Bodal Chemicals — The Indian Stock Story

Bodal Chemicals

- Current Market Price: 116.65

- Target Price: 180

The current key focus of this report is a thematic investment on specialty chemicals. Thionyl chloride is the component which is used to produce Vinyl Sulphone[1]. China is the largest producer of dyes intermediates (used for dyes production), disperse dyes (end use in the polyester textile segment) and azo dyes. Cheaper imports from China and competition within domestic manufacturers had impacted the profitability of Indian players till FY2013.

Chinese Factory Shutdown and VS Cycle –

Then came environmental claws on those segment and it followed with several Chinese factory shutdowns giving a global supply-demand imbalance. It gave Indian companies like Bodal Chemicals and Kiri Industries a huge push in export sales to fill up the demand created by the absence of Chinese market[2].

The price of VS (Vinyl Sulphone) spiked up. As Bodal Chemicals and Kiri Industries (Well, Atul Limited too.) produce VS and the costing of raw material haven’t increased by a huge margin. So the profit margin widens.

Then, the Chinese market rebounded. Factories opened back. But EBITDA (Earnings before interest, taxes, depreciation, and amortization) stayed consistent rather than falling as showing that the clients didn’t sway back.

So the stock is cyclic and cannot be held for long term. Well, there are companies like Vedanta who are also commodity stocks but generated huge returns for investors. This industry grows by CAGR of 8% which is not sufficient for our investment rules. It is not crash proof either.

The Investment in Kiri Industries –

In Unofficed, We had bought Kiri Industries on 13th April 2017 earlier as you can see here based on the Chinese Factory Shutdown impact and undervaluation of Kiri Industries that time –https://www.tradingview.com/chart/KIRIINDUS/2kCwsjwB-Kiri-Industries-Core-Satellite-Approach/

As you can see, we bought Kiri around 270 and the current price is around 593. But here goes the chart of Bodal Chemicals in the meantime –

The question is why it fell and why Kiri rose up and sustained?

CapEx on Expansion –

It is because the last year the complete focus of Bodal Chemicals this last year is on the expansion of Trion Chloride. It is around 300% expansion and likely to an operative on the next few months. When the news of expansion came into the market it immediately discounted and mean reverted.

But the interesting part is Bodal Chemicals didn’t kill their accounts for the expenses of this expansion. QIPs were there and hence their cash flow is very rich right now.

Kiri Industries Vs Bodal Chemicals –

- Now the flag around Kiri is they are not paying out tax and the part of taxation is not clear.

- The good part around Kiri is their PE is lower than Bodal Chemicals.

- Also, CMP/BV is more favorable towards Kiri.

- But Kiri Industries is looking like they are turning the business around. So it is a very volatile bet.

- Promoter stake is increased in Kiri while it is decreased in Bodal Chemicals but BD has the good increase on institutional investors.

- Kiri Industries don’t favor dividends. BD has a good dividend yield.

