Intraday Strategy: Different Compression Patterns

Intraday Strategies: Originally written on Friday at 01:58 AM in Unofficed Channel.

Price action is the easy and simple thing to trade. It is hard for a machine to understand, hard for a code to compete for your human intelligence of pattern recognition. I have two steps:

- Trades that are planned before the market starts that day.

- Trades that are planned after the market starts that day.

And, I always keep my trading diary in Tradingview where it can not be deleted or tampered with giving me a genuine aura in a scammy industry.

I will just share my diary, read it 🙂

A stock is having a super expensive valuation. For valuation, one can quickly refer to Market Mojo. There are tons of valuation models as we speak. A simple way is not to do Ph.D. on that and take results from a site which has done the Ph.D. already.

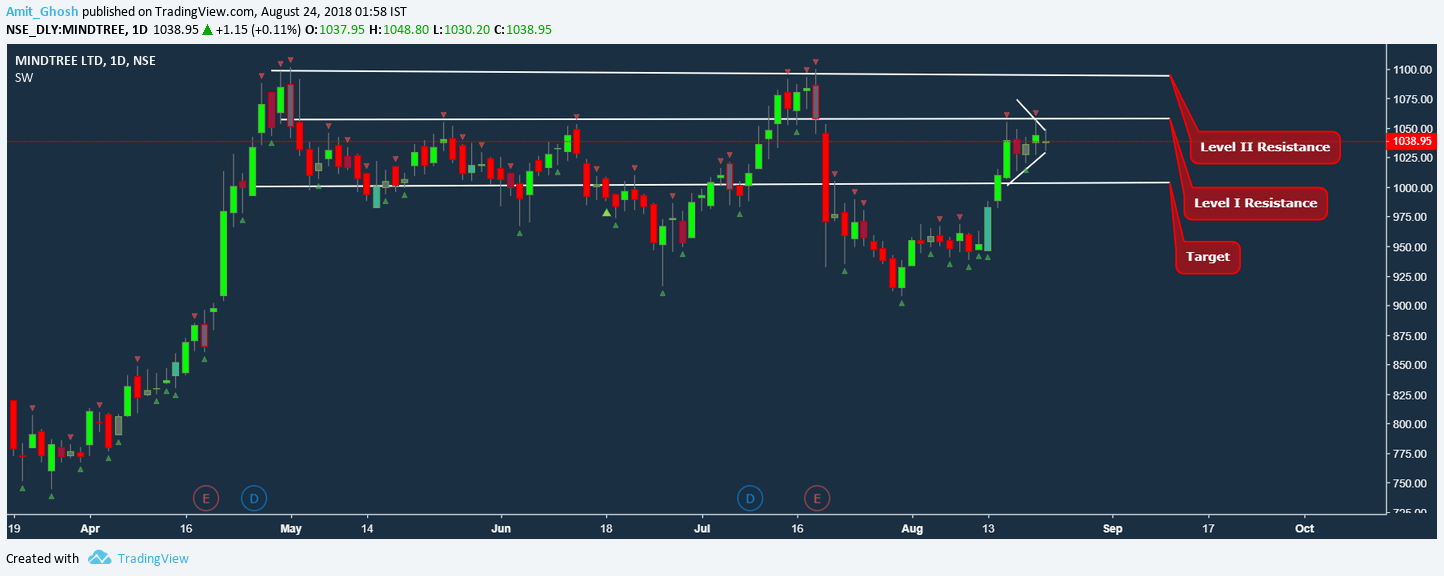

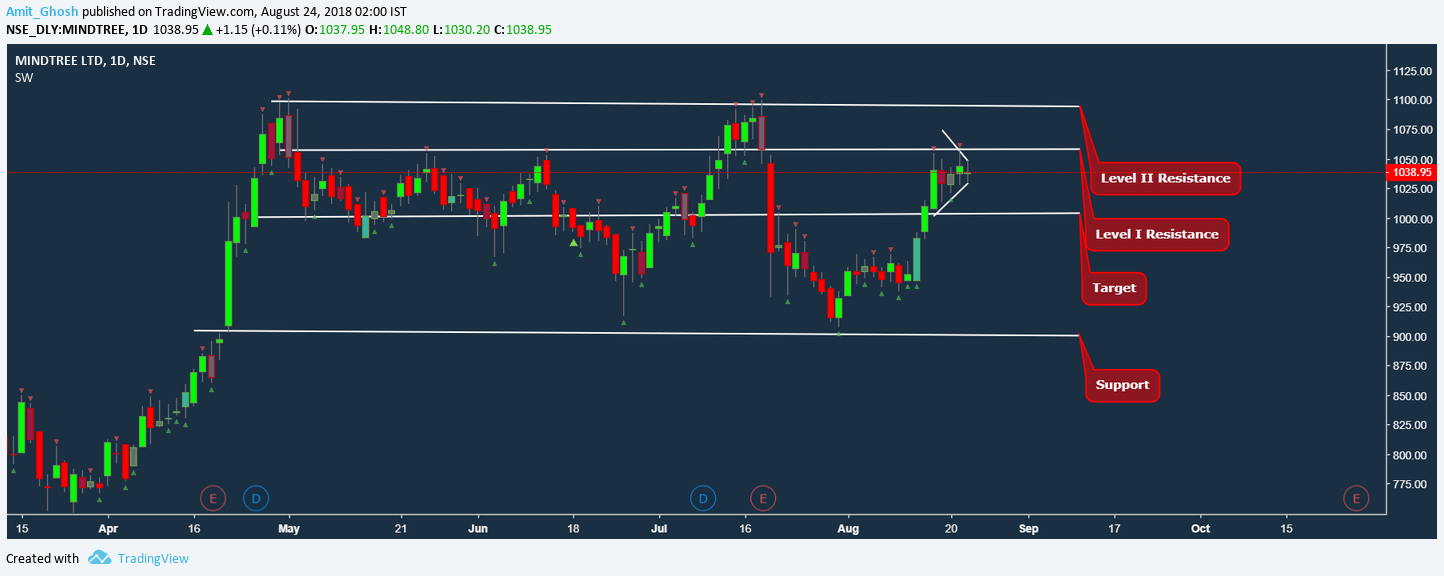

Massive Consolidation is going on as you can see here. Unless the level 1100 is breached and held, one can clearly play with the rangebound play.

900 is a level which is not breached since ages. So we can safely assume that it is good to bet that it won’t be breached too.

IT and Pharma were the suppressed sector and didn’t participate in the former bull run of NIFTY which happened post demonetization. Mainly because of uncertainty over revenue due to trump!

IT business are dependent on USDINR because they earn in USD, The better the rate, the higher the income here. And, IT business move synthetically with US comments on VISA policies of Indian people.

