Hello,

Last two months we have experienced a heavy volatility due to Budget and further catalyzed by jitters over inflation and rising bond yields in US market. What was unexpected was the pre-budget rally which was sudden and abrupt. On breakout of 26000, it rose 1600 points within a span of seven days only to fall again.

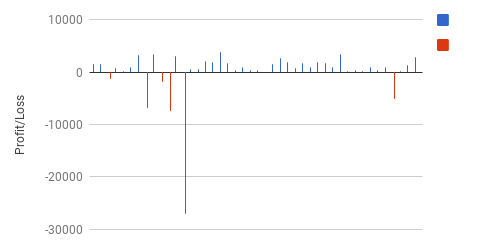

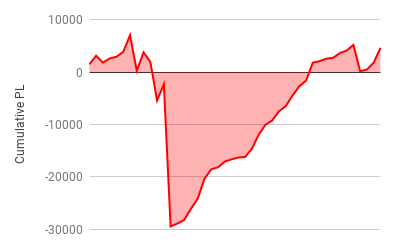

But as it had a gap up opening post breakout of 26000, strategy faced drawdown more than the anticipation and the sudden rise of vega killed all the premiums of PE to take the hedge trades. We recorded second highest loss in our quant since inception.

We didn’t place martingale anticipating a post-budget rally which turned again against our favor as LTCG got announced triggering a massive sell-off; otherwise, we would have recovered our loss in the second week itself.

Without Martingale the only way was to trust on our past winning ratio of >85% and hence interpolation projected a recovery over a span of 6 subsequent weeks at maximum.

It worked out!

It worked out!

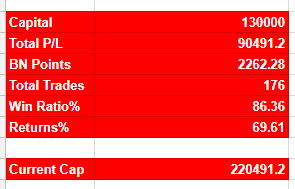

And we ended in profit due to our negatively skewed strategy of having high win ratio with high losses but less amount of losses.

Our strategy got a complete strategic shift as suddenly BankNIFTY lots started to consume more margin than the anticipated margin of 65000 per lot. As VIX rose because of market volatility, margin rose off the charts making it average of 80000 per lot in most of the times which delayed our projected profit towards 10 weeks instead of 6.

To increase exposure margin and to limit the loss, we also bought options against our fundamental belief which all added up more loss but we used the free margin to offset the loss with theta strategy applied on NIFTY. Although the margin is more than 13000, we’re unable to take two normal BankNIFTY lots. Hence, we utilized the free margin for NIFTY trades.

We’ve not added the NIFTY trades as it makes a breakeven with the option buy trades. Before offering Alpha Theta we had some past profit, so old investor accounts didn’t see any impact on margin change.

Old Investors are asked to withdraw their extra profit of roughly 90K to make equal margin with late joiners giving me adoption of newer margin policy without making two sets of users. (i.e. old investors having the account value of 2.2L and new investors with the account value of 1.5L (New customers have asked to keep 20K buffer))

Going forward, we shall utilize the free margin with NIFTY theta trades to make minute profits and use that as a hedge to waste on BankNIFTY option buy to protect unlimited downside or upside. But it will be excluded from the core strategy. It will be called as a Risk Management strategy on top of our usual Theta.

Benchmark – Since inception of Theta BankNIFTY is down by 25318.1 – 24955.20 = -362.9 points ~ 1.43 % and we are up by 3.6% (2.92% brokerage adjusted).

Due to infrastructure, problem investor accounts’ returns are varying from -8k to +8k range. You can tally your trade book with our trade sheet here. We aim to stabilize that by utilizing free margin in other profitable strategies like we already tried our hands in intraday stock short selling.

Outlook – We are bullish on the current market scenario and hence will continue with martingale strategy only because we expect a sudden breakout on the upper side. Also, we are cautious with the market reaction on march end because of a massive sell-off expectation from all tax-smart investors.

-Amit

PS: Thanks for being in Unofficed!