Backtesting Narrow Range Inside Bar Strategy Using Python

When we mention the “Narrow Range Inside Bar,” we are specifically referring to stocks that meet two criteria: they appear in the Narrow Range 7 (NR7) scanner and also exhibit the characteristics of an inside bar pattern.

However, as you have already gone through the earlier chapters of backtesting, You can try out the backtesting method on the scanner of Double Narrow Range 7.

Prerequisite

In the previous chapters,

- We have backtested the Double Inside Bar Intraday Strategy.

- We have also discussed Double Inside Bar Positional Strategy.

The only thing that needs changing in the code is the dataset because everythin g else exactly the same! So double_ib.csv will become nr7.csv which was shared in the earlier chapter. It contains all the FNO stocks that has exhibited Triple Inside Bar Pattern since 2015 to today.

df = pd.read_csv("/root/apps/trident/double_ib.csv")

df

will become –

df = pd.read_csv("/root/apps/trident/nr7.csv")

df

Now, let’s introduce an intriguing twist.

Up until now, we’ve been exploring just two exit methods: same-day exit and exit after 5 days. But what if we experiment with a different approach? How about exiting after just 2 days, meaning the trade closes on the next trading day? (In the event that the next day is a holiday, the trade will be exited on the same day.)

Anyways, to do that, We need to change the check_high_breakout_and_save function we designed in our earlier chapter.

to_date = from_date + datetime.timedelta(hours=5)

becomes –

to_date=from_date+ datetime.timedelta(days=2)

You are welcome to try out different outcomes and play with both the entry and exit conditions!

Comparing the Performance Metrics with Index Inside Bar Intraday Strategy

As the entire codebase will be same, there is no need to re-invent the wheel. Therefore, let’s proceed to examine the three strategies in parallel to gain a more insightful perspective. Now, it will look nasty in mobile, so it is better You view this in Desktop.

NR7 + IB Intraday

Net of buy_pl_points: 278051.6199999994

Net of sell_pl_points: 1057877.7299999995

Positive buy_pl_points count: 546

Negative buy_pl_points count: 611

Total buy_pl_points count: 2238

Positive sell_pl_points count: 642

Negative sell_pl_points count: 484

Total sell_pl_points count: 2238

Average of buy_pl_points: 124.24111706881118

Average of sell_pl_points: 472.68888739946357

Average of positive buy_pl_points: 5465.013040293043

Average of positive sell_pl_points: 4582.949080996886

Average of negative buy_pl_points: -4428.552373158758

Average of negative sell_pl_points: -3893.337975206613

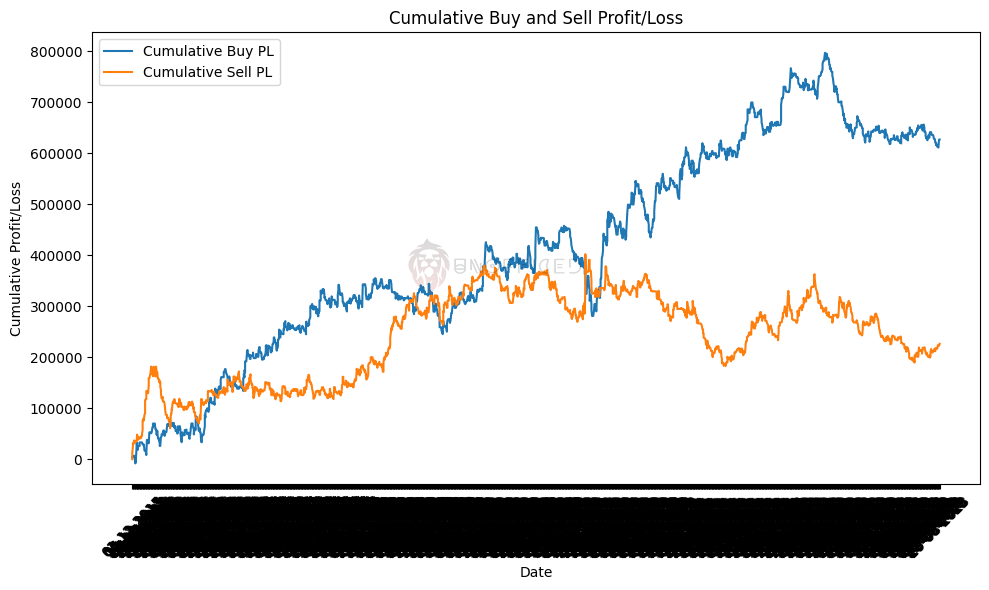

NR7 + IB Next Day

Net of buy_pl_points: 626660.7300000007

Net of sell_pl_points: 226256.93000000028

Positive buy_pl_points count: 631

Negative buy_pl_points count: 724

Total buy_pl_points count: 2239

Positive sell_pl_points count: 633

Negative sell_pl_points count: 718

Total sell_pl_points count: 2239

Average of buy_pl_points: 279.88420276909363

Average of sell_pl_points: 101.0526708351944

Average of positive buy_pl_points: 7095.479698890652

Average of positive sell_pl_points: 5810.943080568722

Average of negative buy_pl_points: -5318.490276243095

Average of negative sell_pl_points: -4807.896991643455

NR7+IB Positional

Net of buy_pl_points: 1087522.4300000002

Net of sell_pl_points: 412298.9700000003

Positive buy_pl_points count: 703

Negative buy_pl_points count: 968

Total buy_pl_points count: 2239

Positive sell_pl_points count: 686

Negative sell_pl_points count: 967

Total sell_pl_points count: 2239

Average of buy_pl_points: 485.71792317999115

Average of sell_pl_points: 184.14424743188937

Average of positive buy_pl_points: 11341.583883357043

Average of positive sell_pl_points: 10449.738644314868

Average of negative buy_pl_points: -7113.234545454547

Average of negative sell_pl_points: -6986.785667011374

Key Insights from Strategy Analysis

After a thorough analysis of the trading strategies, we’ve unearthed some intriguing findings:

- Intraday vs. Positional Exit: The sell strategies exhibit exceptional performance when considering an intraday exit. These strategies seem particularly well-suited for short-term trading.

- Buy Strategies’ Strength: On the flip side, the buy strategies shine when opting for a next-day exit or the positional exit after a 5-day holding period. These approaches demonstrate their effectiveness in capturing larger market movements.

- Exit Comparison: While the 5-day positional exit strategy boasts superior returns compared to a next-day exit, it’s noteworthy that the next day’s return still amounts to nearly 50% of the 5-day positional strategy’s return. This aspect provides food for thought for traders exploring different exit approaches.