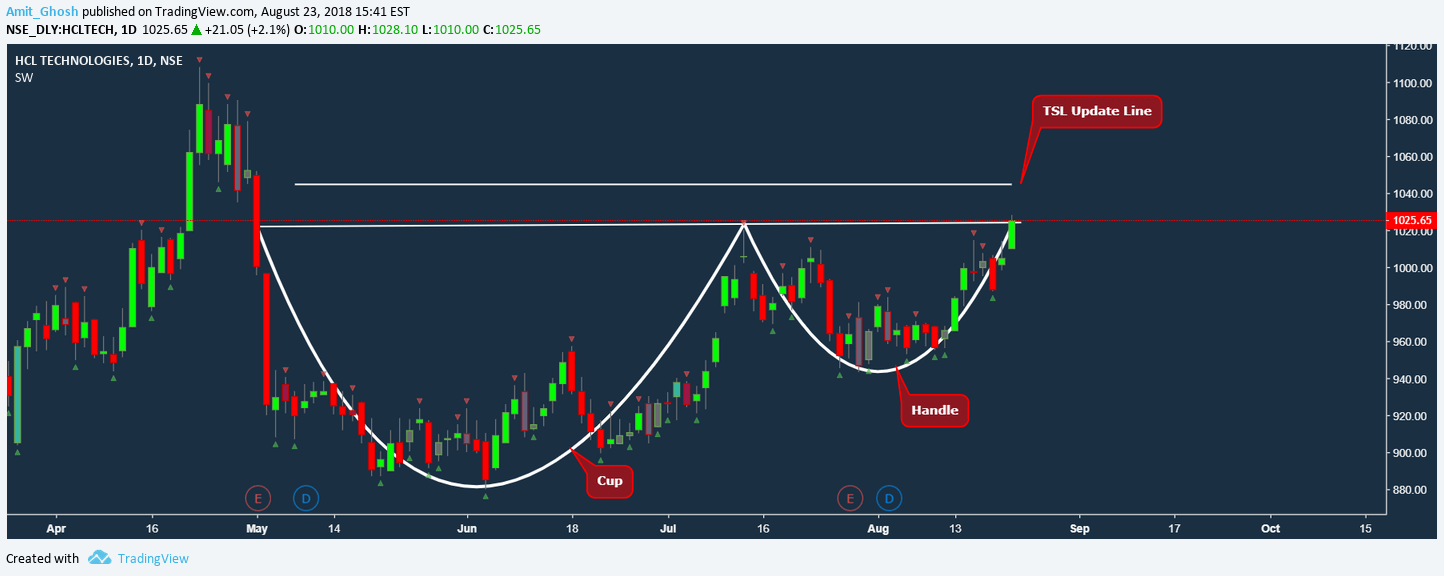

Next Trade: HCL Tech

“HCL Tech Cup and Handle Formation”

In case, You don’t know about this pattern and You are eager to know here are some resources. As of now, I have not made any definitive resource myself on this subject so I will be sharing what I found on the Internet –

How to Trade the Cup and Handle Chart Pattern

The Basics on how to analyze a stocks cup with handle

You always see I write ” In case of gap up above the previous day’s high or gap down below the previous day’s low, please avoid buying it or selling it respectively. Follow the ending of the candle formed in first 5 minutes and follow ORB strategy. “

Planning Day trading with Limit orders and Tradingview

Read here on the usage of ORB Strategy.

