Backtesting Double Inside Bar Intraday Strategy Using Python

In the last chapter, We have backtested the Index Inside Bar Intraday Strategy.

The only thing that needs changing in the code is the dataset because everythin g else exactly the same! So index_ib.csv will become double_ib.csv which was shared in the earlier chapter. It contains all the FNO stocks that has exhibited Double Inside Bar Pattern since 2015 to today.

df = pd.read_csv("/root/apps/trident/index_ib.csv")

df

will become –

df = pd.read_csv("/root/apps/trident/double_ib.csv")

df

The output looks like –

sector marketcapname symbol date

0 Wed Aug 30 2023, 5:56 pm 1 BALKRISIND 30-08-2023

1 Industrials Largecap JKCEMENT 01-12-2015

2 Industrials Midcap AARTIIND 02-12-2015

3 Pharmaceuticals Largecap SYNGENE 02-12-2015

4 Industrials Largecap SHREECEM 03-12-2015

... ... ... ... ...

3924 FMCG Largecap CUMMINSIND 29-08-2023

3925 Auto Largecap ESCORTS 29-08-2023

3926 Services Largecap INDHOTEL 29-08-2023

3927 Media Largecap ZEEL 29-08-2023

3928 Finance Midcap CANFINHOME 29-08-2023

3929 rows × 4 columns

It is exactly similar to the output of the dataset of Inside bars on Index. Now, there were 563 rows there. We have 3929 rows here. So, the program will also take 8 time longer to process as there is 8 times more data.

Adding the Lot Size

Introducting an Uniform Quant

New Code –

import math

quant_size = 500000

df["lotsize"] = df["today_open"].apply(lambda x: math.floor(quant_size/x))

df["buy_pl_points"] = df["buy_pl_points"]*df["lotsize"]

df["sell_pl_points"] = df["sell_pl_points"]*df["lotsize"]

df

Old Code –

def calculate_lotsize(row):

if row["symbol"] == "BANKNIFTY":

return 15

elif row["symbol"] == "NIFTY":

return 50

else:

return 40

df["lotsize"] = df.apply(calculate_lotsize, axis=1)

df["buy_pl_points"] = df["buy_pl_points"]*df["lotsize"]

df["sell_pl_points"] = df["sell_pl_points"]*df["lotsize"]

