Planning Day trading with Limit orders and Tradingview

In Buddha, We often share lots of ideas in TradingView. As it is intraday setup, there are always lots of setups waiting for the trigger. Sometimes it is hard to monitor so many charts and stocks simultaneously. Personally, I trade with 6 screens, still, it is too much to monitor due to lots of movement.

The basic trading strategy of Buddha is –

- Long if it breaks the high of the previous day with a stop loss at the previous day’s low.

- In case of gap up above the previous day’s high or gap down below the previous day’s low, please avoid buying it or selling it respectively. Follow the ending of the candle formed in first 5 minutes and follow ORB strategy.

ORB Strategy

What is the ORB strategy mentioned here? Let’s discuss with a case study on how to deal with this kind of scenes.

When a stock opens a huge gap up or gaps down. It follows some additional property. Think this way – You have a stock future which opened a 2% gap up. Will you keep it open if it starts falling? Similarly, You have a pharma future and USFDA issue came and it gapped down 5%. What will you do?

The thing is You will certainly do something. Most people will! That creates the additional property. So, those are the special cases we need to keep eye on.

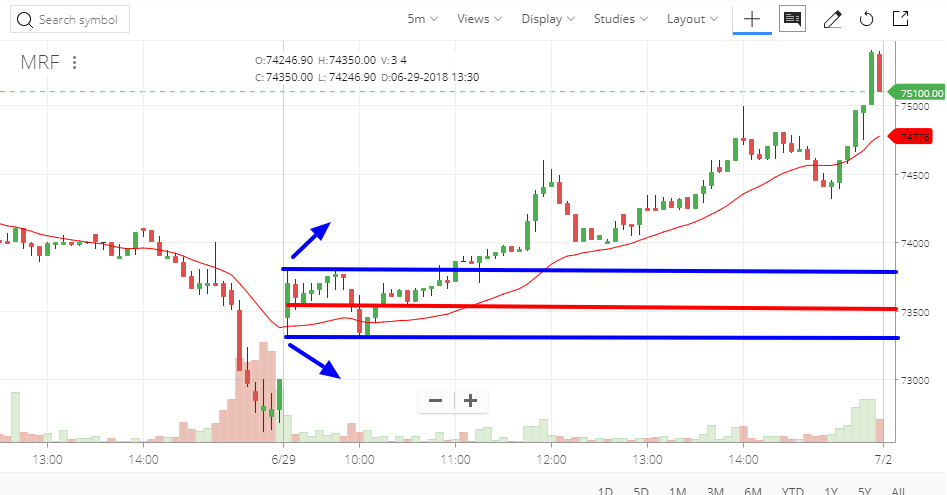

Last Friday, We had a buy setup for MRF. Now as you can see MRF opened with a gap up.

What we did is We patiently waited for the first 5 minutes candlestick to form. So, it is a 5 minutes time frame.

The rule is simple –

- We buy if the high of the 5 minutes candle is broken.

- We sell if the low of the 5 minutes candle is broken.

We were looking for buying only. So, You can see although the sell order triggered and hit stop loss. We’re saved!

There can be two ideas of stop loss –

- In case of a buy, the candle’s low is stop loss and In case of a sell, candle’s high is stop loss.

- The candle’s t (high+low)/2 is the stop loss.

I set the stop loss looking at the candle’s height (i.e., high- low)! If it is too big I go for the second; If it is a small one, I go for the first one.

Limit Orders

It solves the case of gap ups and gap downs! But how to keep track of all the trades; How to plan the order book?

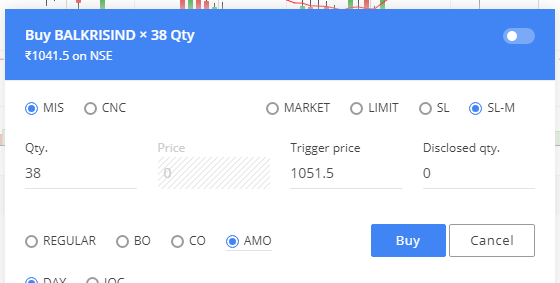

First, You need to follow a quant system if you’re doing equities. Like, 40K quant. Breaking 1051 triggers the buy order. So, We will always take slightly above this level. Like 1051.10.

But the thing is the price of the stock is lower than 1051.1. So if you place a buy order with a limit at 1051.1, it will trigger automatically. So we use the power of stop loss in a tricky way.

40000/1051.1 ~ 38 (It means with 40,000 INR we can buy only 38 stocks).

Here is how you set the order entry. With the proper use of After Market Orders! You can set all the trade triggers in AMO in the previous night and You’re good to go.

*Above image is from Zerodha.

You will get a notification when the order is triggered. Just check up causally and place the stop loss as per your risk management for that day. Let the profits run!

[…] Let’s follow the ORB rule. […]

[…] Planning Day trading with Limit orders and Tradingview […]

Hi,

Its great blog but i have small confusion. I didn’t get below line line exactly

“So we use the power of stop loss in a tricky way.

40000/1051.1 ~ 38 (It means with 40,000 INR we can buy only 38 stocks).”

Please explain….

Regards,

Sandeep

If the stock’s price is 1051.1.

If You have 40000.

You can buy only 38 shares. Right?

[…] You can read about that here -> https://unofficed.com/courses/time-compression-trading/lessons/planning-day-trading-with-limit-order… […]