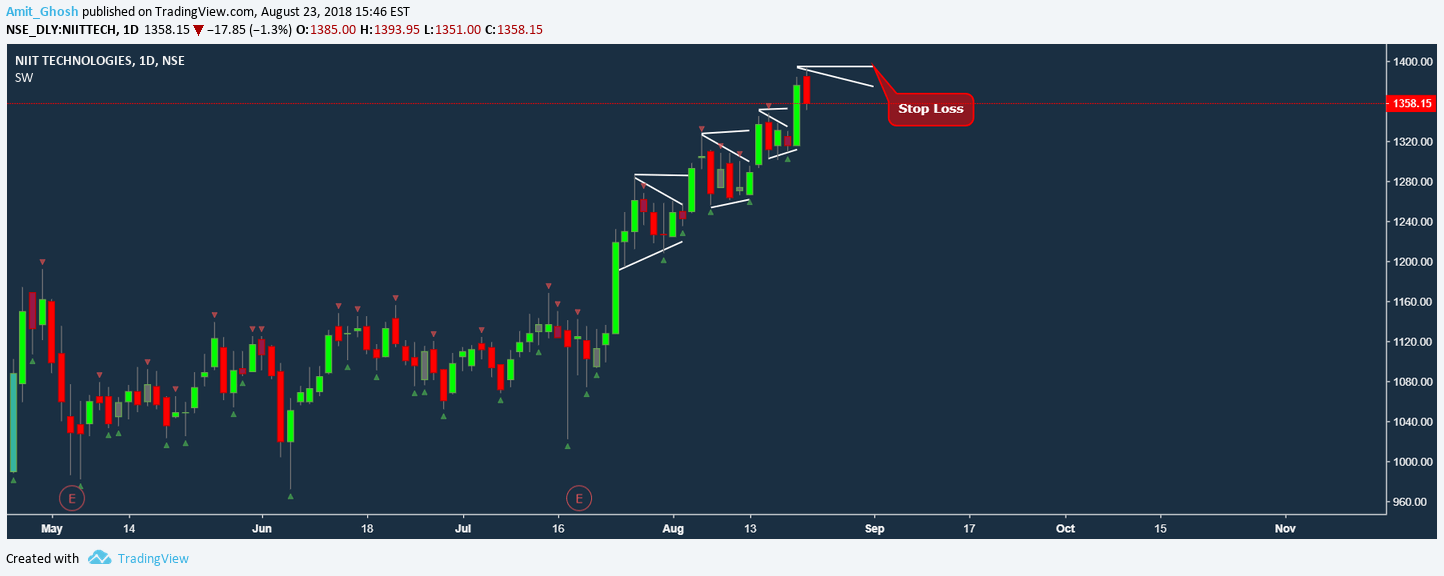

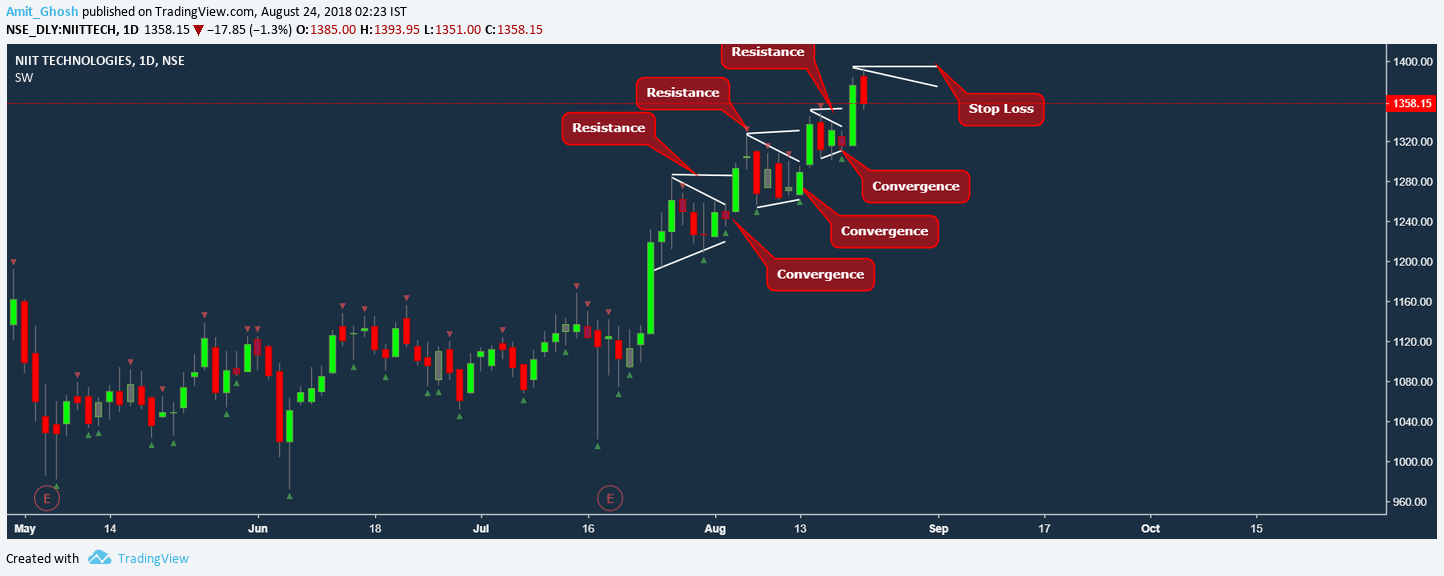

Next Trade: NIIT Technologies

“NIIT Technology Flag Pattern” – This is definitely not a flag pattern but it is definitely some pattern which is following the same conformation.

It is just forming a weird pattern where it is moving up after a period of 3-4 days and the next day it shoots more up (due to short covering). The next day it falls never breaching that level for some time into some sort of convergence.