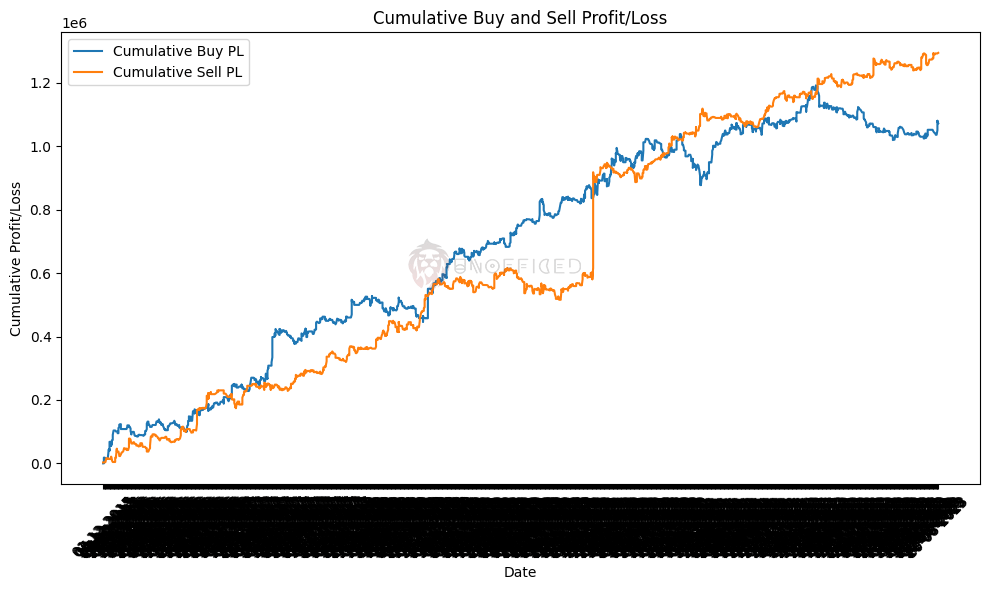

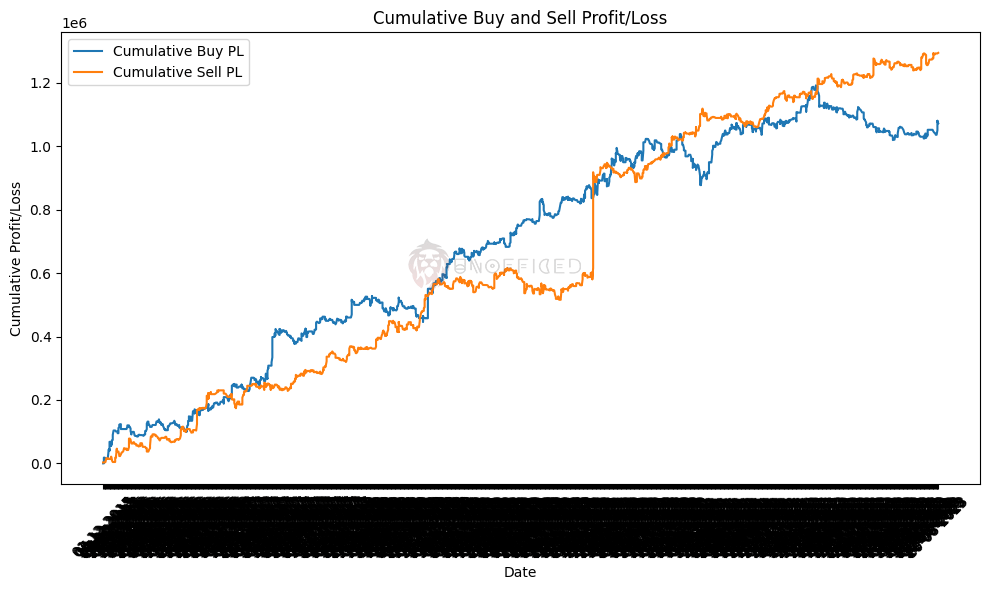

Plotting the Equity Curve

Comparing the Performance Metrics with Index Inside Bar Intraday Strategy

While it may be intriguing to observe the evolution of performance metrics in the Index Inside Bar’s Intraday Strategy’s results, a comprehensive analysis requires a side-by-side comparison with the data. Without this comparative context, it’s challenging to draw meaningful conclusions.

Therefore, let’s proceed to examine both strategies in parallel to gain a more insightful perspective.

Index IB Intraday

Net of buy_pl_points: 2221.00000000001

Net of sell_pl_points: 4721.430000000011

Positive buy_pl_points count: 46

Negative buy_pl_points count: 27

Total buy_pl_points count: 171

Positive sell_pl_points count: 60

Negative sell_pl_points count: 24

Total sell_pl_points count: 171

Average of buy_pl_points: 347.5760233918145

Average of sell_pl_points: 563.6125730994178

Average of positive buy_pl_points: 2607.565217391311

Average of positive sell_pl_points: 2375.0291666666717

Average of negative buy_pl_points: -2241.203703703704

Average of negative sell_pl_points: -1921.8333333333273

Double IB Intraday

Net of buy_pl_points: 1072125.2599999963

Net of sell_pl_points: 1294312.709999999

Positive buy_pl_points count: 586

Negative buy_pl_points count: 624

Total buy_pl_points count: 2479

Positive sell_pl_points count: 635

Negative sell_pl_points count: 551

Total sell_pl_points count: 2479

Average of buy_pl_points: 432.4829608713176

Average of sell_pl_points: 522.110814844695

Average of positive buy_pl_points: 6782.096245733783

Average of positive sell_pl_points: 5536.072881889762

Average of negative buy_pl_points: -4650.93451923077

Average of negative sell_pl_points: -4031.022813067151

The only conclusion We get from here is – If the Index Inside Bar Strategy triggers a sell trade, then the amount of profit, if happens will be high! However, in both case, the sell trades in net makes more money than the buy trades.