We were talking about an approach to how a strategy is developed based on past performance.

- We are bad on cutting on profit hit.

- We are bad on cutting on SL hit.

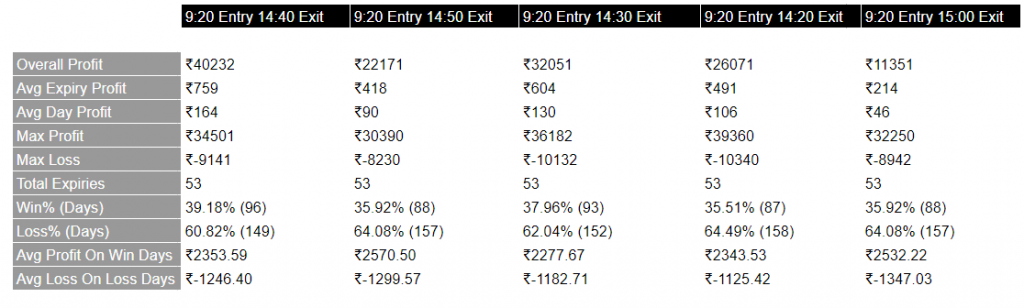

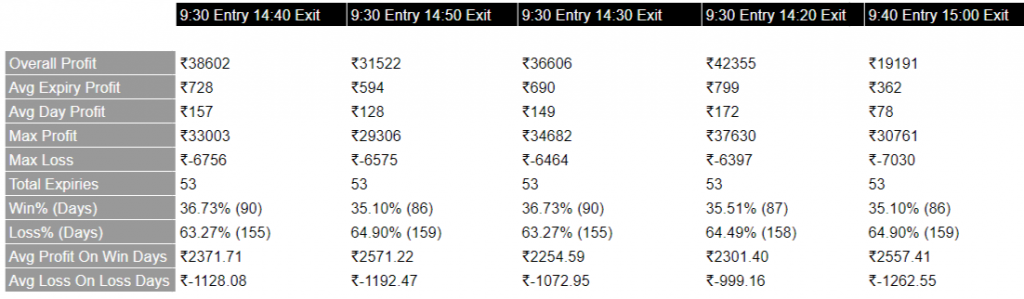

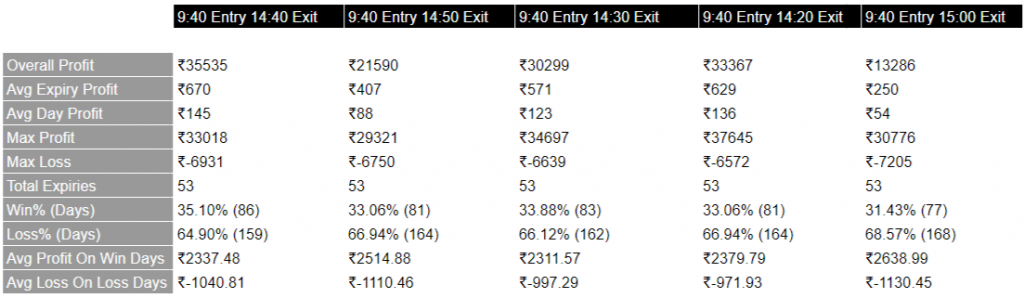

Now Let’s say a strategy where we enter at x time and exit at y time irrespective of profit and loss. So, we don’t have to use minds in between. Our max loss is defined anyways as it is option buy. Let’s shoot a tiny question, let’s say, In case of options buy, which of the following scenario is better –

- Entering at 9:20

- Or, Entering at 9:30

Now to, decide that the first thing that comes to mind is we are entering a long straddle. So, if we think theta-wise, the late the entry, the less the time working against us but then again.

But how much 10 minutes matter?

It is a close contest and out of 10 days, in most of the variations, we make a profit on 3 days and make a loss in the rest of the 7 days. But, in the end, it makes a profit!

If anyone is not following the discussion –

- We are buying options for ATM CE and ATM PE at x time.

- There is no SL. Max you can lose is the premium.

- There is no Target.

- No headache to close at any point in the between. The fewer decisions we irrational humans have to make, the better.

- We exit at y time.

