How to Use Gann Square of 9 Calculator

Using Gann Square of 9 Calculator

Here’s how to employ the GANN Calculator effectively:

- Wait for at least an hour after the market opens.

- Take note of the current market price or the average traded price for any security.

- Input this figure into the calculator.

- Click the “calculate” button.

The calculator will then compute the GANN angles relative to the last traded price or the average traded price, providing you with clear levels for buying or short selling, along with target and stop-loss points.

As an illustrative example of trading using the GANN Calculator:

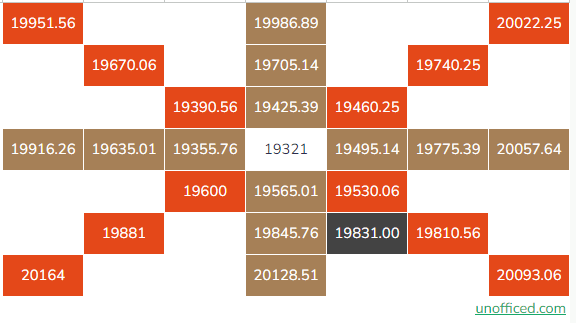

On the 8th of September 2023, we executed a trade in Nifty futures. After confirming that the price stood at 19831, we input this value into our calculator and initiated the calculation.

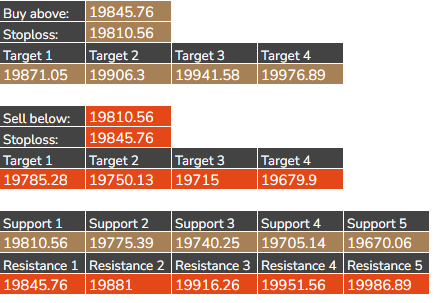

The GANN Square of 9 Calculator yielded the following trading levels:

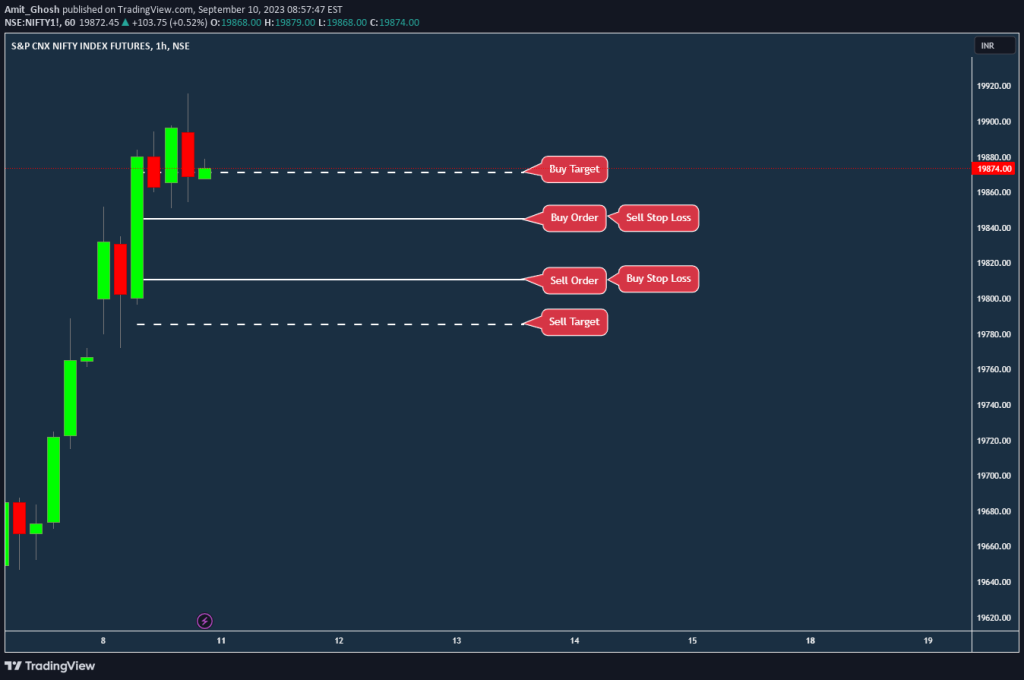

We placed two bracket orders for both the buy and sell levels. The buy order was triggered, and we subsequently canceled the short sell order.

The Concept of SAR:

- Do Remember, In case of a Buy Trade, the entry of the Sell Trade acts like Buy Trade’s stop loss.

- Similarly, In case of a Sell Trade, the entry of the Buy Trade acts like Sell Trade’s stop loss.

This concept is called Stop And Reverse i.e. SAR.

It means if the stop loss of one trade is triggered, it initiates the opposite trade immedaitely.