Backtesting Double Inside Bar Positional Strategy Using Python

Prerequisite

In the last chapters,

- We have backtested the Double Inside Bar Intraday Strategy.

- We have also discussed Index Inside Bar Positional Strategy.

So, We need to change the check_high_breakout_and_save function we designed in Index Inside Bar Positional Strategy Chapter. Then, We can just follow the rest of the codebase of Double Inside Bar Intraday Strategy Chapter as it is. So,

to_date = from_date + datetime.timedelta(hours=5)

becomes –

to_date=from_date+ datetime.timedelta(days=5)

You can download the rest of the check_high_breakout_and_save function from Index Inside Bar Positional Strategy Chapter. Let’s not discuss the same thing over and over again complicating things –

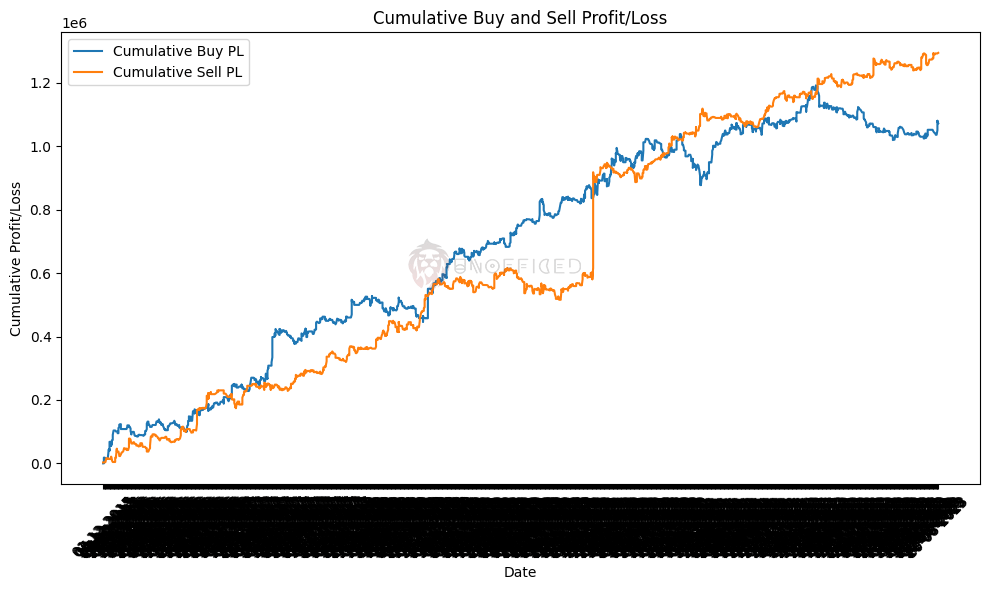

Plotting the Equity Curve

Comparing the Performance Metrics with Intraday Strategy

While it may be intriguing to observe the evolution of performance metrics in the Positional Strategy’s results, a comprehensive analysis requires a side-by-side comparison with the Intraday Strategy’s data. Without this comparative context, it’s challenging to draw meaningful conclusions.

Therefore, let’s proceed to examine both strategies in parallel to gain a more insightful perspective.

Double IB Intraday

Net of buy_pl_points: 1072125.2599999963

Net of sell_pl_points: 1294312.709999999

Positive buy_pl_points count: 586

Negative buy_pl_points count: 624

Total buy_pl_points count: 2479

Positive sell_pl_points count: 635

Negative sell_pl_points count: 551

Total sell_pl_points count: 2479

Average of buy_pl_points: 432.4829608713176

Average of sell_pl_points: 522.110814844695

Average of positive buy_pl_points: 6782.096245733783

Average of positive sell_pl_points: 5536.072881889762

Average of negative buy_pl_points: -4650.93451923077

Average of negative sell_pl_points: -4031.022813067151

Double IB Positional

Net of buy_pl_points: 1342170.9899999984

Net of sell_pl_points: 1359112.0599999984

Positive buy_pl_points count: 737

Negative buy_pl_points count: 1042

Total buy_pl_points count: 2479

Positive sell_pl_points count: 768

Negative sell_pl_points count: 993

Total sell_pl_points count: 2479

Average of buy_pl_points: 541.4162928600235

Average of sell_pl_points: 548.2501250504229

Average of positive buy_pl_points: 12614.405644504748

Average of positive sell_pl_points: 11654.301354166666

Average of negative buy_pl_points: -7634.0172456813825

Average of negative sell_pl_points: -7644.905720040283