Betting on Range Using Options Trading

We will discuss a strategy that is derived from a statistical approach on both option buying and option selling researched over the last two years of data. With the current leverage from the broker, the ROI is pretty lucrative and the risk is well defined! Even better, You can Automate it.

If you are not familiar with the basics of options trading in the stock market, take a look at the following article – How to trade options in the stock market

Example – Justdial Bear Flag

Justdial had been in a downtrend and ended up making a bear flag. (In terms of concepts of bounce – It broke the downtrend and starting going up in a bullish sideways channel. We are calling it “bullish sideways trend” instead of uptrend because it is messy and not following the concepts of an uptrend in a clean manner.)

In the stock market, the first assumption is that – We do not know the direction of where it is going. We try to predict the direction but now, as you can see – We can also predict a range using options.

The concept of Range Betting is an important takeaway from this conversation.

Here are all possible altercations that are possible and monetizable from this chart if we’re to believe Justdial will move at least at “some” direction. (It can make unlimited Doji till month-end and at 400 only too! Right?)

We define “PRZ”. It is an acronym for Potential Reverse Zone.

There are 5 such points in this case as per our current perception. Different people will have different perception.

Broader Market has triggered a huge sell-off, So my perception is “not bullish”. Now, In futures, We can just short Justdial with stop loss but in the world of “options trading”, we have multiple options which are why this discussion!

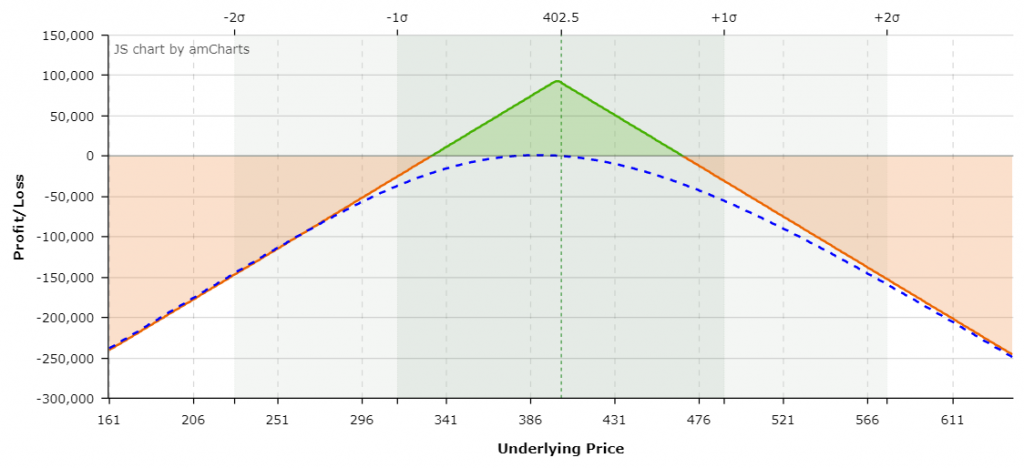

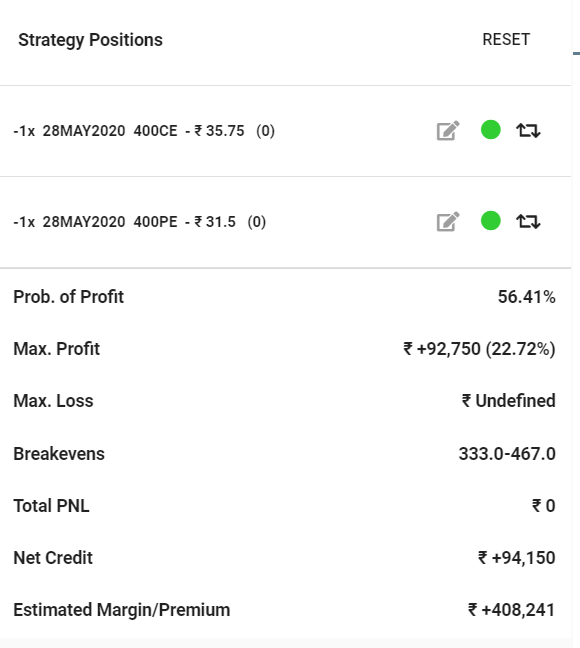

Straddle

Refer – https://unofficed.com/lessons/straddle/

There is no loss between 330-470.

The range is marked with red lines.

