Exploring Technical Indicators in the Indian Stock Market with Zerodha API and Python

This is a programming lesson. So there will be very less amount of explanation and more code. If you’re stuck somewhere, feel free to comment.

What Is a Technical Indicator?

Technical indicators are heuristic or mathematical calculations that rely on a security’s price, volume, or open interest, often employed by traders who adhere to technical analysis principles.

These indicators serve as tools for predicting future price movements by scrutinizing historical data. Some widely used technical indicators encompass the Relative Strength Index, Money Flow Index, Stochastics, MACD, and Bollinger Bands®.

How Technical Indicators Works?

Technical analysis is a trading discipline that involves the evaluation of investments and the identification of trading opportunities by analyzing statistical trends derived from trading activities, such as price movements and trading volumes. In contrast to fundamental analysts, who assess a security’s intrinsic value based on financial and economic data, technical analysts concentrate on patterns in price movements, trading signals, and a variety of analytical charting tools to gauge a security’s strength or weakness.

This approach to analysis can be applied to any security with historical trading data, encompassing stocks, futures, commodities, fixed-income instruments, currencies, and other financial assets. While we primarily focus on stocks in our examples in this tutorial, it’s essential to recognize that these concepts are universally applicable. In fact, technical analysis finds more extensive use in commodities and forex markets, where traders are primarily concerned with short-term price fluctuations.

Technical indicators, often referred to as “technicals,” center their analysis on historical trading data, including price, volume, and open interest, rather than delving into a company’s fundamentals like earnings, revenue, or profit margins. These indicators are particularly popular among active traders because they are tailored to analyze short-term price movements. However, even long-term investors can utilize technical indicators to pinpoint optimal entry and exit points.

There are two fundamental categories of technical indicators:

Overlays: These technical indicators use the same scale as prices and are plotted directly over the price chart. Notable examples include moving averages and Bollinger Bands®.

Oscillators: Oscillators are technical indicators that fluctuate between a local minimum and maximum and are typically plotted either above or below a price chart. Prominent examples encompass the stochastic oscillator, MACD (Moving Average Convergence Divergence), and RSI (Relative Strength Index).

Note – The structure of historical data and live data from Zerodha is identical. During the development and testing of functions, it’s not feasible to wait for days or months to validate their performance using live data.

To address this, we’ll initially test and validate our functions using historical data. Once we have confirmed that the functions generate accurate signals and execute trades correctly with historical data, we can seamlessly transition to using live data for real-time trading.

Python Code

'''

# Date must be present as a Pandas DataFrame with ['date', 'open', 'high', 'low', 'close', 'volume'] as columns

df = pd.DataFrame(data["data"]["candles"], columns=['date', 'open', 'high', 'low', 'close', 'volume'])

'''

df=pd.DataFrame(kite.historical_data(779521,"2019-04-14 15:00:00","2019-08-16 09:16:00","day",0))[["date","open","high","low","close","volume"]]

display(df.tail(10))

