Theta

The option’s theta is the rate of decline in the value of an option over time. The theta measures the rate at which options lose their value. It basically tells about the decay of an option’s extrinsic value.

But theoretically, Theta assumes implied volatility and price movement stays at the same place. But implied volatility and any price movement inflates the extrinsic value.

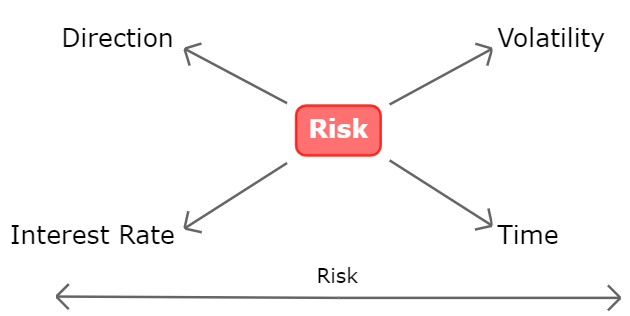

The more rise in risk, the more rise in extrinsic value and vice versa. This is a linear relationship.

- Theta of +100 means you gain 100 Rs per day.

- Theta of -100 means you lose 100 Rs per day.

Option writers love Theta. Selling options means having positive theta and buying options means we have negative theta.

- ITM options have theta of almost 0 as they do not lose value on a daily basis.

- The extrinsic value is highest on the ATM options. So, the effect of theta is highest on the ATM options.