Infibeam Stock: At what price to buy?

I always like Justdial. A business with no future prospects. Sooner or later it will delist anyways. So I keep shorting it whenever it goes up without a stop loss. When things go wrong I short Put options recover half losses there and Justdial always comes down to touch my target again.

Infibeam is new Justdial. You need to read the whole IPO note before commenting.

When did you last purchased anything from Infibeam? Ask 100 people who bought anything from the Internet. I doubt you will get 10 people

That’s it.

Valuation models will always show ultra expensive valuations for the e-commerce stocks. Amazon ‘terrifies me as a company,’ says a valuation professor. But Amazon is no more an e-commerce company.

The market discounts the future. In that sense, Amazon is really terrifying. It is robust and the growth is staggering. But, stop! Infibeam?

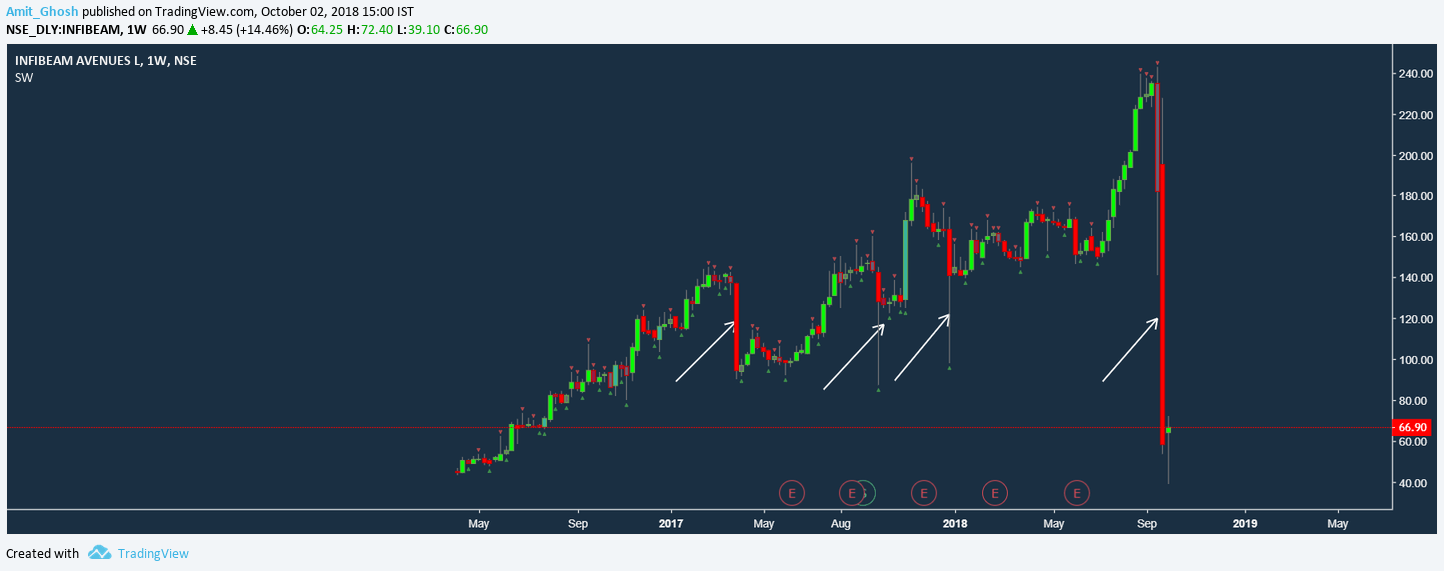

Different people use different valuation models. I use DCF. The number comes around 65. But it doesn’t include the bubble premium of being e-commerce stock. This is not the first crash of Infibeam either.

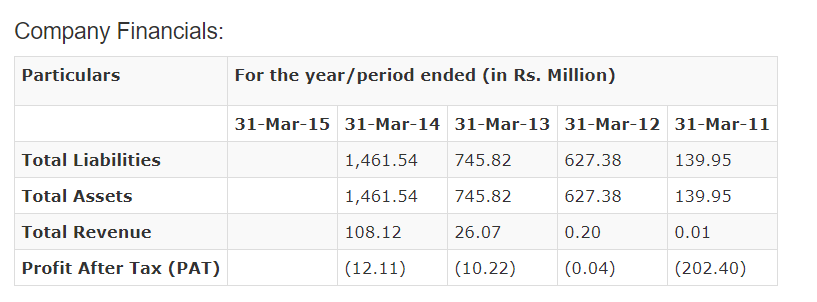

Investors of Infibeam are already aware of these flash crashes. It happened three more times. It is manipulator’s heaven!