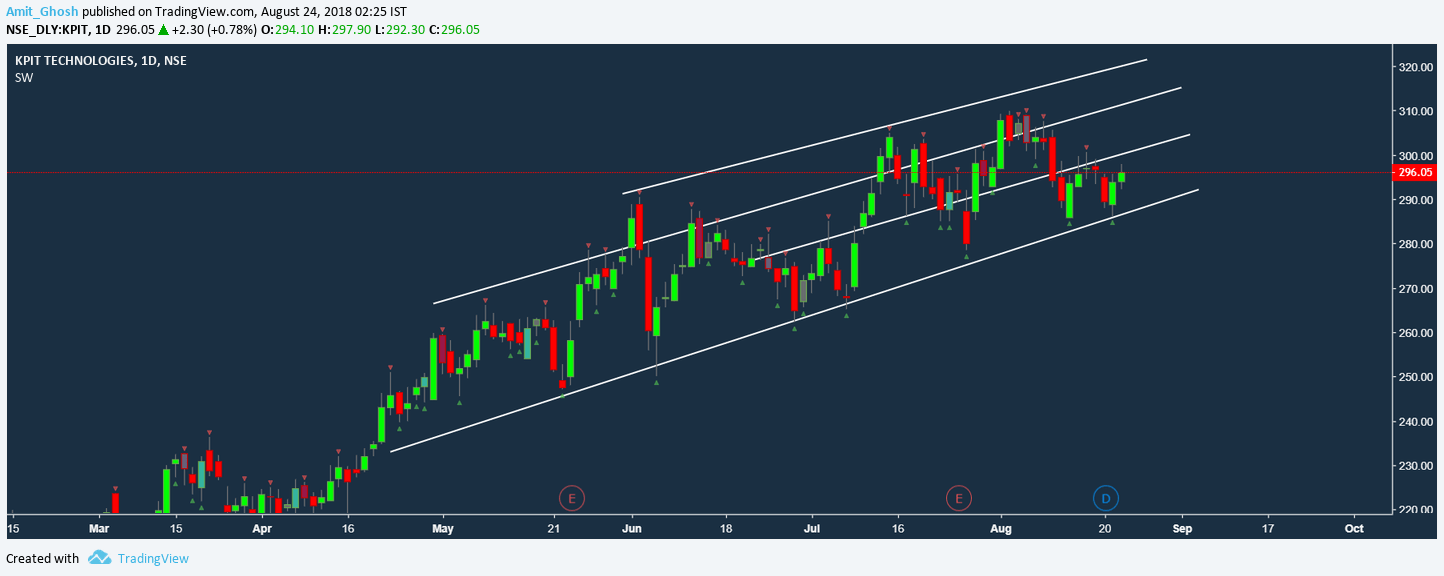

Then I was checking KPIT. No one likes the consolidation part.

Long if it breaks the high of the previous day with a stop loss at the previous day’s low. But it can end with a trap and tons of consolidation. No one likes that.

