Options Premium

In simple terms, the premium is the amount of money that the option buyer pays to the option seller for the right to buy or sell the underlying asset at a specified price within a specific time frame.

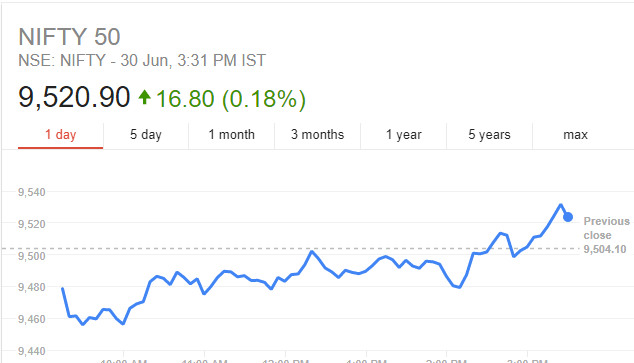

As per this image, NIFTY 50 index’s spot price is 9520.9

And, The price of NIFTY July 9600 CE is 69.45. NIFTY July 9600 CE signifies the contract which asserts NIFTY will close above 9600 at the time of closing of the market on the expiry.

- Those who agree will buy this contract and will be noted as an option buyer/holder.

- Those who disagree will sell this contract and will be noted as an option seller/writer.

Premium is the money required to be paid by the option buyer to the option seller/writer.

NIFTY options have a lot size of 75. Lot sizes are pre-defined. Here the premium is 75*69.45 = 5208.75 ~ 5209

When the contract is executed, an option buyer pays this money to the option writer.

Options Price Vs Options Premium

- The Options Price is 69.45.

- The Options Premium is Option Price * Lot Size ~ 5209

In general discussion forums, You can see Traders telling the premium of 9600CE is 69.45. In the world of trading, the terminology used can sometimes be confusing. When it comes to options trading, the price of an option contract is often referred to as the options premium. While it may not be technically accurate, traders have adopted this term in their everyday language. Therefore, it is important to be aware of both terms to avoid any misunderstandings in the market.