Options selling as passive way: If by passive, thirty minutes per week is Ok then I can show you with three examples. The core is the same –

- Capital Protection [Immediate Hedge on BEP Breach]

- Analysing all events beforehand

- Not acting unless BEP is breached

- Diversification

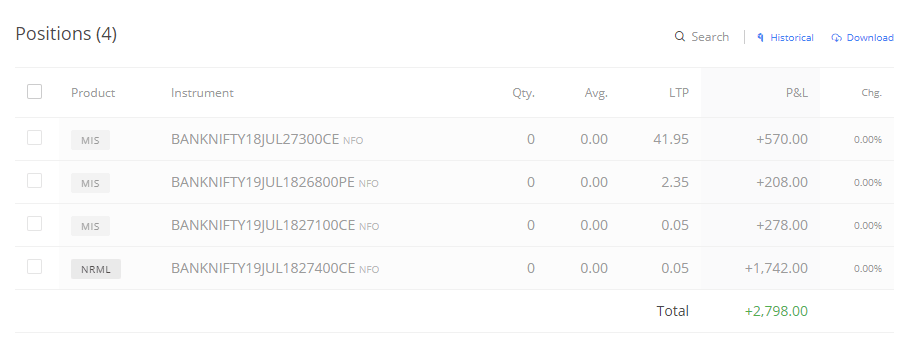

Strategy 1 – Option Interest:

Sell strike prices based on OI. Then keep eye on BankNIFTY Weekly Option chain from here at the end of the day for any sudden shift.

Sell 26900 PE at 117.85 and closed at 92

Sell 27000 CE at 145.95 and closed at 0

6872 INR on 130000 INR.

Strategy 2 – Technicals:

Sell strike prices based on results anticipation and technical support and resistance projection towards expiry.

5076 INR on 130000 INR.

Strategy 3 – OTM CE:

Considering you have the margin for one lot only; then take the call options to more further resistance point than Strategy 2.

1760 INR on 65000 INR. Also, you can do intraday by selling an OTM put option on Thursday to get a proper balance.

Each Setup Hardly takes 30 minutes of your entire week.