Effect of Interest Rates

What is Interest Rate in Options Trading?

People often make the mistake of assuming that the interest rate you get from the bank while putting your money is the same interest rate being discussed in Options Trading!

The “interest rate” referred in relation to Options Trading is known as “Risk-Free Interest Rate”. Now, what do you mean by the Risk-Free Interest rate? The Risk-Free Interest Rate is the interest an investor would expect from an absolutely risk-free investment over a given period of time.

Since this interest rate can be obtained with no risk, it is implied that any additional risk taken by an investor should be rewarded with an interest rate higher than the risk-free rate.[1]

Most of the world uses the London Interbank Offered Rate (LIBOR) which is sort of a benchmark interest rate for major global banks. If not LIBOR, Mostly the overnight interbank offered rate of that country is chosen. In India, We use Mumbai Interbank Offer Rate (MIBOR).

You can see live MIBOR rates at https://fbil.org.in/. It’s 4.61% for 3rd April 2020.

Now, By investing in another financial instrument such as Options or buying a stock, the trader is foregoing the risk-free interest they can get on their money. So, option pricing models involve risk-free interest rates!

The annualized continuously compounded rate on MIBOR is then taken into consideration in the Black Scholes Model for the calculation of theoretical options price as the options greek “Rho”.

Effect of Interest Rates on Call Options

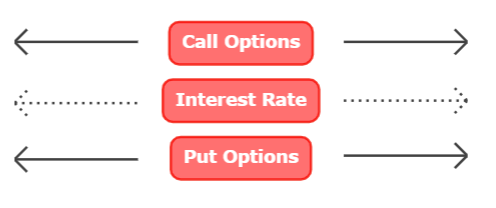

Premium of Call options rises when the interest rate rises and vice versa.

Anyways this is obvious because of the Interest Rate Component (Rho) changes in the Black Scholes Options Pricing model. But what can be real life justification for this effect?

Risk Free Interest rate is the opportunity cost for the trader who invests in other financial instruments such as stocks or options. When interest rates are high, the opportunity cost of buying stocks becomes higher. This is what makes buying call options more attractive than buying stocks as we pay a fraction of the cost of the money it takes to buy the actual stocks. The rest of the money is assumed better utilized with risk free returns! Anyways, it theoretically justifies for slightly higher premiums of call options assuming other factors unchanged.

Also, There is the quote: ” As interest rates in the economy increase, the expected return required by investors from the stock tends to increase. In addition, the present value of any future cash flow received by the holder of the option decreases”. So, We are supposed to pay a higher premium for the future obligation of ownership of the stock.

Effect of Interest Rates on Put Options

Premium of Put options falls when the interest rate rises and vice versa. We can use the same arguments used above in case of call options to build up rational reasoning over this comment.

Effect of Interest Rates on Realistic Trading

Interest rate only affects the extrinsic value of an option and not the intrinsic value. So, OTM options having a high extrinsic amount get more affected as well as options with a far expiration cycle get more affected because of the same reason.

But, actually, interest rates rise so slowly that its effects are overshadowed by the price fluctuations caused by other options greek. Interest rate change is a high volatility event which triggers implied volatility and hence, vega! That affects extrinsic value significantly more than interest rates does.