Options Trading and Implied Volatility

For Using Option Straddle Strategy with implied volatility

First, the market already discounts the all available information using which you’re betting the event yourself.

Options are insurance contracts. Large institutions use options to hedge their positions against uncertainty.

Whenever the underlying’s future performance is uncertain; there is more demand for insurance on that underlying and hence cases like results, RBI policies or other serious corporate announcements increases the implied volatility which in turn increases the price of options beforehand of that event.

This is called “IV expansion.”

An option will expire on next 5 days. It’s trading at a high premium. Isn’t it? It has results tomorrow.

Buying HDFCBANK Jul 1700 CE at 22 means HDFC Bank needs to close above 1703 + 22 = 1725 to make you profit.

Let’s say it moves up beyond 1725 post the results.

Then HDFCBANK Jul 1700 PE will go 0 making you a 19 point loss. Now your break even is 1703 + 22 + 19 = 1744 to make you profit.

I am not taking the case where you scalp the profit in between smartly because if you are that smart why not just buy the futures and stay tight.

The implied volatility (IV) drops immediately after the results. Irrespective of the direction of the stock’s movement the option prices drop as the IV factor is no more. You can actually catch when it is dropping after the major event.

Here are Ashok Leyland’s option strikes today. Last week its results were declared. IV dropped.

It dropped for a good amount of time window as you can see. Lot size was 7000. Easy money of 7000 * (.92-.75) = 1190 INR on that hour.

![]()

This is a perfect catch on the spot on the time of the news killing the huge premium being offered due to IV.

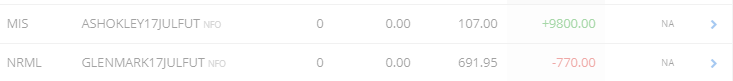

You can also scalp the trend created after the event like one member of our slack group did. Do note that LTP, when he closed this position, is 107 after which it fell to 101. He missed 42000 INR profit but he was scared.

Sometimes being scared is good as you can see stop loss of another trade hit.

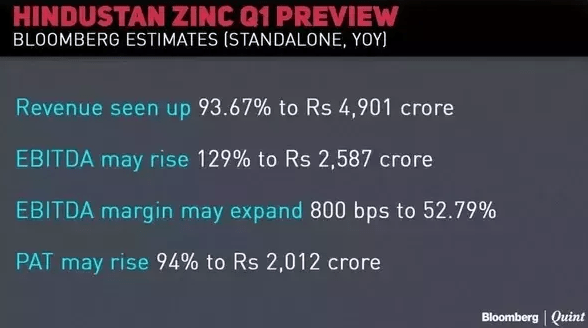

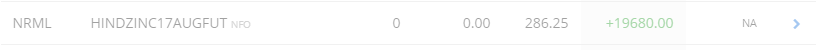

But you need to keep in mind the case of illiquid stock options. The Bid/Ask will be significant making an illogical impact on the logical thought process. Like Hindustan Zinc.

Sometime after the results; it results in a spike and it keeps consolidating. Many times it falls from there due to profit booking; many times it rises up from there. Chance of rising is low because the market has already appreciated the stock enough. My primary aim to ride that spike.

Refer: Earnings Today: Bajaj Auto, Hindustan Zinc, Wipro

Company’s expectation is to post 100% profit. Epic! But it is illiquid one. So I went with futures and scalped the trend.

Same goes with Capital Finance. That is another huge illiquid one.

Nothing is risk-free. My aim is to win the war. It’s OK to lose some battles. Buying option is the worst idea ever. Try stripping the volatility.