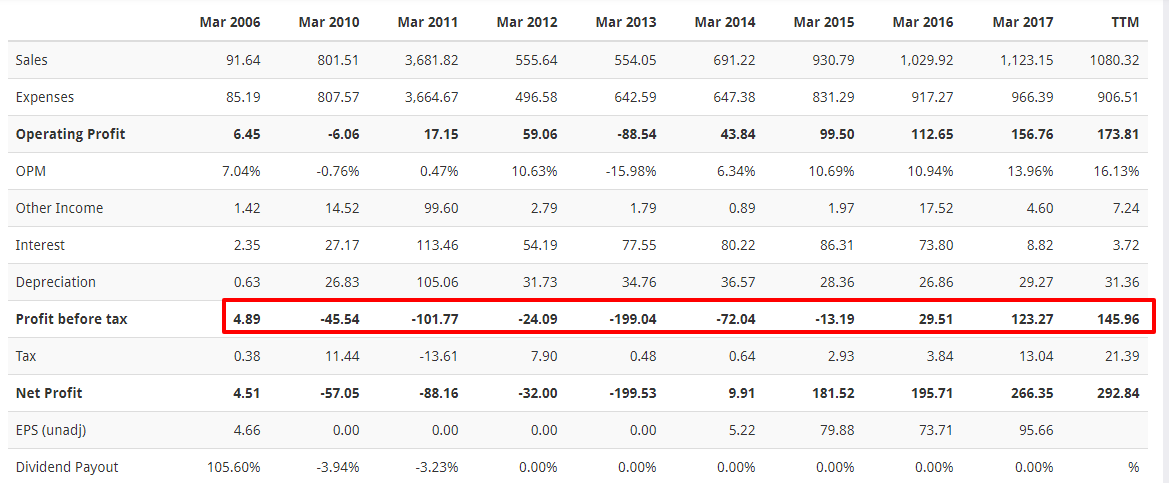

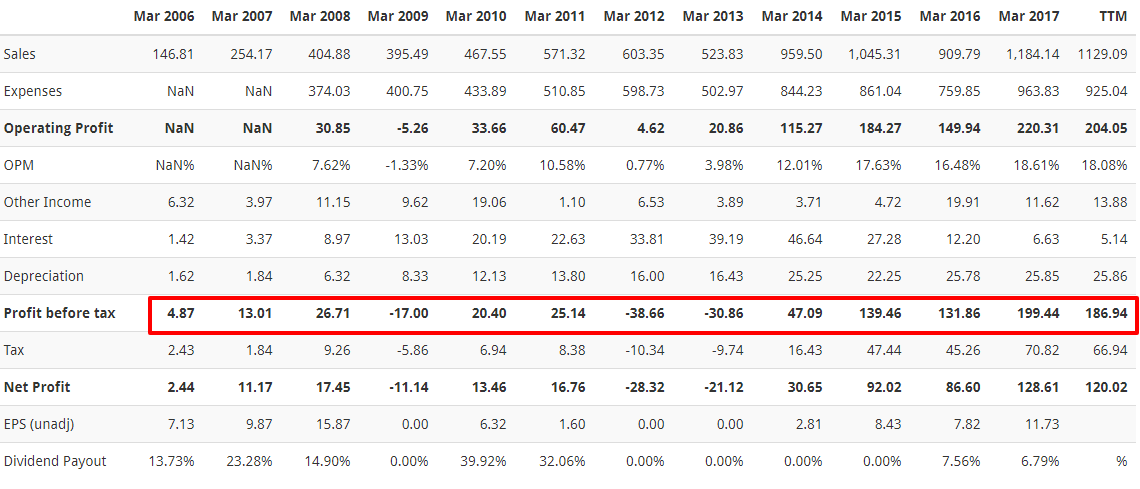

Annual Consolidated Figures of Kiri Industries

Annual Consolidated Figures of Bodal Chemicals

One can clearly see that the management of Bodal Chemicals is very much efficient than Kiri Industries and they are volatility averse.

Current Rationale of Buying Bodal Chemicals –

- The raw material price is down and is likely to mean revert and it will affect the company positively.

- Crude is up. It negatively affects the company and its discounted.

- USDINR is up. It negatively affects the company and its discounted. USDINR affects 30%. As exports account for 30% sales.

Now all three are cyclic and likely to mean the reverse. Even if it doesn’t market has already discounted that part.

- Capex Expansion. As said they are increasing their capacity. Demand is high. So sales will be higher anyway. Even the demand is not high, there are lots of derivatives of that product which makes it so risk-averse.

- There are two things that make money

a. Dyes – Which we discussed.

b. Intermediates – Intermediates are some other chemicals which are mainly for the domestic market. Dyes gets exported. Now the Intermediates is likely to expand in sales due to last govt affairs. - QIP on Oct 17, ICICI & Reliance got shares at price 172 which is much higher from the current price and yesterday ICICI fund managers met with the management of Bodal Chemicals and they issued a positive note! We can expect more buying from institutional holdings.

Reference –

- https://www.moneycontrol.com/news/business/companies/what-risevinyl-sulphone-price-means-for-indian-dye-makers-964733.html

- https://webcache.googleusercontent.com/search?q=cache:https://www.chemarc.com/content/stricter-regulatory-landscape/5a979da9a64f4346a9d2d19d

Due to the volatility in the earnings, exposure to Kiri Industries is not recommended but one can have a small allocation in Kiri Industries as well. There is a slight chance the business can be a complete turn around in the new era of Modi Government’s new schemes.

I m a investor .I want fundamental stocks.