Support And Resistance Using Open Interest

“Open Interest is the silent partner in the support and resistance relationship – it’s not always obvious, but it’s always there, quietly influencing the market.”

Let’s recap all the concepts –

Open Interest is a powerful tool that can help traders identify potential support and resistance levels in the market. In this chapter, we will explore the concept of support and resistance, how to use Open Interest to identify these levels, and how to incorporate this information into your trading strategy.

Support and resistance levels are areas on the price chart where the market has previously struggled to move above or below. These levels can act as barriers to price movement, with support preventing prices from falling further and resistance preventing prices from rising further.

Support

Support is like a lifeline for a stock price, a level on a chart where it has a hard time breaking down. This is where the buyers tend to come in and start buying, which creates demand and supports the price.

When a stock falls to this level, it has two options:

- First, it can “bounce” off of the support level and start to climb up again.

- Second, it can break through the support level and continue to fall until it finds another level of support.

The more times a stock bounces off a support level, the stronger that level becomes. It means that more buyers are stepping in at that price level, creating a stronger demand and support.

Remember, support is not a guarantee that the stock price will always bounce back up. It is a level where the stock has historically had support in the past. Sometimes, stocks can break through support levels and keep falling, but it’s still a crucial indicator to keep an eye on while making trading decisions.

Resistance

In the exciting world of trading, resistance is a formidable opponent to the stock price. Resistance levels are the historical price points that the stock has struggled to surpass, creating a ceiling that stops the stock from going any higher.

Just like support levels, there are two ways that stocks test resistance areas. The stock will either try to rise above the resistance level and then “bounce” off of it, causing the stock to drop in price, or it will break through the resistance level and continue to rise.

Resistance levels are created when there is a higher volume of sellers than buyers in the market, which causes the rally in stock price to halt. These levels are significant because they help traders understand where selling pressure is high and where the stock is likely to reverse course.

When a stock reaches a resistance level, traders who believe the stock has reached its peak will start selling, causing the stock to fall in price. If the resistance level is no longer significant, the stock may break through it and continue to rise.

Open Interest and Support and Resistance

Open Interest is a measure of the number of outstanding contracts in the market. A significant increase or decrease in Open Interest can indicate the potential for a strong trend, with high Open Interest levels corresponding to areas of potential support and resistance.

To use Open Interest to identify potential support and resistance levels, start by looking for areas of significant Open Interest. Then, identify the corresponding price levels where the market has previously struggled to move above or below. These levels can serve as potential support and resistance levels.

Summarizing –

- Open Interest (OI) is an important indicator for support and resistance in derivatives.

- OI indicates the number of outstanding contracts in the market, showing where traders have built positions.

- High call open interest can act as resistance, especially at slightly out-of-the-money strikes among shorter-dated options.

- Option sellers will begin to unwind their hedges as the stock approaches the strike level, adding pressure to the underlying shares.

- Heavy put open interest can act as support, as traders sell puts to minimize risk and remain market-neutral.

- Put writers might sell the underlying stock short to balance their sold positions.

- When the options expire or the put buyers unwind their positions, short interest on the equity will be repurchased, adding to buying pressure as the underlying shares approach noteworthy strikes.

Calculating Key Levels of Support and Resistance Using Open Interest

As said earlier, To use Open Interest to identify potential support and resistance levels, start by looking for areas of significant Open Interest.

So,

- The strike price where we have the highest open interest in the call options indicates the strongest resistance. Let’s call it R1.

- The strike price where we have the highest open interest in the put options indicates the strongest support. Let’s call it S1.

Similarly,

- The strike price where we have the second highest open interest in the call options indicates the second strongest resistance. Let’s call it R2.

- The strike price where we have the second highest open interest in the put options indicates the second strongest support. Let’s call it S2.

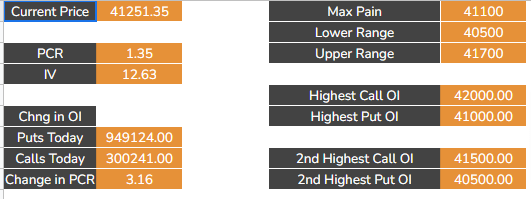

Here is a snapshot of BankNIFTY’s current week’s option’s open interest and the derived Support and Resistance based on this theory!

Support and Resistance from Price Action Theory Vs. Support and Resistance from Open Interest Theory

Did you know that even though Open Interest (OI) is an important indicator for finding support and resistance levels, it doesn’t always follow the same patterns as price action? That’s right!

Sometimes the strike with the Second Highest Call Options Open Interest can be further away from the Last Traded Price (LTP) than the strike with the Highest Call Options Open Interest. This means that theoretically, our strongest resistance level (or, Support Level if we re-think of a similar scenario in the context of Put Options) will break before the second strongest one.

This never happens in Price Action. How we can call a level strongest if it can break ahead of the second strongest level? So, in terms of Open Interest, the levels of support and resistance are not the same as the levels derived from the Price Action Theory.

- A strike with the highest Put Options Open Interest indicates that the intensity of support will be the highest at this strike.

- A strike with the highest Call Options Open Interest indicates that the intensity of resistance will be the highest at this strike.

- The higher the intensity, the higher the chance of that level holding as a Support or Resistance.

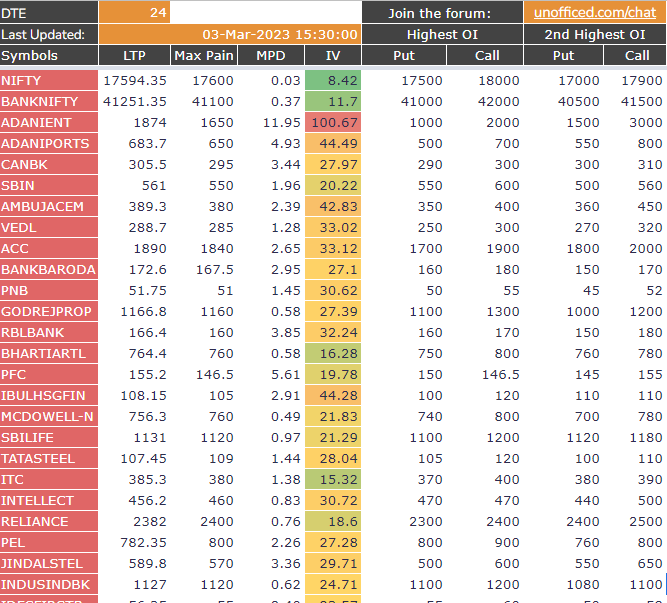

Now, Let’s look at the scanner made on the website of Unofficed.com for a real-life example. It shows the strikes having the Highest and Second Highest Open Interest of the derivatives under one roof.

This table sums up the difference in a more appropriate manner –

| Support and Resistance from Price Action Theory | Support and Resistance from Open Interest Theory |

Basis | Based on historical price movements | Based on the number of open contracts in the market |

Calculation | Determined by looking at key levels where the price has previously reversed or stalled | Determined by looking at the strikes with highest open interest |

Significance | Considered to be more reliable | Considered to be equally reliable |

Limitations | Does not account for market sentiment | May not reflect current price trends |

Breakout Confirmation | Requires confirmation through price action | Can be confirmed by price action or options activity |