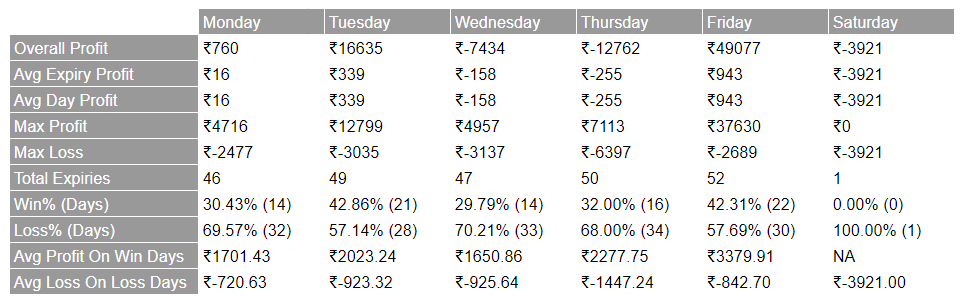

Now the sheet shows, what happens if you had done for last year. (You are welcome to do it beyond more considering the sample size is fair to low.)

While many discount brokers don’t, Aliceblue gives leverage of 2x in option buying too. Taking that into consideration, profit is good.

Brokerage and Charges

For 2 lots, it is 100 INR overall a day (20 INR to buy, 20 INR to sell and 18 INR will be other charges like STT, Exchange Charges etc.). In total, it is 98-99. So let’s keep at 100.

We have 255 trading days. 255*100=25500 will be stricken off straight off the bat! The guys who have fixed plan have an evolutionary advantage here because they pay no brokerage!

The Assumption

While doing such assumption is unfair considering our small sample size but let’s apply the theory of induction in a broad manner (If it had happened last time, it will happen this time too.) and based on that let’s choose a model and investigate further.

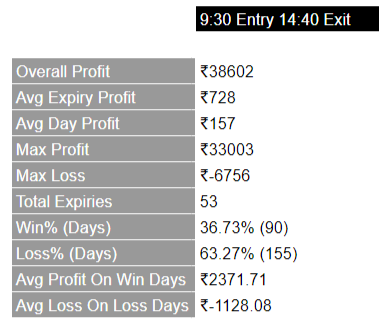

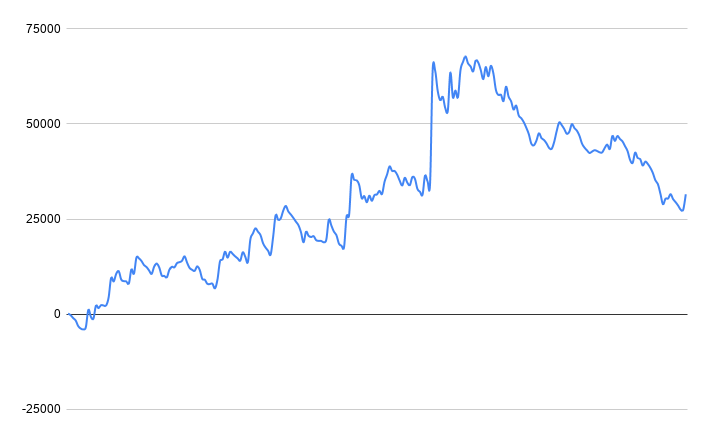

The highest profit model of last year.

- The net capital used here is 10K only.

- Net Profit after charges = 42355-25500=16855.

- Assuming 30% slippage = 70% of 16855 = 11798.5

So far, So good. This is a realistic approach. If you have been reading the articles and seeing this kind of backtest. That does not tell about 25500 INR of charges. It’s important and non-negotiable. Now, to next findings.

This shows consolidated profit loss in date wise of the strategy where we enter at 9:30 and exit at 14:20

We are making losses on Wednesday and Thursday. Let’s throw Saturday. Saturday, Sunday happens because of Muharat Trading or Budget day special. Now, the curious part here is, Although Monday is showing a profit, it is actually is a loss!

There are 45 trading days in Monday making 4500 INR in charges but with 760 INR profit; hence making a net of -4500+760 = -3740. So, Monday is out of the question.

- Wednesday and Thursday – Long Straddle makes losses!

- Let’s just do it for Tuesday and Friday then?

Also, Friday has the least theta impact! Friday has the least theta impact! Now, if you go into further deep, We made more than 80% profit of Friday from one day only! 20th September.

That’s the whole point, right? Option buy is buying insurance to benefit from this kind of uncertainty that can not be quantifiable i.e modelled with maths. That’s the bet that there should be such events. Like, In 2018, We had 31st May.

We may never know when’s next but we will be surely in a huge profit on that day! 20th September is a celebratory day. 15% tax announcement. In the first 7 mins, lots of accounts went blown that day.

But instead of doing something headlessly which is equivalent to throwing 10K in water, this is a better systematic approach which is what is my statement!

One Comment