Delta

The Delta of an option estimates the rate of change in the price of the option given a 1 point move in the underlying asset. In short, it gives us a better understanding of our directional exposure.

Delta hovers between –

- 0 to 1 for a call option.

- -1 to 0 for a put option.

Many traders use -100 to 100 scale instead of -1 to 1.

For example, if a stock option has a delta value of 0.5, this means that if the underlying stock increases in price by 1 per share, the option on it will rise by 0.5 per share, all else being equal.

Right now, NIFTY’s LTP is 9111.9.

So NIFTY 16th Apr 9100PE is considered as an ATM put option. It’s trading at 253.7.

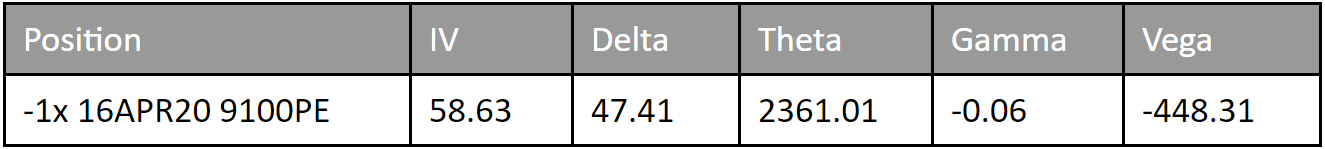

Let’s have a look at the greeks for better understanding –

The Concept of Rupee Delta

In this case, Delta of 47.41 means we gain 47.41 when a stock goes up by 1 point and lose 47.41 Rs when the stock goes down by 1 point.

But, We are forgetting one thing i.e. lot size. In America, when the concept of Delta kicked in, the common lot size was 100. In the case of NIFTY, the lot size is right now 75.[1]

The above position is about 1 Lot 16APR20 9100PE

i.e. 75 quantity of 16APR20 9100PE.

But the Delta of 47.41 is based on an assumption of 100 quantities of 16APR20 9100PE. We need to convert the Delta according to the lot size of our position.

Delta’s value for 100 quantity = 47.41

Delta’s value for 1 quantity = .4741

Delta’s value for 75 quantity = .4741*75 = 35.5575 ~ 35.56

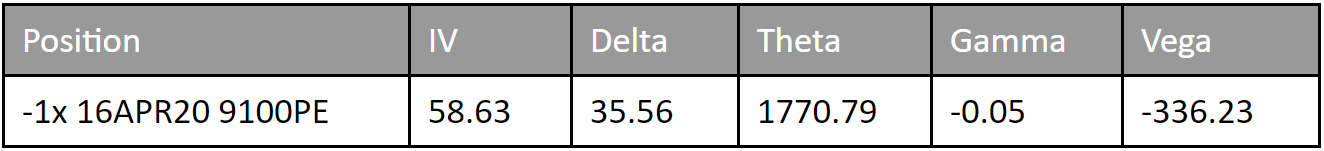

Similarly, We need to do the same for all the greeks –

Now, it is correct. It’s called the Rupee Delta or “Delta in Rupees”. We can extend the term to Rupee Theta, Rupee Gamma and Rupee Vega.

Although Options Greeks initially started assuming with 100 quantity lot size. Now-a-days, the lot sizes of security varies expiration cycle wise as well as exchange wise.

So, we must ensure that the greeks are calculated to the proper lot sizes directly. Anyways, We shall just continue to say plain Delta, Theta, Gamma, Vega assuming they are properly calculated with the lot size.

The Confusion in Calculation

- If NIFTY falls to 9000, then what shall be the price of our 1 Lot NIFTY 16APR20 9100PE?

- Fall in NIFTY = 9111.9 – 9000 = 111.9 points

- Delta of 16APR20 9100PE = 35.56

- Premium of 16APR20 9100PE = 253.7 points = 253.7*75 INR.

- Expected Increase in Premium = 35.56*111.9 INR.

- Expected Increase in Premium per 1 qty = (35.56*111.9)/75 points = 53.05552 points ~ 53.1 points

So, the price of our 1 Lot NIFTY 16APR20 9100PE will be (253.7+53.1) points = 306.8 points.