Output –

date open high low close volume

73 2019-08-01 00:00:00+05:30 330.80 331.50 311.35 317.15 40853304

74 2019-08-02 00:00:00+05:30 315.55 322.25 307.05 308.45 64472348

75 2019-08-05 00:00:00+05:30 298.45 302.85 291.70 300.25 48815899

76 2019-08-06 00:00:00+05:30 298.80 304.25 297.25 301.40 30442970

77 2019-08-07 00:00:00+05:30 302.40 302.45 288.80 289.90 30820114

78 2019-08-08 00:00:00+05:30 290.00 295.50 285.60 294.35 32929233

79 2019-08-09 00:00:00+05:30 296.30 298.00 290.05 291.35 23377581

80 2019-08-13 00:00:00+05:30 290.90 291.55 282.50 283.35 24231272

81 2019-08-14 00:00:00+05:30 285.05 291.25 284.50 289.75 18523649

82 2019-08-16 00:00:00+05:30 287.95 292.80 284.30 290.90 20047399

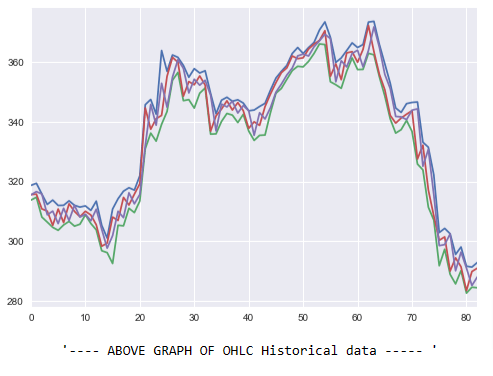

Ploting data

plt.style.use('seaborn')

df['high'].plot()

df['low'].plot()

df['close'].plot()

df['open'].plot()

plt.show()

print (" \t'---- ABOVE GRAPH OF OHLC Historical data ----- ' \n \n ")

Output –

Indicators

ATR (Average True Range)

- ATR measures market volatility, aiding in setting stop-loss levels.

- It quantifies potential price swings by considering the true range of price movements.

- Traders use ATR to adjust risk management strategies in varying market conditions.

"""

Function to compute Average True Range (ATR)

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

period : Integer indicates the period of computation in terms of number of candles

ohlc: List defining OHLC Column names (default ['Open', 'High', 'Low', 'Close'])

Returns :

df : Pandas DataFrame with new columns added for

True Range (TR)

ATR (ATR_$period)

"""

def atr(df,period):

df['hl']=abs(df['high']-df['low'])

df['hpc']=abs(df['high']-df['close'].shift())

df['lpc']=abs(df['low']-df['close'].shift())

df['tr']=df[['hl','hpc','lpc']].max(axis=1)

df['ATR']=pd.DataFrame.ewm(df["tr"], span=period,min_periods=period).mean()

df.drop(["hl","hpc","lpc","tr"],axis = 1 , inplace =True)

atr(df,14)

df.tail()

Output –

date open high low close volume ATR

78 2019-08-08 00:00:00+05:30 290.00 295.50 285.60 294.35 32929233 11.851230

79 2019-08-09 00:00:00+05:30 296.30 298.00 290.05 291.35 23377581 11.331060

80 2019-08-13 00:00:00+05:30 290.90 291.55 282.50 283.35 24231272 11.026916

81 2019-08-14 00:00:00+05:30 285.05 291.25 284.50 289.75 18523649 10.609991

82 2019-08-16 00:00:00+05:30 287.95 292.80 284.30 290.90 20047399 10.328657

RSI (Relative Strength Index)

- RSI assesses the momentum of an asset on a scale of 0 to 100.

- Values above 70 indicate overbought conditions, while values below 30 suggest oversold conditions.

- It’s a popular tool for identifying potential trend reversals and entry/exit points.

"""

Function to compute Relative Strength Index (RSI)

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

period : Integer indicates the period of computation in terms of number of candles

Returns :

df : Pandas DataFrame with new columns added for

Relative Strength Index (RSI_$period)

"""

rsi_period=14

chg=df["close"].diff(1)

gain=chg.mask(chg<0,0)

loss=chg.mask(chg>0,0)

avg_gain=gain.ewm(com=rsi_period-1,min_periods=rsi_period).mean()

avg_loss=loss.ewm(com=rsi_period-1,min_periods=rsi_period).mean()

rs =abs(avg_gain / avg_loss)

rsi =100 -(100/(1+rs))

df['rsi']=rsi

display(df.tail())

Output –

date open high low close volume ATR rsi

78 2019-08-08 00:00:00+05:30 290.00 295.50 285.60 294.35 32929233 11.851230 26.529639

79 2019-08-09 00:00:00+05:30 296.30 298.00 290.05 291.35 23377581 11.331060 25.567214

80 2019-08-13 00:00:00+05:30 290.90 291.55 282.50 283.35 24231272 11.026916 23.154909

81 2019-08-14 00:00:00+05:30 285.05 291.25 284.50 289.75 18523649 10.609991 28.931857

82 2019-08-16 00:00:00+05:30 287.95 292.80 284.30 290.90 20047399 10.328657 29.950888

SMA (simple moving average)

- SMA calculates the average price over a specified time period.

