Intraday Strategy with Narrow Range Theory (NR7)

Refining NR7 Strategy with Inside Bar Theory:

NR7 functions as a method for generating a watchlist, offering various widely embraced approaches for handling stocks identified within the NR7 watchlist (pertaining to how, when, and what factors to consider for entry and exit decisions).

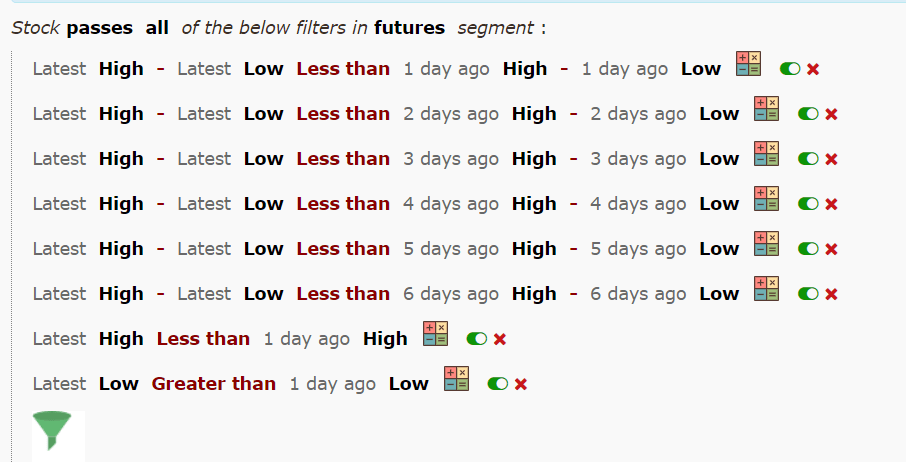

Among these approaches, one frequently utilized technique involves enhancing the watchlist through the application of inside bars. In this context, the stocks listed in the NR7 watchlist are evaluated to determine if their most recent bar forms an inside bar pattern.

The inside bar strategy is a price action strategy and is also based on the same theory of expansion and contraction but here the expansion and contractions are defined based on different rules.

So, the probability of winning automatically improves.

Here is the final scanner –

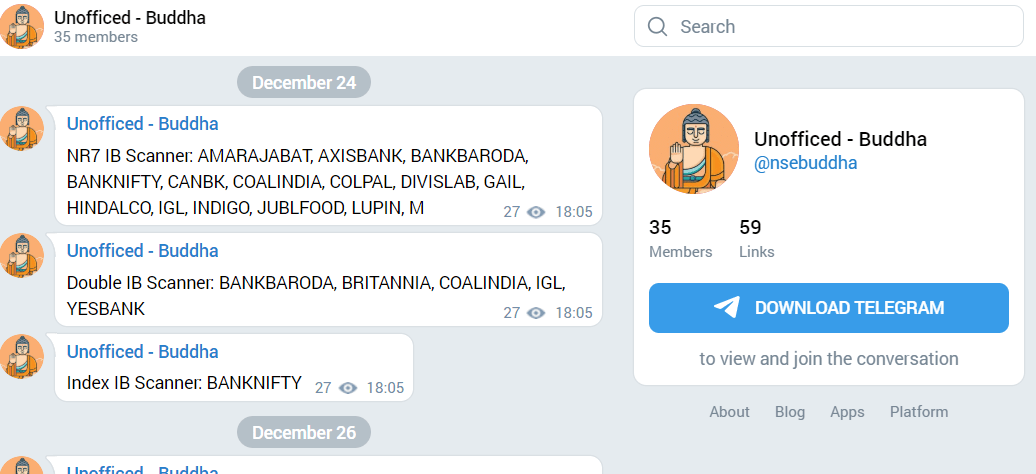

Here goes the output –

Intraday NR7 Strategy based on Weekend Theory:

The primary trading idea of NR7 Setup here is –

- Long if the high of the previous day’s high is broken with stop loss at the previous day’s low.

- Short if the low of the previous day’s low is broken with stop loss at the previous day’s high.

