How do traders use volatility for trading?

You can read a detailed answer here – The impact of vix in Indian Stock market

But, Let’s talk about Vega. The option’s vega is a measure of the impact of changes in the underlying volatility on the option price.

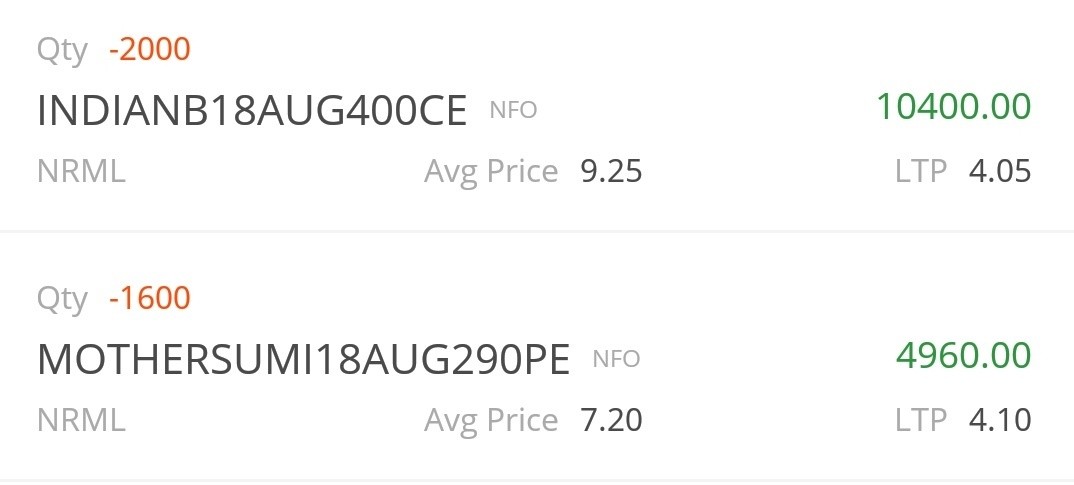

- Motherson Sumi had results yesterday.

- Indian Bank had results today.

What my strategy is – Sell options before the results events based on –

- Checking past results which created a synthetic effect on this stock and the momentum of direction.

- Support and Resistance

- OI Support and Resistance.

Now here lies a problem, there is no site where IV of a stock is properly calculated eyeing on the aspect that Indian Market is illiquid. So I made one. You can use here.

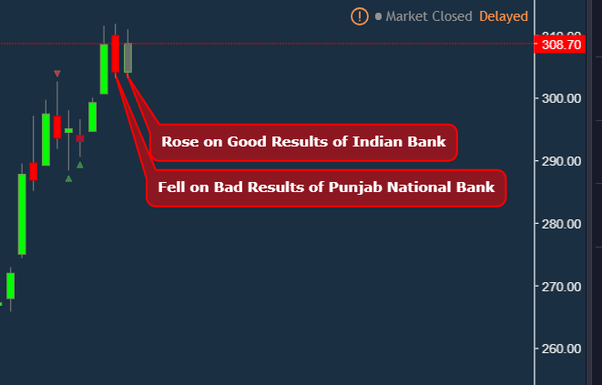

You can see in the above image how SBI is acting synthetically on the results of Punjab National Bank and Indian Bank.

You need to have ample margin to a firefight on the worst case which hasn’t happened since ever once this results season (let’s don’t jinx it)

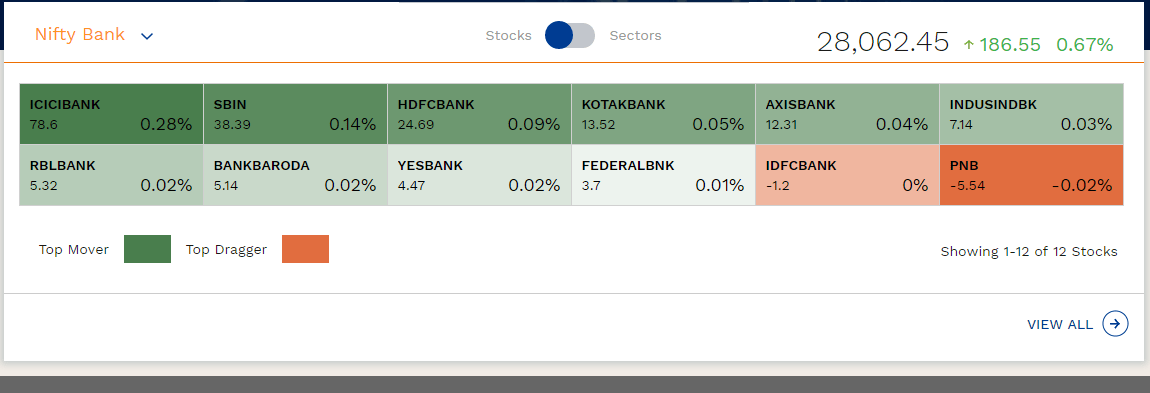

Now, You can see clearly how Indian Bank today affected BankNIFTY by synthetically affecting SBI which has results on Friday. If X gives good results, so should Y. Simple theory!

And,

It makes good money!

What is the next trade? Sell SBIN 340 CE at tomorrow 15:00. You can track here properly live.