But it will be a huge cause of headaches if it does a one-sided movement. We need to keep changing our strikes to reshape our range in which we will stay in profit.

What if We do not want to do that? We can bet on the same thing with a limited loss setup. If we are right, We will get less profit but we don’t have to micromanage or have fear of extreme losses!

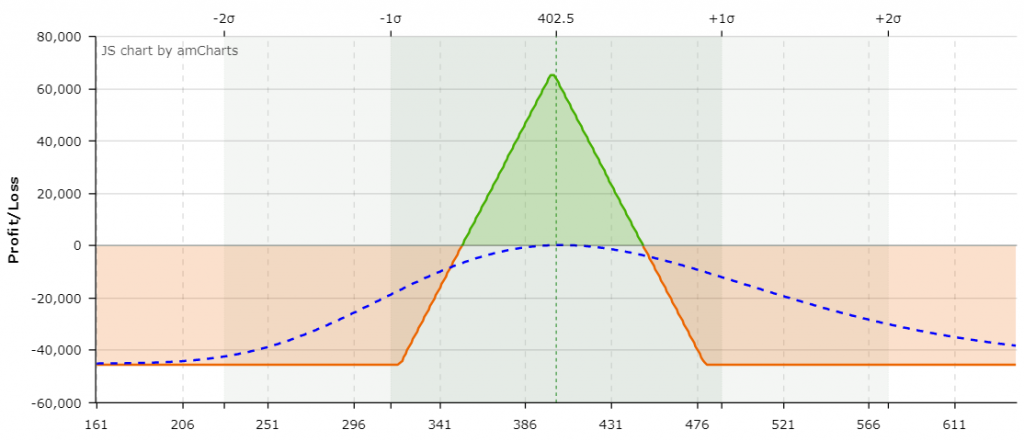

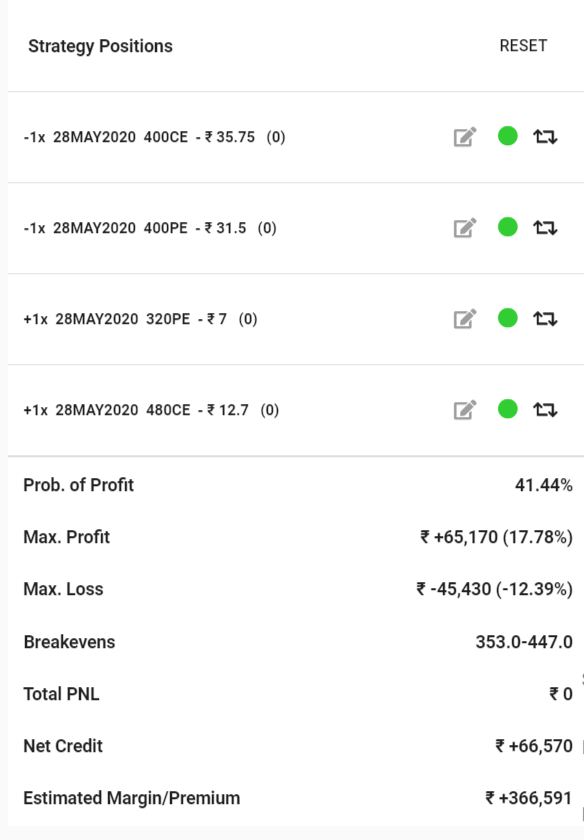

This is Iron Condor.

Refer – https://unofficed.com/lessons/iron-condor/

Now there is no loss between 360-450

The range within which we were making a profit, contracted! The amount of profit is also contracted. The cost is quite steep for the insurance of sweet dreams.

Anyways, We were discussing neutral strategies. But our view is bearish.

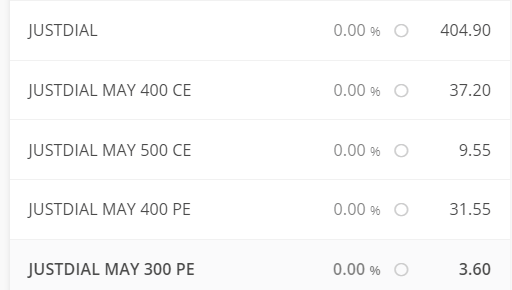

Now we can just sell call options of ATM strike price i.e 400CE at 37.2

Or, We can also sell OTM strike price i.e. 500CE at 9.55

In a similar analogy, We can also buy ATM strike price of 400 PE at 31.55 or OTM strike price of 300 PE at 3.6