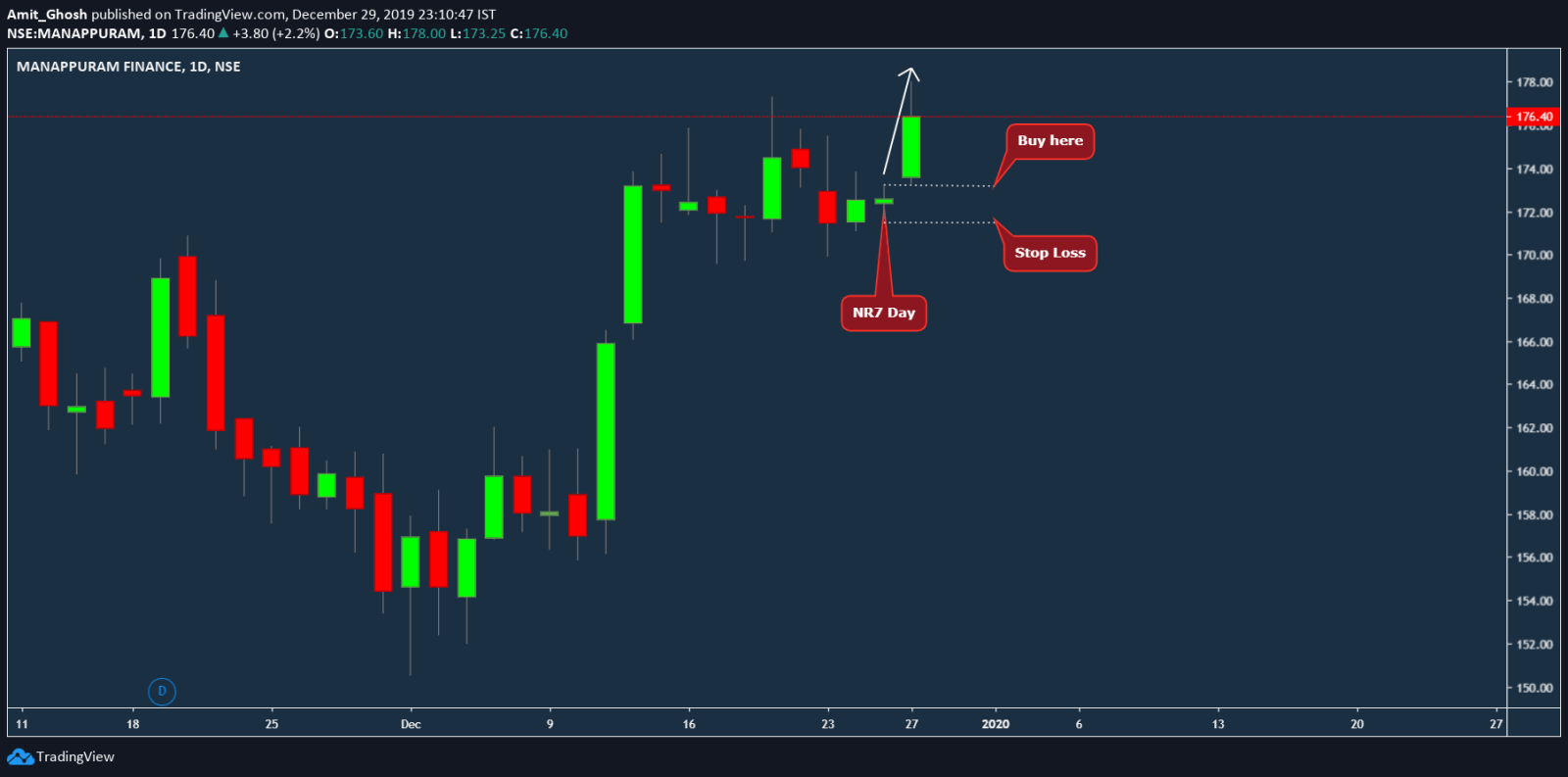

Example –

#1 Manappuram Finance –

Yesterday, It had the Narrowest Range day in the last 7 days i.e. NR7 day and it was having an inside bar. It trigged buy at the beginning of the day and ran with good momentum.