- It helps smooth price data, making trends more apparent.

- Traders use SMAs to identify trend direction and potential support/resistance levels.

"""

Function to compute Simple Moving Average (SMA)

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

base : String indicating the column name from which the SMA needs to be computed from

target : String indicates the column name to which the computed data needs to be stored

period : Integer indicates the period of computation in terms of number of candles

Returns :

df : Pandas DataFrame with new column added with name 'target'

"""

def SMA(df, column="close", period=14):

smavg = df.close.rolling(14).mean()

return df.join(smavg.to_frame('SMA'))

a=SMA(df)

a.tail()

Output –

date open high low close volume ATR rsi SMA

78 2019-08-08 00:00:00+05:30 290.00 295.50 285.60 294.35 32929233 11.851230 26.529639 323.685714

79 2019-08-09 00:00:00+05:30 296.30 298.00 290.05 291.35 23377581 11.331060 25.567214 319.435714

80 2019-08-13 00:00:00+05:30 290.90 291.55 282.50 283.35 24231272 11.026916 23.154909 315.232143

81 2019-08-14 00:00:00+05:30 285.05 291.25 284.50 289.75 18523649 10.609991 28.931857 311.671429

82 2019-08-16 00:00:00+05:30 287.95 292.80 284.30 290.90 20047399 10.328657 29.950888 308.071429

EMA (Exponential Moving Average)

- EMA gives more weight to recent prices, reacting faster to market changes.

- It’s favored by traders for quicker trend identification.

- EMA crossovers are often used to signal potential entry or exit points.

"""

Function to compute Exponential Moving Average (EMA)

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

base : String indicating the column name from which the EMA needs to be computed from

target : String indicates the column name to which the computed data needs to be stored

period : Integer indicates the period of computation in terms of number of candles

alpha : Boolean if True indicates to use the formula for computing EMA using alpha (default is False)

Returns :

df : Pandas DataFrame with new column added with name 'target'

"""

def EMA(df, column="close", period=14):

ema = df[column].ewm(span=period, min_periods=period - 1).mean()

return df.join(ema.to_frame('EMA'))

pp= ( EMA(df)["EMA"].shift(1)*13 + df['close'] ) / 14

pp.tail()

Output –

78 321.111774

79 317.329208

80 313.293848

81 309.758441

82 307.172770

dtype: float64

Bollinger band

- Bollinger Bands® consist of three lines: a middle SMA and upper/lower bands.

- They expand and contract with price volatility, providing insights into potential price reversals.

- Traders use them to gauge volatility and identify potential breakout points.

def BollingerBand(df, column="close", period=20):

sma = df[column].rolling(window=period, min_periods=period - 1).mean()

std = df[column].rolling(window=period, min_periods=period - 1).std()

up = (sma + (std * 2)).to_frame('BBANDUP')

lower = (sma - (std * 2)).to_frame('BBANDLO')

return df.join(up).join(lower)

c=BollingerBand(df)

c.tail()

Output –

date open high low close volume ATR rsi BBANDUP BBANDLO

78 2019-08-08 00:00:00+05:30 290.00 295.50 285.60 294.35 32929233 11.851230 26.529639 387.024069 284.140931

79 2019-08-09 00:00:00+05:30 296.30 298.00 290.05 291.35 23377581 11.331060 25.567214 385.242185 278.697815

80 2019-08-13 00:00:00+05:30 290.90 291.55 282.50 283.35 24231272 11.026916 23.154909 383.881457 272.388543

81 2019-08-14 00:00:00+05:30 285.05 291.25 284.50 289.75 18523649 10.609991 28.931857 379.931275 268.878725

82 2019-08-16 00:00:00+05:30 287.95 292.80 284.30 290.90 20047399 10.328657 29.950888 372.909758 267.750242

Heiken Ashi

- Heiken Ashi charts smooth out price fluctuations, helping traders visualize trends.