If it looks confusing but it is necessary to the root of it –

- By 1 point we mean the impact of 1 quantity only. And, We took a position of 1 lot which is 75 quantities.

- The Delta of the position -1x 16APR20 9100PE is 35.56. [Note that, the number of lots is mentioned here]

- In this case, Delta of 35.56 means we gain 35.56 when stock goes up by 1 point and lose 35.56 Rs when stock goes down by 1 point.

- We are holding 1 lot which is 75 quantities in this case!

- The Delta of 9100PE is 47.41

- In this case, Delta of 47.41 means we gain 47.41 when stock goes up by 1 point and lose 47.41 Rs when stock goes down by 1 point.

- We are holding 100 quantities!

The Concept of Share Equivalency

Each share of stock is 1 delta, so 75 shares of stock would equal 75 positive deltas. Now a short OTM put sold with a .3 Delta can be viewed as a purchase of .3 shares.[2]

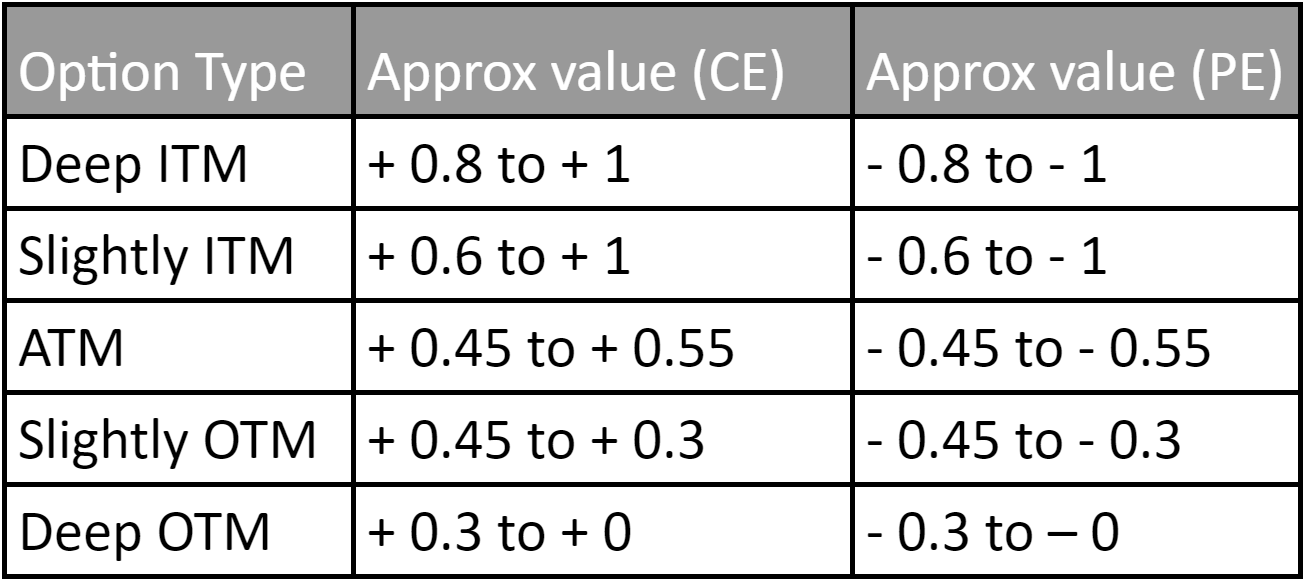

Here is a table that gives approximation of Delta values –

It’s important to remember that deltas change, so if the stock price dropped the put deltas would increase significantly. So, one needs to keep managing the delta actively!

Note: If it is written about selling a put option with 30 delta. It will mean .3 only. As said earlier, many traders use -100 to 100 scale!

Greeks in Decimal

While discussing the Greeks Calendar Spread, Time Butterfly Spread and Diagonal Spread We have shown the Greeks in decimal value as the theta column gets too high.

It assumes the quantity as 1. We can multiply this value with the lot size to get the correct figure for the position.

[1]The Lot size keeps changing time to time.

[2] In case we sell 1 Lot Nifty, It will be equivalent of .3*75 = 22.5 shares.