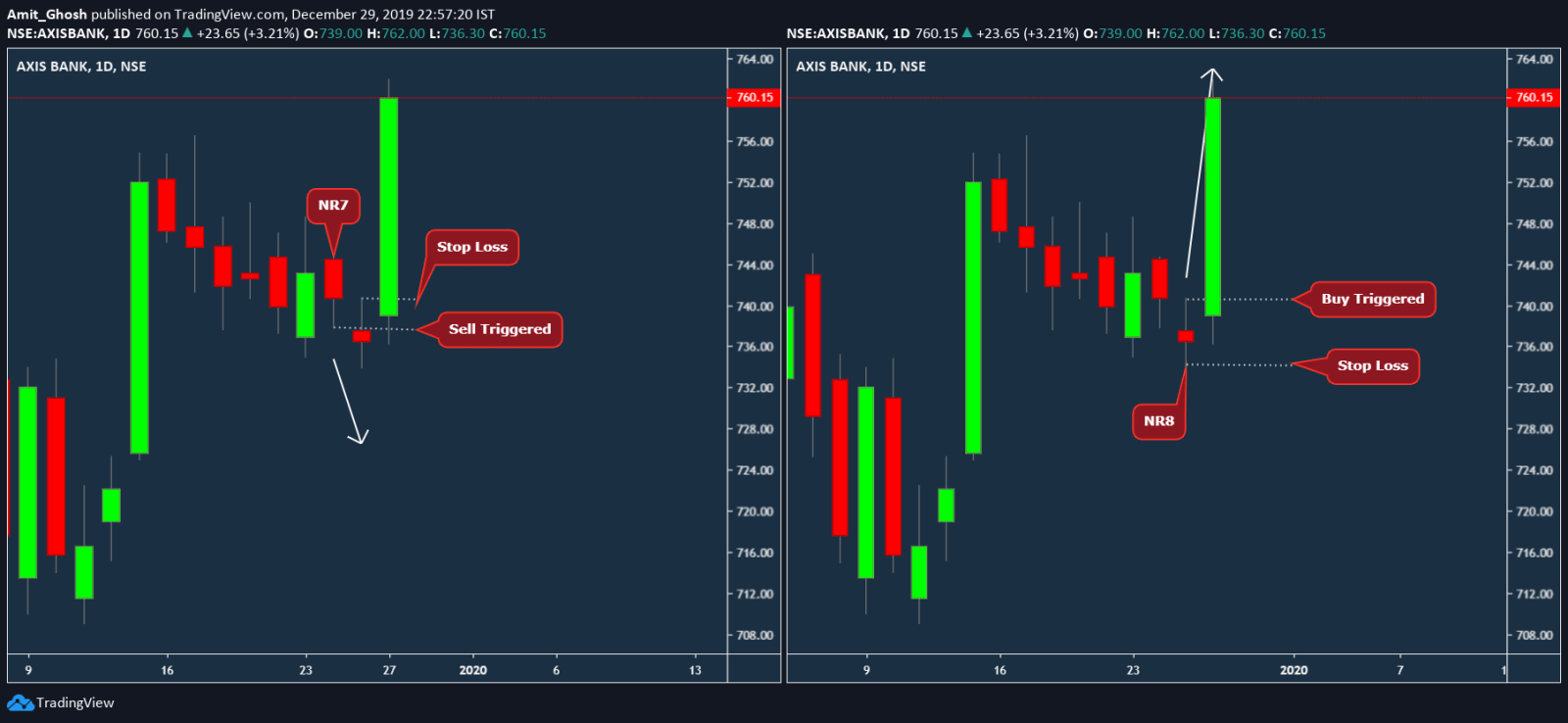

#2 Axis Bank –

#2 Axis Bank –

The day before yesterday, Axis bank was having NR7 and Inside Bar day and it triggered sell. That ended in profit.

But, Yesterday, Axis bank had NR8 day because the range created on the NR7 day ended up narrower. But, ironically, this time, it triggered buy. That ended in massive profits.

Intraday NR7 Strategy based on Gap Theory:

In this case,

- Long if there is a gap up with stop loss at the previous day’s low.

- Short if there is a gap down with stop loss at the previous day’s high.

But, let’s stick to the first said method only.

You can find more examples in this article – How do you find out the breakout direction of NR7?

But how do you locate this NR4 and NR7 to trade effectively.

https://docs.google.com/spreadsheets/d/1pu7kS2mdnLjYH-oyv-ckmZtsBd-Eo1OZW-Wg1kVDxMs/edit?chrome=false&rm=demo#gid=1549459645

It may help..

Hi, the spreadsheet had been deleted. pls re-upload

Hi, Please re-upload the above spreadsheet again, the link is not opening.

[…] Strategies: Intraday Strategy: NR7 Intraday Strategy: CandleSticks Intraday Strategy: Opening Range Breakout Intraday Strategy: Gap Up […]

[…] How do you find out the breakout direction of NR7Intraday Strategy: NR7 […]

it takes almost 50 dummy trades to do it -or try to trade it in 1 quantity in cash segment -so its a minimal risk still live trade-after each trade ask 2 question-1)why i m right? n 2) why i m wrong? analyse it n u will hv ur answer with confidance after 50 such trades

Is the scanner shown an internal tool or it is available publicly to be accessible?

its based on chartalert website -open it -create custom scanner as shown here with watchlist of fno stocks