A Quick Dive into Option Greeks

Refer – https://unofficed.com/courses/the-option-greeks/

If you’re an options trader, you may have heard about “Greeks,” but perhaps you don’t know exactly what they are or, more importantly, what they can do for you.

It gives us a mathematical understanding.

Greeks are calculated using a theoretical options pricing model.

Delta, Gamma, Theta, and Vega – which are the first partial derivatives of the Black Scholes options pricing model are the more common ones.

As we’re going to discuss Intraday models. The most important greek of all here is – Theta.

The option’s theta is the rate of decline in the value of an option over time.

Selling options means having positive theta and buying options means we have negative theta.

In our case, Justdial 400CE is sold at 35.75 and the expiry is on 28th May, The theta is 946.73. It means We will get ₹946.73 if JUSTDIAL price and volatility remains constant tomorrow.

If Justdial expires at CMP i.e. 404.9, the Price of 400CE will be 4.9. We will make a profit of 35.75-4.9 = 30.85 points in that case. The lot size of the Justdial is 1400. So it is about 1400*30.85=43190 INR

We have 25 days to expiry. In that theory, we should have made 43190/25= 1727.6 by tomorrow instead of 946.73 right?

Wrong!

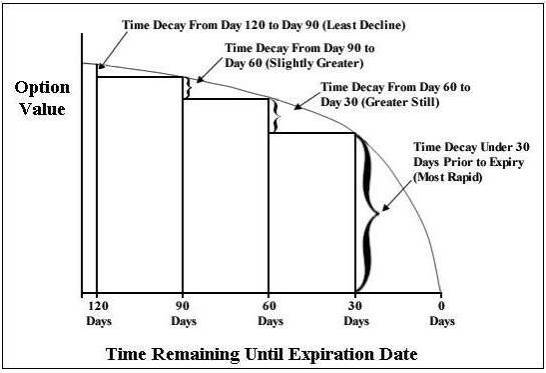

The effect of theta increases exponentially as the time to expiry comes near.

Takeaways

- If we sell as soon as possible, the theta has more time to eat premium.

- If we buy as late as we can, the theta has more time to eat premium.

But this is not true!! Because options are not just about “Theta”.

Options are insurances. Theta is all about the decline of risk of the insurance over time.

Lets forget about Direction as it is not in our hands.

Lets forget about Interest Rate because there are preplanned announcements from RBI’s side on interest rate decision and hence can be avoided.

Let’s talk about volatility.

On the start of the market, the volatility is at its peak.

It can be easily seen on the charts of India Vix too!

Lots of AMO order gets executed, people try to punch order due to FOMO or various reason. Its chaos.

Then, there is execution risk. The brokers also get stuck, so does the exchange. It is sort of herculean effort to execute trade on 9:15:00

Here comes the concept of Implied Volatility and Vega.

Implied Volatility is an estimate of expected movement in a particular stock or security or asset. It basically tells what the market is “implying” about the volatility.

It is derived from the price of an option in the market.

IV doesn’t define option prices. The option price defines IV. Supply and Demand creates option price.

IV of far OTM options can be way higher and IV of ATM options. There can be asymmetry. You can read further on volatility and its effect at https://unofficed.com/lessons/implied-volatility/

Vega is the change in the option price when the Implied Volatility of the underlying asset moves up or down 1%. Our profits/loss from IV collapse will be determined by Vega.

Volatility is calculated by a few things, namely –

- Change on the price.

- The speed at which the change in the price happened.

- Historical Price changes. (If the markets have gapped down over three times in the last three days, there is a high chance it can gap down tomorrow as well, Right?)

- Expected price movements. (Like Fundamental Events)

Read more here – https://unofficed.com/lessons/vega

All brokers start their intraday square off from 15:00. So, selecting a broker that allows you to keep the position to 15:20 will give an unfair advantage! Also windows for huge deals open from 15:00. This is another volatility.