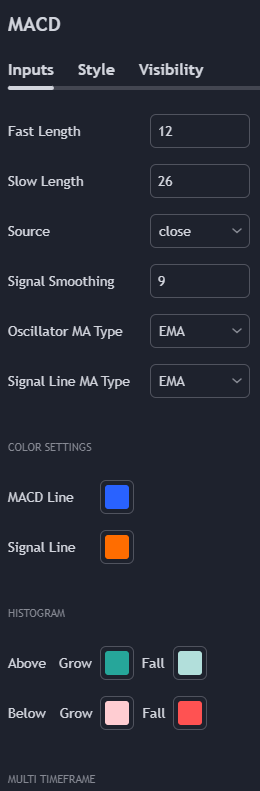

How to change the MACD settings

The MACD indicator’s standard settings are 12, 26 and 9.

As with most indicators, you can adjust the settings to change how quickly or slowly it reacts to the movement of price, resulting in the number of trade signals being generated. The numbers 12, 26, and 9 refer to the specific periods used in the MACD indicator, which are known as the “Fast Length,” “Slow Length,” and “Signal Smoothing.”

Now, before we dive deep, We need to see how MACD is constructed.

Increase settings ->

If you increase the settings of the indicator, it will generate a lot fewer signals, which would prevent many false signals.

The downside of doing this is that you can miss out on the start of some big market moves.

Decrease settings ->

On the flip side, if you decrease the indicator’s settings, it will have the opposite effect, making it more sensitive and generating more signals.

The downside of doing this is that you can have many losing trades because of the false signals the indicator would give.

Now, Lets dig more deeper on each settings level.

Increasing the Fast and Slow Lengths:

By increasing the number of periods for the fast and slow lengths, you’re including more data points in your moving averages.

- This makes the MACD line smoother and less reactive to price changes.

- It will generate fewer signals, which can help filter out some of the noise and false signals.

However, this also means that the indicator will be slower to react to new trends, potentially causing you to enter trades later.

Decreasing the Fast and Slow Lengths:

Conversely, if you decrease the number of periods for the fast and slow lengths, the MACD line becomes more sensitive.

- It will react more quickly to price changes and generate more trading signals.

- This can be beneficial in a fast-moving market where you want to capture trends early.

However, the downside is that it can produce more false signals, leading to a higher number of losing trades if the market is choppy or if there’s a lot of price noise.

Adjusting the Signal Smoothing:

Changing the number of periods for the signal line will affect how quickly it reacts to the MACD line.

- A higher number will make it smoother and slower to react, potentially reducing the number of trade signals and false positives.

- A lower number will make it more sensitive, increasing the number of trade signals but also the potential for false signals.

That’s why we wrote, “If you increase the settings of the indicator, it will generate a lot fewer signals, which would prevent many false signals.” in the last discussion because every settings when get increased, attributes on generating fewer signals.

If you do decide to change the indicator settings, make sure the changes made are improving your trading results. Traders often backtest different settings against historical data to find the optimal balance for their trading strategy and risk tolerance.

So far You have learned –

- The MACD is a trending indicator.

- It can help you decide when to buy or sell an asset, enabling you to enter trades as they start and exit them before they finish.

- The MACD line is a moving average line that tracks the underlying asset’s price.

- The signal line is a moving average of the MACD line and interacts with it to produce trading signals.

- The histogram displays the difference between the MACD and signal lines and indicates the momentum of a price move and when it may be about to end.

- Buy and sell signals are given when the MACD line moves above and below the signal respectively.

- The histogram revolves around the zero line.

- Bars below the signal line indicate downward momentum and above the zero line indicates upwards momentum.

- Increasing the indicator settings slows down its reaction so that it produces fewer signals. This reduces the risk of false signals.

- Decreasing the indicator settings speeds up its reaction so that it produces more signals but raises the risk of false signals.