Skewness

Skewness describes how a data distribution leans. ( i.e. describes asymmetry from the normal distribution)

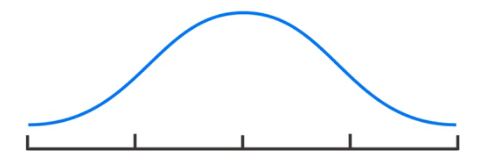

In a normal distribution curve, the data is distributed symmetrically to both sides of the peak which is the mean here. The curve describing normal distribution is also called the Bell curve.

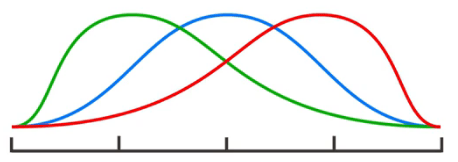

Skewness can be positive or negative.

The standard normal distribution has a skewness of zero, and therefore, it is said to be symmetric.

Negative Skewness –

- If the distribution of a data set has a skewness less than zero, the data is skewed to the left.

- In the case of negative skewness (red curve here), the data piles up on the peak on the right side and the tail points left.

- Negatively skewed returns mean frequent small gains and few large losses.

Positive Skewness –

- Conversely, data that has a positive skewness is said to be skewed to the right.

- In case of positive skewness (green curve here), the data piles up on the peak on the left side and the tail points right.

- Positively skewed returns mean frequent small losses and few large gains.

Skewness is extremely important to finance and investing. It helps an investor to choose investment options based on their growth and risk appetite.

Most sets of data, including stock prices and asset returns, have either positive or negative skew, rather than following the balanced normal distribution, which has a skewness of zero.

So to optimize it maximum, an investor should choose a mix of positively and negatively skewed investments.

Every equity investors try to make investments in companies that have a positive skew. Reliance, Maruti, Eicher are examples of positively skewed companies whereas our strategy on Hydrapoint was negatively skewed.

Well, asset prices follow a lognormal distribution, which is skewed to the right because asset prices are non-negative. Hence they are positively skewed! Most good stocks are positively skewed.

What is returns when you invest in a stock? Consider the yearly returns; the reason they are big companies is most of the year they end in positive and very few times they end in negative.