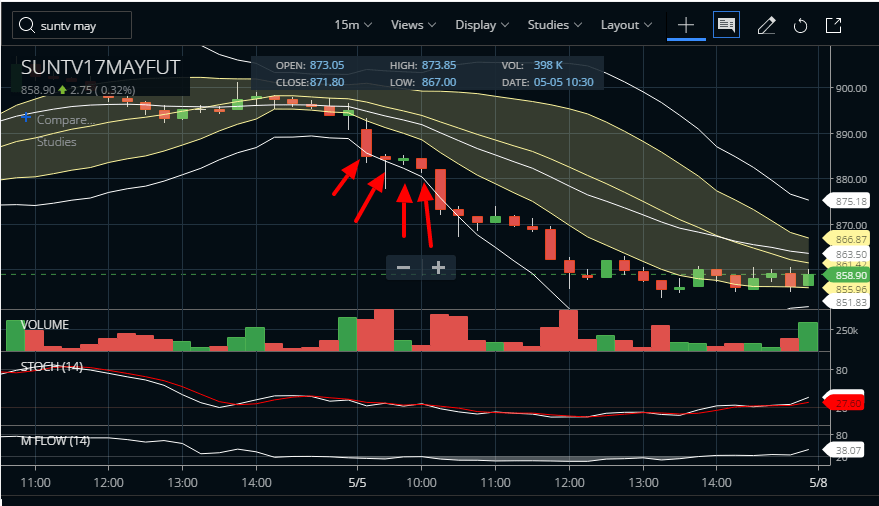

SunTV Futures Trade Using Bollinger Bands

- Candle 1 is red.

- Candle 2 is red.

- Candle 3 is green but we have entered into sell order on Candle 2’s close i.e. 883.95

- Candle 4 – Now as our candle 3 is green. We are waiting to fire two buy orders on Candle 3’s high i.e 885 expecting a 3BB trading opportunity. But well, it didn’t come.

Hence, it adhered to the established Bollinger Band Ride (BBR) trade setup. The sell order remains active, currently holding an unrealized profit.

It’s worth noting that while I have previously utilized Sun TV May Futures on a 1-hour timeframe, the latest chart is based on a 15-minute timeframe. To avoid any confusion, you can refer to the discussion regarding the Titan May Futures example.

When you enter a trade with the standard BBR setup, your exit point is determined by the median Bollinger crossover. This approach inherently limits potential losses, as the absence of a median Bollinger crossover in a BBR trade typically signifies the potential for substantial profits.

In contrast, entering a trade with the 3BB setup involves placing the initial stop loss at the high (for buy scenarios) or low (for sell scenarios) of the third candle. Given the higher likelihood of a 3BB setup crossing the median Bollinger with confidence, the stop loss is not adjusted until this crossover occurs. Subsequently, a trailing stop loss is implemented based on price action, specifically the high (for buy scenarios) or low (for sell scenarios) of the previous candle.