- Candlestick patterns on Heiken Ashi charts differ from traditional candlesticks.

- They are useful for filtering noise in price data and identifying trend changes.

def HA(df, ohlc=['Open', 'High', 'Low', 'Close']):

"""

Function to compute Heiken Ashi Candles (HA)

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

ohlc: List defining OHLC Column names (default ['Open', 'High', 'Low', 'Close'])

Returns :

df : Pandas DataFrame with new columns added for

Heiken Ashi Close (HA_$ohlc[3])

Heiken Ashi Open (HA_$ohlc[0])

Heiken Ashi High (HA_$ohlc[1])

Heiken Ashi Low (HA_$ohlc[2])

"""

ha_open = 'HA_' + ohlc[0]

ha_high = 'HA_' + ohlc[1]

ha_low = 'HA_' + ohlc[2]

ha_close = 'HA_' + ohlc[3]

df[ha_close] = (df[ohlc[0]] + df[ohlc[1]] + df[ohlc[2]] + df[ohlc[3]]) / 4

df[ha_open] = 0.00

for i in range(0, len(df)):

if i == 0:

df[ha_open].iat[i] = (df[ohlc[0]].iat[i] + df[ohlc[3]].iat[i]) / 2

else:

df[ha_open].iat[i] = (df[ha_open].iat[i - 1] + df[ha_close].iat[i - 1]) / 2

df[ha_high]=df[[ha_open, ha_close, ohlc[1]]].max(axis=1)

df[ha_low]=df[[ha_open, ha_close, ohlc[2]]].min(axis=1)

return df

STDDEV (Standard Deviation):

- STDDEV measures price variability or dispersion around a mean.

- It’s valuable for assessing the risk and volatility associated with an asset.

- Traders use it to adjust their strategies based on market conditions.

def STDDEV(df, base, target, period):

"""

Function to compute Standard Deviation (STDDEV)

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

base : String indicating the column name from which the SMA needs to be computed from

target : String indicates the column name to which the computed data needs to be stored

period : Integer indicates the period of computation in terms of number of candles

Returns :

df : Pandas DataFrame with new column added with name 'target'

"""

df[target] = df[base].rolling(window=period).std()

df[target].fillna(0, inplace=True)

return df

Supertrend:

- Supertrend generates stop lines based on price movements, aiding in trend following.

- It offers straightforward signals: Buy when price is above the line, and Sell when below.

- Traders use it to ride trends and avoid false signals in sideways markets.

def SuperTrend(df, period, multiplier, ohlc=['Open', 'High', 'Low', 'Close']):

"""

Function to compute SuperTrend

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

period : Integer indicates the period of computation in terms of number of candles

multiplier : Integer indicates value to multiply the ATR

ohlc: List defining OHLC Column names (default ['Open', 'High', 'Low', 'Close'])

Returns :

df : Pandas DataFrame with new columns added for

True Range (TR), ATR (ATR_$period)

SuperTrend (ST_$period_$multiplier)

SuperTrend Direction (STX_$period_$multiplier)

"""

ATR(df, period, ohlc=ohlc)

atr = 'ATR_' + str(period)

st = 'ST_' + str(period) + '_' + str(multiplier)

stx = 'STX_' + str(period) + '_' + str(multiplier)

"""

SuperTrend Algorithm :

BASIC UPPERBAND = (HIGH + LOW) / 2 + Multiplier * ATR

BASIC LOWERBAND = (HIGH + LOW) / 2 - Multiplier * ATR

FINAL UPPERBAND = IF( (Current BASICUPPERBAND < Previous FINAL UPPERBAND) or (Previous Close > Previous FINAL UPPERBAND))

THEN (Current BASIC UPPERBAND) ELSE Previous FINALUPPERBAND)

FINAL LOWERBAND = IF( (Current BASIC LOWERBAND > Previous FINAL LOWERBAND) or (Previous Close < Previous FINAL LOWERBAND))