- If we sell Justdial futures at 404.9, our profit will be unlimited (Well, highest profit can be 404.9 if Justdial goes 0.) **but we will start making a loss the moment Justdial trades above 404.9

- But if we sell 400CE at 37.2, We can make a maximum profit of 37.2 but **we will start making a loss when Justdial trades above 437.2

- 500CE sell at 9.55 is even worse in terms of reward i.e We can make a maximum profit of only 9.55 better in terms of risk i.e. **we will start making a loss when Justdial trades above 509.55

So, the Stock market is designed in a way that risk and reward are linear! The more risk you take, The more chances of money you make/lose!

- The risk of options is always lower than the Risk of futures.

- The risk of options is also lower than risk of equities.

Although, You can not short equities in India. Let’s say You buy Justdial at 404.9, we will start making a loss the moment Justdial trades below 404.9

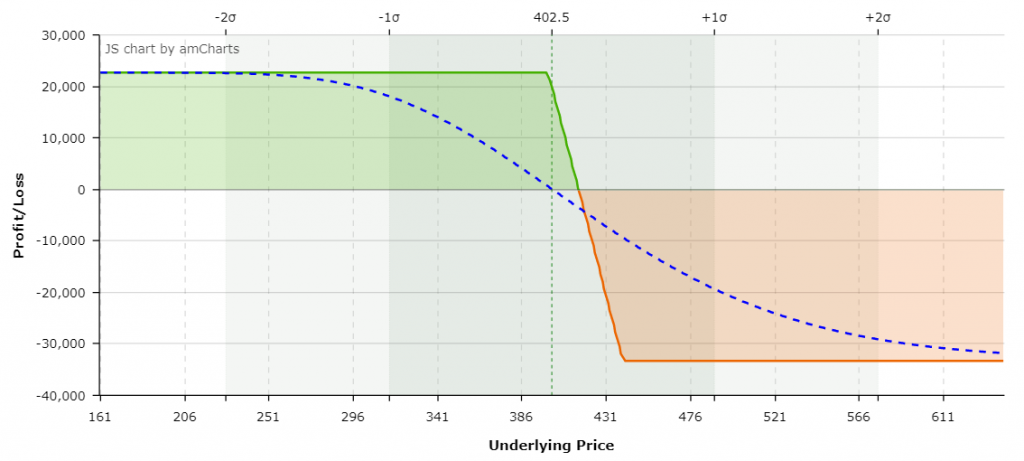

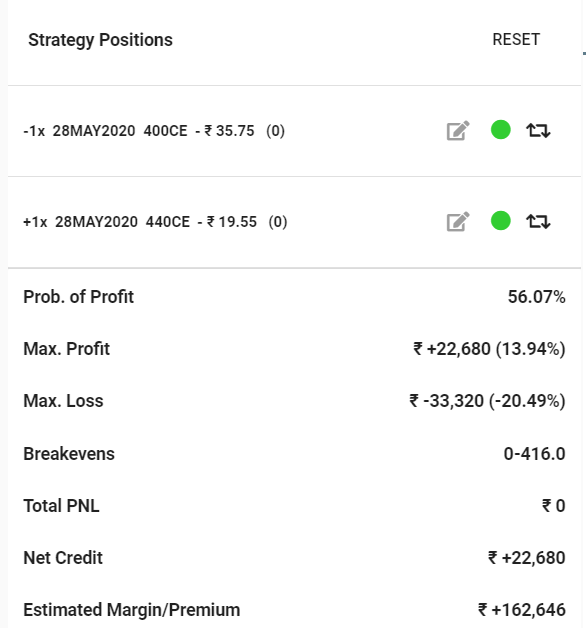

Coming back to the original discussion – We can also introduce a limited loss set up in this case too. This is called call spread.

We will make limited loss if Justdial ends above 420.

Refer – https://unofficed.com/lessons/vertical-spread/

Because of permutations and combinations of payoff graphs due to multiple strike price and multiple expiries, Things can go literal creative and You can bet on many amazing things apart from “just range” or “limited loss” trades. You can explore the most popular strategies from the Unofficed website.

The Justdial chart is posted in Tview. You can use the “Make it mine” feature to use it and see the levels in more details –http://in.tradingview.com/chart/JUSTDIAL/rv1xkEz5-WatchList-Justdial-Pivot-Points/

Wonderful Explanation