Backtesting Triple Inside Bar Strategy Using Python

Prerequisite

In the last chapters,

- We have backtested the Double Inside Bar Intraday Strategy.

- We have also discussed Double Inside Bar Positional Strategy.

The only thing that needs changing in the code is the dataset because everythin g else exactly the same! So double_ib.csv will become triple_ib.csv which was shared in the earlier chapter. It contains all the FNO stocks that has exhibited Triple Inside Bar Pattern since 2015 to today.

df = pd.read_csv("/root/apps/trident/double_ib.csv")

df

will become –

df = pd.read_csv("/root/apps/trident/triple_ib.csv")

df

The output looks like –

date symbol marketcapname sector

0 08-12-2015 GNFC Midcap Industrials

1 16-12-2015 SHREECEM Largecap Industrials

2 23-12-2015 AMBUJACEM Largecap Industrials

3 17-02-2016 NESTLEIND Largecap FMCG

4 22-02-2016 MUTHOOTFIN Largecap Finance

... ... ... ... ...

172 20-06-2023 FEDERALBNK Largecap Bank

173 27-06-2023 NTPC Largecap Miscellaneous

174 02-08-2023 M&MFIN Largecap Finance

175 10-08-2023 SUNPHARMA Largecap Pharmaceuticals

176 21-08-2023 ZYDUSLIFE Largecap Pharmaceuticals

177 rows × 4 columns

It is exactly similar to the output of the dataset of other Inside bars. But the number of output is lowest i.e. 177! It is because Triple Inside Bar is the rarest of all.

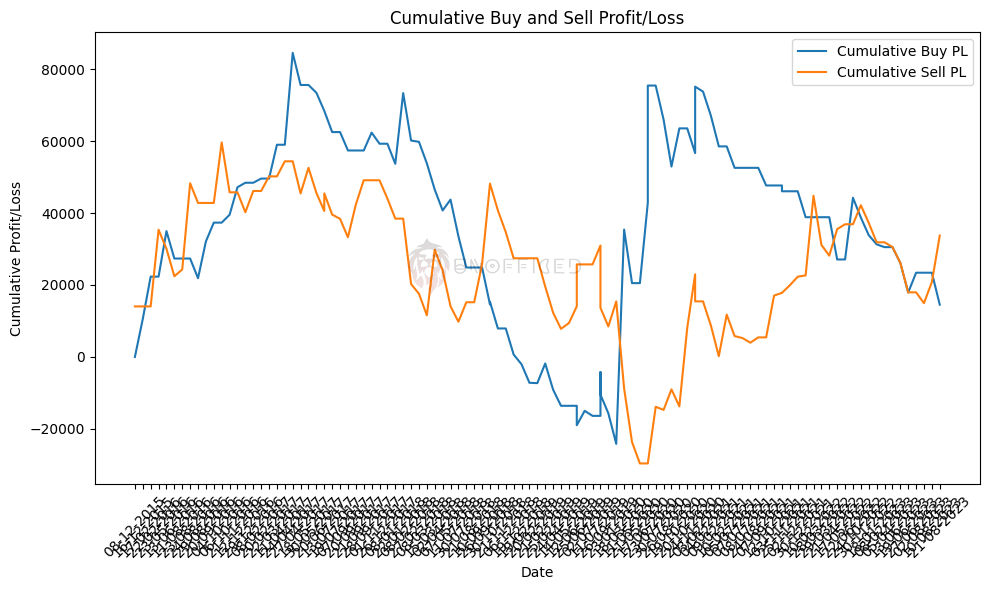

Comparing the Performance Metrics with Index Inside Bar Intraday Strategy

As the entire codebase will be same, there is no need to re-invent the wheel. Therefore, let’s proceed to examine both strategies in parallel to gain a more insightful perspective.

Triple IB Intraday

Net of buy_pl_points: 14538.290000000285

Net of sell_pl_points: 33741.169999999925

Positive buy_pl_points count: 25

Negative buy_pl_points count: 48

Total buy_pl_points count: 111

Positive sell_pl_points count: 38

Negative sell_pl_points count: 47

Total sell_pl_points count: 111

Average of buy_pl_points: 130.97558558558816

Average of sell_pl_points: 303.97450450450384

Average of positive buy_pl_points: 12550.495200000014

Average of positive sell_pl_points: 9212.78184210526

Average of negative buy_pl_points: -6233.835208333335

Average of negative sell_pl_points: -6730.734893617021

Triple IB Positional

Net of buy_pl_points: 74966.53000000017

Net of sell_pl_points: 45652.83000000011

Positive buy_pl_points count: 24

Negative buy_pl_points count: 27

Total buy_pl_points count: 111

Positive sell_pl_points count: 32

Negative sell_pl_points count: 26

Total sell_pl_points count: 111

Average of buy_pl_points: 675.3741441441457

Average of sell_pl_points: 411.28675675675777

Average of positive buy_pl_points: 7344.96125

Average of positive sell_pl_points: 4699.525312499999

Average of negative buy_pl_points: -3752.3162962962906

Average of negative sell_pl_points: -4028.1530769230712

The key takeaway from this analysis is clear: the Triple Inside Bar strategy can be challenging when applying the same Inside Bar strategy to it. It tends to consolidate mostly at the starting point and often results in losses. This reinforces our decision to avoid Triple Inside Bar trades in the context of the Buddha strategy, highlighting the importance of data-driven analysis.

However the Backtested data analytics are available in detailed format in our website for lazy people –