THEN (Current BASIC LOWERBAND) ELSE Previous FINAL LOWERBAND)

SUPERTREND = IF((Previous SUPERTREND = Previous FINAL UPPERBAND) and (Current Close <= Current FINAL UPPERBAND)) THEN

Current FINAL UPPERBAND

ELSE

IF((Previous SUPERTREND = Previous FINAL UPPERBAND) and (Current Close > Current FINAL UPPERBAND)) THEN

Current FINAL LOWERBAND

ELSE

IF((Previous SUPERTREND = Previous FINAL LOWERBAND) and (Current Close >= Current FINAL LOWERBAND)) THEN

Current FINAL LOWERBAND

ELSE

IF((Previous SUPERTREND = Previous FINAL LOWERBAND) and (Current Close < Current FINAL LOWERBAND)) THEN

Current FINAL UPPERBAND

"""

# Compute basic upper and lower bands

df['basic_ub'] = (df[ohlc[1]] + df[ohlc[2]]) / 2 + multiplier * df[atr]

df['basic_lb'] = (df[ohlc[1]] + df[ohlc[2]]) / 2 - multiplier * df[atr]

# Compute final upper and lower bands

df['final_ub'] = 0.00

df['final_lb'] = 0.00

for i in range(period, len(df)):

df['final_ub'].iat[i] = df['basic_ub'].iat[i] if df['basic_ub'].iat[i] < df['final_ub'].iat[i - 1] or df[ohlc[3]].iat[i - 1] > df['final_ub'].iat[i - 1] else df['final_ub'].iat[i - 1]

df['final_lb'].iat[i] = df['basic_lb'].iat[i] if df['basic_lb'].iat[i] > df['final_lb'].iat[i - 1] or df[ohlc[3]].iat[i - 1] < df['final_lb'].iat[i - 1] else df['final_lb'].iat[i - 1]

# Set the Supertrend value

df[st] = 0.00

for i in range(period, len(df)):

df[st].iat[i] = df['final_ub'].iat[i] if df[st].iat[i - 1] == df['final_ub'].iat[i - 1] and df[ohlc[3]].iat[i] <= df['final_ub'].iat[i] else \

df['final_lb'].iat[i] if df[st].iat[i - 1] == df['final_ub'].iat[i - 1] and df[ohlc[3]].iat[i] > df['final_ub'].iat[i] else \

df['final_lb'].iat[i] if df[st].iat[i - 1] == df['final_lb'].iat[i - 1] and df[ohlc[3]].iat[i] >= df['final_lb'].iat[i] else \

df['final_ub'].iat[i] if df[st].iat[i - 1] == df['final_lb'].iat[i - 1] and df[ohlc[3]].iat[i] < df['final_lb'].iat[i] else 0.00

# Mark the trend direction up/down

df[stx] = np.where((df[st] > 0.00), np.where((df[ohlc[3]] < df[st]), 'down', 'up'), np.NaN)

# Remove basic and final bands from the columns

df.drop(['basic_ub', 'basic_lb', 'final_ub', 'final_lb'], inplace=True, axis=1)

df.fillna(0, inplace=True)

return df

MACD (Moving Average Convergence Divergence):

- MACD is a popular momentum indicator that reveals changes in the strength and direction of a trend.

- It consists of two lines, the MACD line and the signal line, along with a histogram.

- Traders use MACD crossovers and histogram patterns to identify potential buy and sell signals for assets

def MACD(df, fastEMA=12, slowEMA=26, signal=9, base='Close'):

"""

Function to compute Moving Average Convergence Divergence (MACD)

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

fastEMA : Integer indicates faster EMA

slowEMA : Integer indicates slower EMA

signal : Integer indicates the signal generator for MACD

base : String indicating the column name from which the MACD needs to be computed from (Default Close)

Returns :

df : Pandas DataFrame with new columns added for

Fast EMA (ema_$fastEMA)

Slow EMA (ema_$slowEMA)

MACD (macd_$fastEMA_$slowEMA_$signal)

