at Rs. 33

After quite a period of consolidation, it started moving up to go to Rs. 58, but again, no support from results or EPS increase. Hence it is languishing at that price. Buy Marksans Pharma; target of Rs 60: Centrum

Every quarter, investors and analysts expecting better performance from this company, give a higher rating, increase the price target etc but it has never lived up to its expectations. On top of it, there were rumors that the promoter has reduced their shareholding in this company (There were bulk deals from other investors: Market Stats, Block Deals) and there is no communication from the management on the actions needed to satisfy UKMHRA.

Unless it has some good things happening, Marksans Pharma Share Price can go nowhere.

Factors on Marksans Pharma Share Price

- The management has to communicate well, to the investors and on the conference calls about the status of the company’s progress to get clearance from UKMHRA.

- There is a need for a clear roadmap on the strategy of the company going forward, the markets they will operate in, the products they will offer etc.

- New product portfolio and expansion have to be spelled out to allay the concerns and for investors to get back the belief in this company.

- New facility construction in another state of India needs to be looked at for alternate arrangements. (Dr. Reddy’s, Cadila, Sun Pharma etc all have had issues with USFDA many times, but they didn’t crumble like Marksans because they moved the production to other facilities).

These, I think are some of the points which can aid in the investor’s belief, get analysts support and rejuvenate the company’s growth onto a higher path. After that, all we need is to stay invested, to get multi-bagger returns, many folds.

Data Credits: Stock Screener for Indian Stocks: Screener.In, Stock/Share Market Investing – Live BSE/NSE, India Stock Market Recommendations, and Tips, Live Stock Markets, Sensex/Nifty, Commodity Market, Investment Portfolio, Financial News, Mutual Funds

Really wonderful article. Every investor must read.

Thank you very much for the appreciation.

Very nice case study ..

[…] Analysis Case Studies: Marksans Pharma Kushal […]

Things are looking up again, might be a good time to look in!