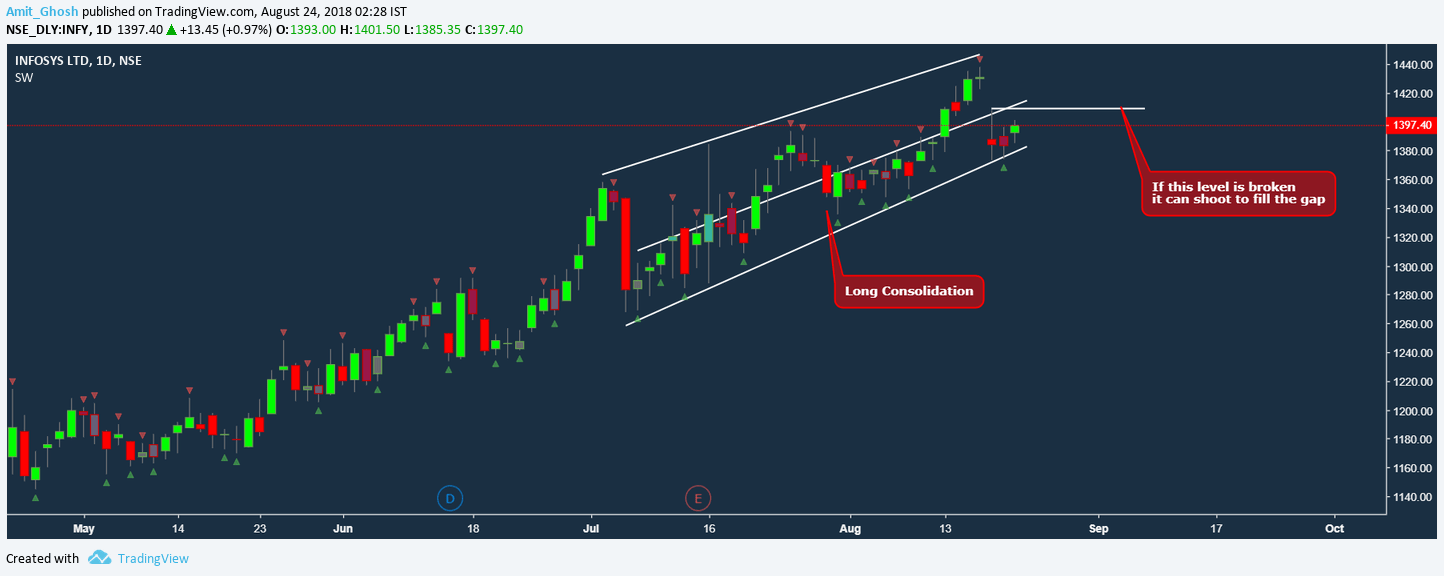

Infosys is the same. Looks like the uptrend will be broken in W charts. And it can lead into a sideways trend before further going down or up. Well, no one likes the down moves. So, no trade

Long consolidation in that channel. There is a good trade possibility but that is very far. Lower channel it is nightmare to get trapped into a consolidation.

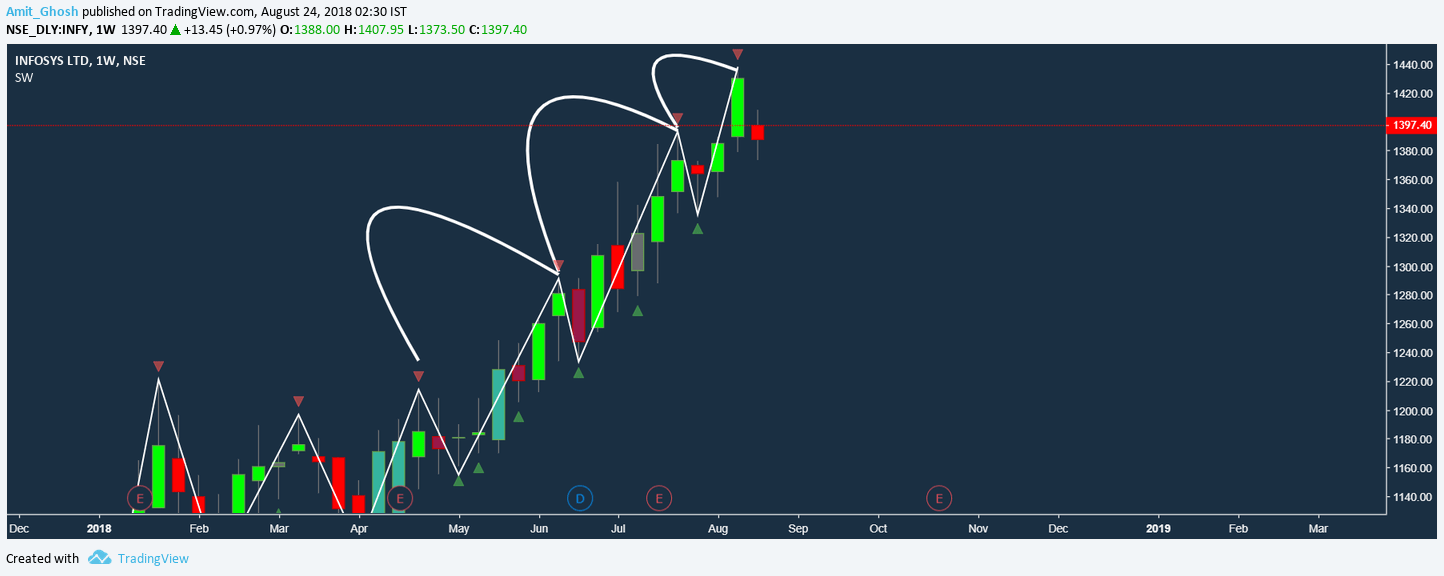

Added the zigzag line to Infosys. You can read more about trend identification and swing trading with the zigzag line in Bounce – Learn Swing Trading

Plans:

“NIIT Technology Flag Pattern”

“HCL Tech Cup and Handle Formation”-23

You can click the play button to see how these intraday strategies carried out!

Outcome: