Trading Nifty Futures Intraday

Let’s see my trading diary of nifty last Friday.

The goal is to trade NIFTY index systematically, pre-planned with proper risk management.

Plan

Link – https://in.tradingview.com/chart…

Fundamentals –

- HDFC Bank will post its results on Saturday. No sane investor will lose the stock before the results as it repeated posts perfect 20% since ages.

- Also, Maruti and ITC are index heavy and they have results too.

- The broader market is mildly bearish.

- There is Rahul Gandhi Modi drama which can cause volatility in the second half.

Technicals –

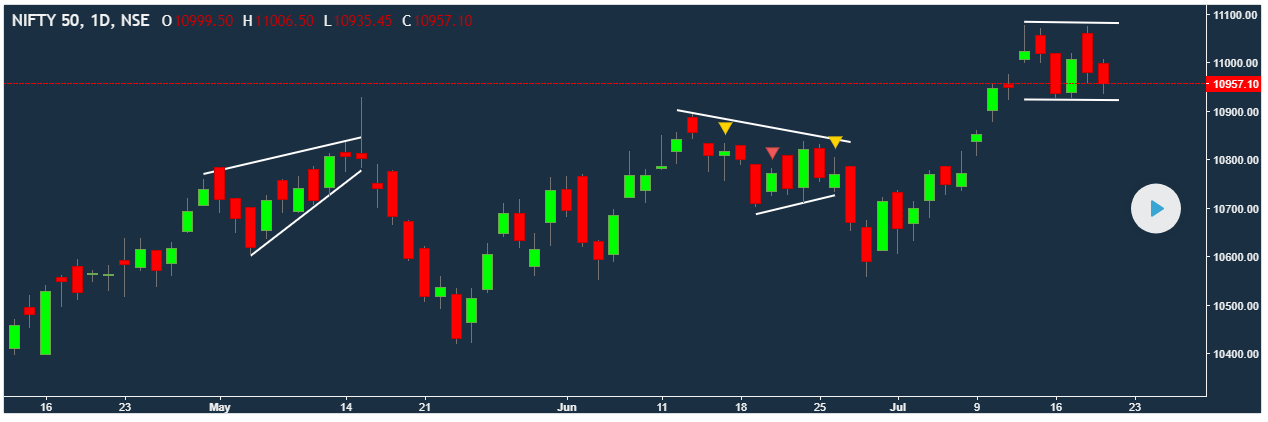

Whenever NIFTY rises up it consolidates before it makes its next move. So, to honor the consolidation, it will keep bouncing in that channel.

Verdict –

Let’s follow the ORB rule.

- If it is on the buy side, We buy Nifty Futures and sell 11000 PE.

- If it is on the sell side, We wait for the gap to fill and buy Nifty Futures and sell 11000 PE.

In case, Europe opens (i.e. We should be alert on 12:15 to 12:30) bearish triggered weekend selloff. We make it a straddle with 11000 CE.

Results –

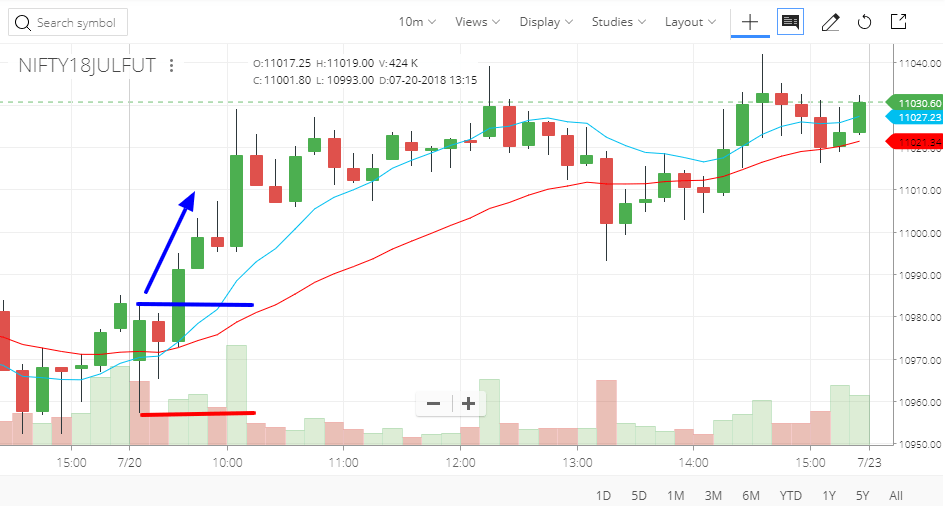

So, We are following the opening range created by the candle in the first 10 minutes. As per our rules, we shall initiate by if the high of this candle is broken with a stop loss at the low of this candle.

So, the trade is initiated. Now, the question is how to protect maximum profit. Many times it happens that it stays in the profit zone and suddenly goes into a loss.

That’s sad.

The first thing that is recommended is to update the stop loss from the red line to the blue line i.e. the entry immediately after when it comes to profit. It ensures we are not in loss.

Having no money is richer by 10 INR than a guy who lost 10 INR. Right?

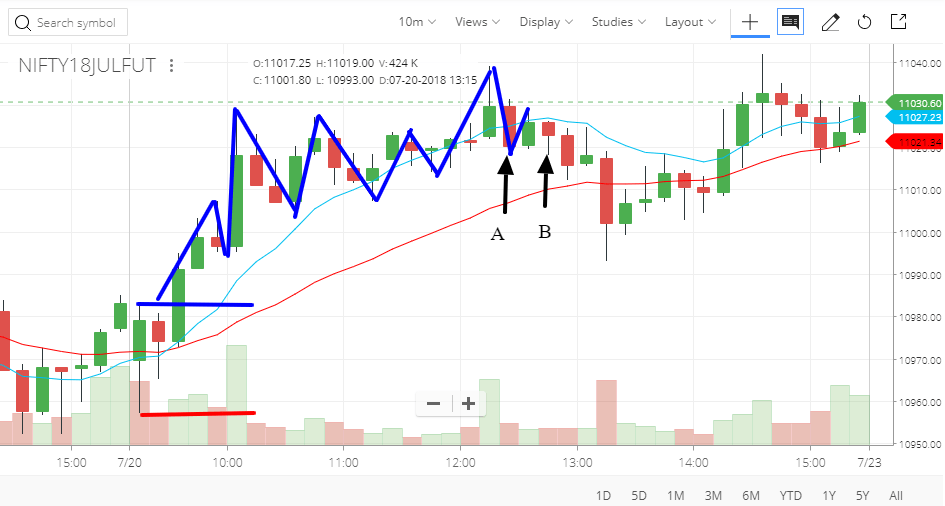

We follow simple bounce strategy i.e. swing highs and swing lows. You need to update the stop loss to each higher lows created.

After some point, the candle marked by B (11018.05) breached the low of the candle marked by A (11018.4) by a tiny .35 points. Mathematics is amazing. The uptrend is demolished here. Trade is closed.

Trade Details –

Buy at 10982.95 Sell at 11018.05 making 35.1 points. Cutting brokerage and slippage, it will stand near 30 points.

2250 INR on 32921 is pretty good.

NIFTY 11000 PE was sold at 95 and closed at 75 making 25 points.

1800 INR on 32921 is also pretty good.

But there was another option for followers,

Instead of not closing 11000 PE, selling 11000 CE to make it straddle as because of the Rahul Gandhi-Modi and Friday second half always creates bearish pressure while HDFC Bank results should uphold NIFTY.

Following that,

- NIFTY 11000PE was sold at 95, closed at 58.

- NIFTY 11000CE was sold at 80, closed at 83.

Net profit = 95-58+80-83 = 34 points.

2550 INR on 32921 is amazing.

By textbook, 11000CE is called sister trade of 11000PE.