But it always goes up.

Let’s use the principles of mathematical induction here and buy it. But the allocation has to be very small because of this contrarian nature.

But history says – As you can see from the chart, it doesn’t go up fast. It will take time. History also says – It will crash again. So trail accordingly.

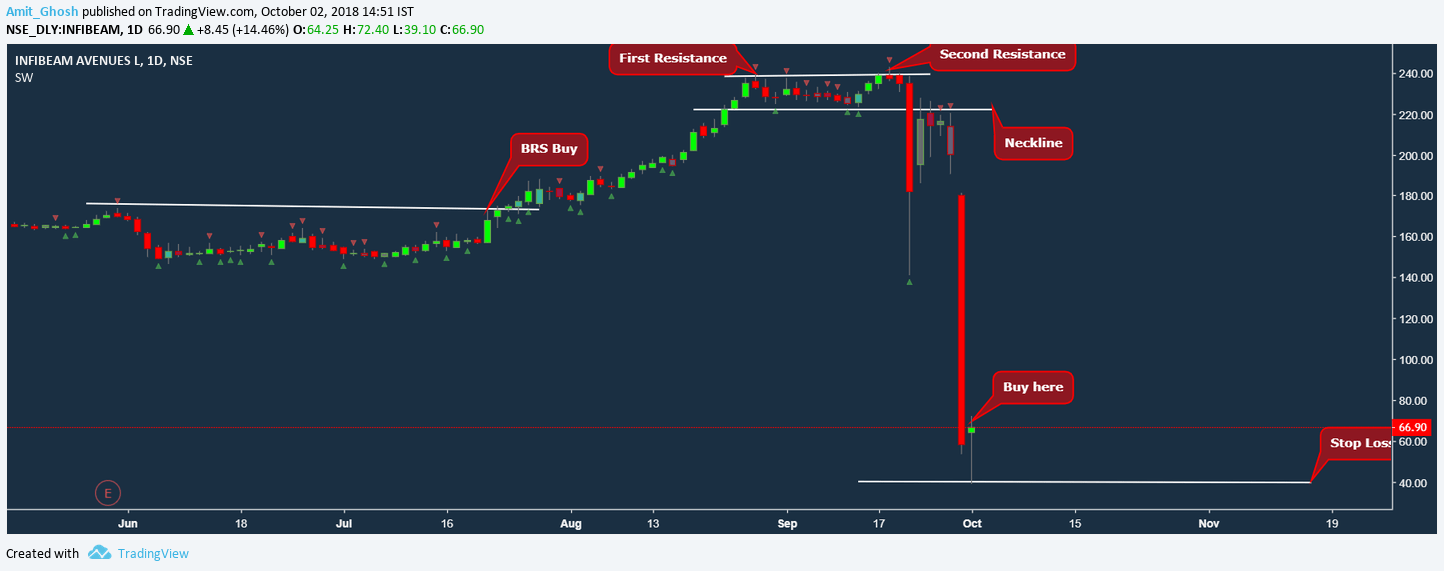

This was the technical view. But why the stock fundamentally fell?

- WhatsApp Message Reshared –

Last week, a WhatsApp message, allegedly attributed to brokerage Equirus Capital Private Limited (EPCL), raised doubts about Infibeam’s accounting policies and corporate governance.The message said that Infibeam gave an interest-free and unsecured loan to a subsidiary with negative net assets to be repaid over eight years. However, the same day, Equirus Capital denied issuing any such note.Meanwhile, Infibeam accepted that the company has given interest-free unsecured loans to its wholly-owned subsidiary NSI Infinium Global, according to a report. The company maintained that these loans were short-term ones, are repayable on demand and have been utilized by NSI Infinium Global solely for its business and operations. - IL&FS default – IL&FS: The crisis that has India in panic mode. The market is anyways panicked because of this issue.

So it is synthetical fall and purely panic play. Fundamentals are unchanged. Hence, a buy but the panic can resurface anytime to give short-term pain!