MACD Signal (signal_$fastEMA_$slowEMA_$signal)

MACD Histogram (MACD (hist_$fastEMA_$slowEMA_$signal))

"""

fE = "ema_" + str(fastEMA)

sE = "ema_" + str(slowEMA)

macd = "macd_" + str(fastEMA) + "_" + str(slowEMA) + "_" + str(signal)

sig = "signal_" + str(fastEMA) + "_" + str(slowEMA) + "_" + str(signal)

hist = "hist_" + str(fastEMA) + "_" + str(slowEMA) + "_" + str(signal)

# Compute fast and slow EMA

EMA(df, base, fE, fastEMA)

EMA(df, base, sE, slowEMA)

# Compute MACD

df[macd] = np.where(np.logical_and(np.logical_not(df[fE] == 0), np.logical_not(df[sE] == 0)), df[fE] - df[sE], 0)

# Compute MACD Signal

EMA(df, macd, sig, signal)

# Compute MACD Histogram

df[hist] = np.where(np.logical_and(np.logical_not(df[macd] == 0), np.logical_not(df[sig] == 0)), df[macd] - df[sig], 0)

return df

Ichimoku Cloud:

- The Ichimoku Cloud combines various indicators to provide a comprehensive view of the market.

- It includes components like the Kumo (cloud), Tenkan-sen, and Kijun-sen lines.

- Traders use it for assessing support, resistance, and trend direction simultaneously.

def Ichimoku(df, ohlc=['Open', 'High', 'Low', 'Close'], param=[9, 26, 52, 26]):

"""

Function to compute Ichimoku Cloud parameter (Ichimoku)

Args :

df : Pandas DataFrame which contains ['date', 'open', 'high', 'low', 'close', 'volume'] columns

ohlc: List defining OHLC Column names (default ['Open', 'High', 'Low', 'Close'])

param: Periods to be used in computation (default [tenkan_sen_period, kijun_sen_period, senkou_span_period, chikou_span_period] = [9, 26, 52, 26])

Returns :

df : Pandas DataFrame with new columns added for ['Tenkan Sen', 'Kijun Sen', 'Senkou Span A', 'Senkou Span B', 'Chikou Span']

"""

high = df[ohlc[1]]

low = df[ohlc[2]]

close = df[ohlc[3]]

tenkan_sen_period = param[0]

kijun_sen_period = param[1]

senkou_span_period = param[2]

chikou_span_period = param[3]

tenkan_sen_column = 'Tenkan Sen'

kijun_sen_column = 'Kijun Sen'

senkou_span_a_column = 'Senkou Span A'

senkou_span_b_column = 'Senkou Span B'

chikou_span_column = 'Chikou Span'

# Tenkan-sen (Conversion Line)

tenkan_sen_high = high.rolling(window=tenkan_sen_period).max()

tenkan_sen_low = low.rolling(window=tenkan_sen_period).min()

df[tenkan_sen_column] = (tenkan_sen_high + tenkan_sen_low) / 2

# Kijun-sen (Base Line)

kijun_sen_high = high.rolling(window=kijun_sen_period).max()

kijun_sen_low = low.rolling(window=kijun_sen_period).min()

df[kijun_sen_column] = (kijun_sen_high + kijun_sen_low) / 2

# Senkou Span A (Leading Span A)

df[senkou_span_a_column] = ((df[tenkan_sen_column] + df[kijun_sen_column]) / 2).shift(kijun_sen_period)

# Senkou Span B (Leading Span B)

senkou_span_high = high.rolling(window=senkou_span_period).max()

senkou_span_low = low.rolling(window=senkou_span_period).min()

df[senkou_span_b_column] = ((senkou_span_high + senkou_span_low) / 2).shift(kijun_sen_period)

# The most current closing price plotted chikou_span_period time periods behind

df[chikou_span_column] = close.shift(-1 * chikou_span_period)

return df

Thank you for this! This is really helpful as a reference as I use different broker to fetch real-time data and temporarily write to Redis.