Strike Price

The strike price of an option is the price at which the buyer of the option can buy or sell the underlying asset. In the Indian share market, the strike price of options is usually set at regular intervals, such as every 50 points for the NIFTY index options.

For example, suppose the current spot price of the NIFTY index is 10,000. The NIFTY options contracts may have strike prices at 9,900, 9,950, 10,000, 10,050, and 10,100.

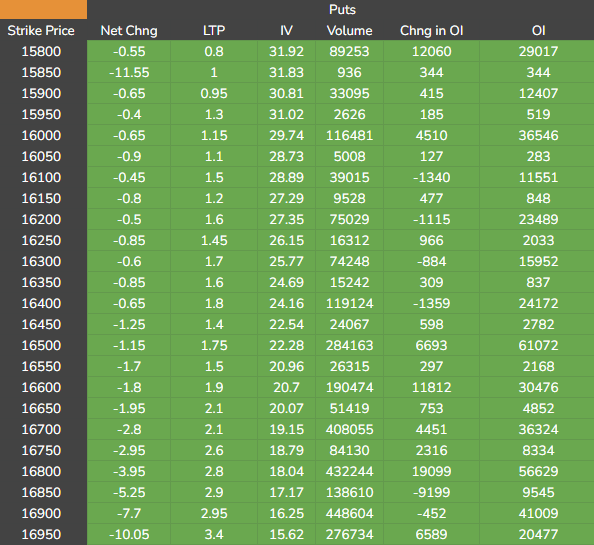

This snapshot of NIFTY Put Options displays crucial information such as the respective Strike Prices and their corresponding Premiums (LTPs), among a few other data points.

- If an option buyer thinks that the NIFTY index will rise above 10,050, they can buy a call option with a strike price of 10,050.

- On the other hand, if they believe that the NIFTY index will fall below 9,950, they can buy a put option with a strike price of 9,950.

In summary, the strike price of an option is the price at which the option buyer can buy or sell the underlying asset. In the Indian share market, options typically have strike prices set at regular intervals, and the strike price plays an important role in determining the option’s premium.