Volume Order Imbalance – How StopLoss is hunted

Volume order Imbalance is one of such strategies which focuses on stop loss hunting! It is amazing and mostly used by HFT firms.

Impatience and Imbalance:

You can read more about it from here. It is a derivative of order imbalance strategy originally coined in this research paper.

Let me try to explain in layman terms.

![]()

Let’s say we want to exit this position. It’s moderately not liquid enough if you compare with index options as well as not too much illiquid like Britannia.

We want to exit this position i.e. we are buying it, hence it is buyer initiated. Now the more impatient we are, we will tend to book slight more loss by closing at higher prices and hence moving the LTP of the instrument up.

The imbalance tells if the trades (In this case, our limit order of buy) is buyer initiated or seller initiated and it is done by checking the LTP and the order book of the bid/ask.

If you’re an active trader, You also have noticed the fight of algorithms in bid/ask whenever you move your limit price near to LTP.

Fear and Imbalance:

Apart from the above cases of impatience leading to imbalance, here is another case that leads to the same scenario. Stoploss, i.e. fear of losing more, and hence closing the position!

Refer –

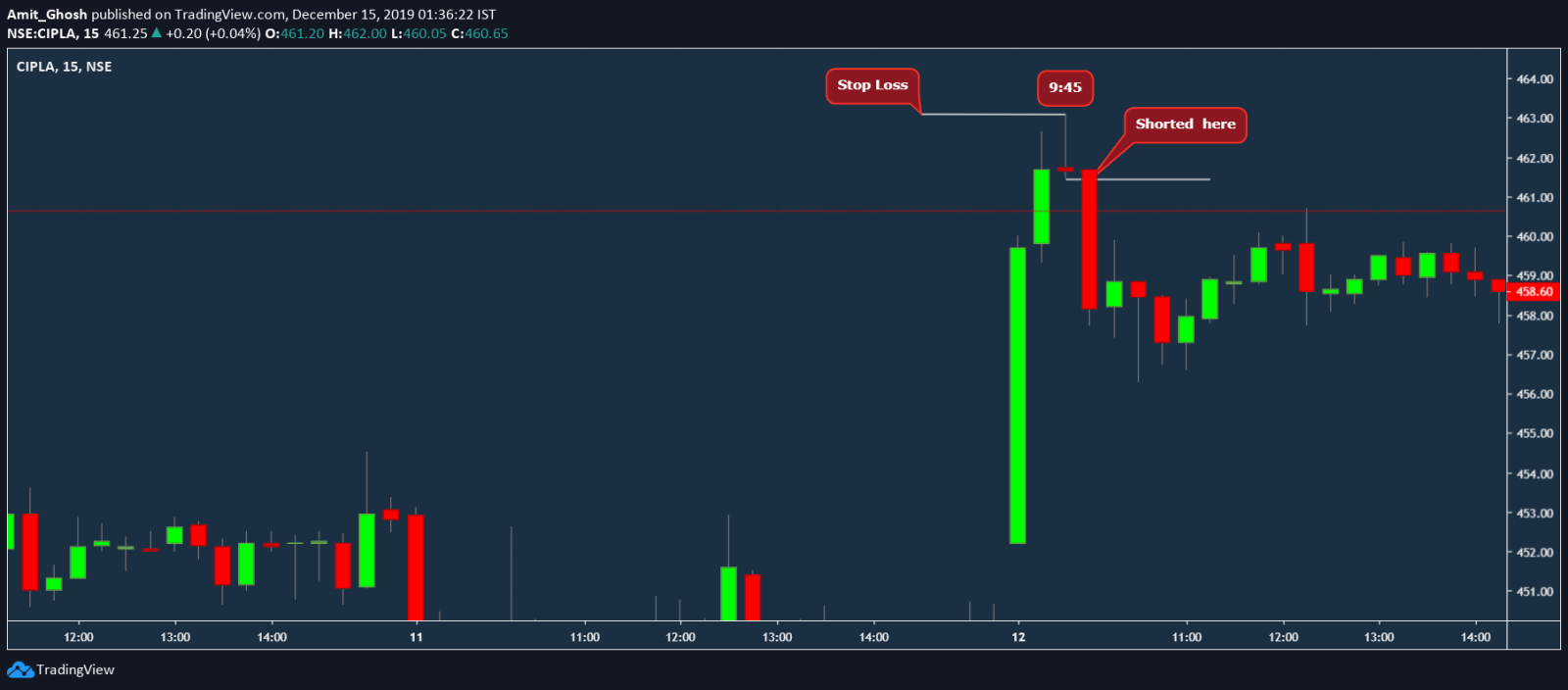

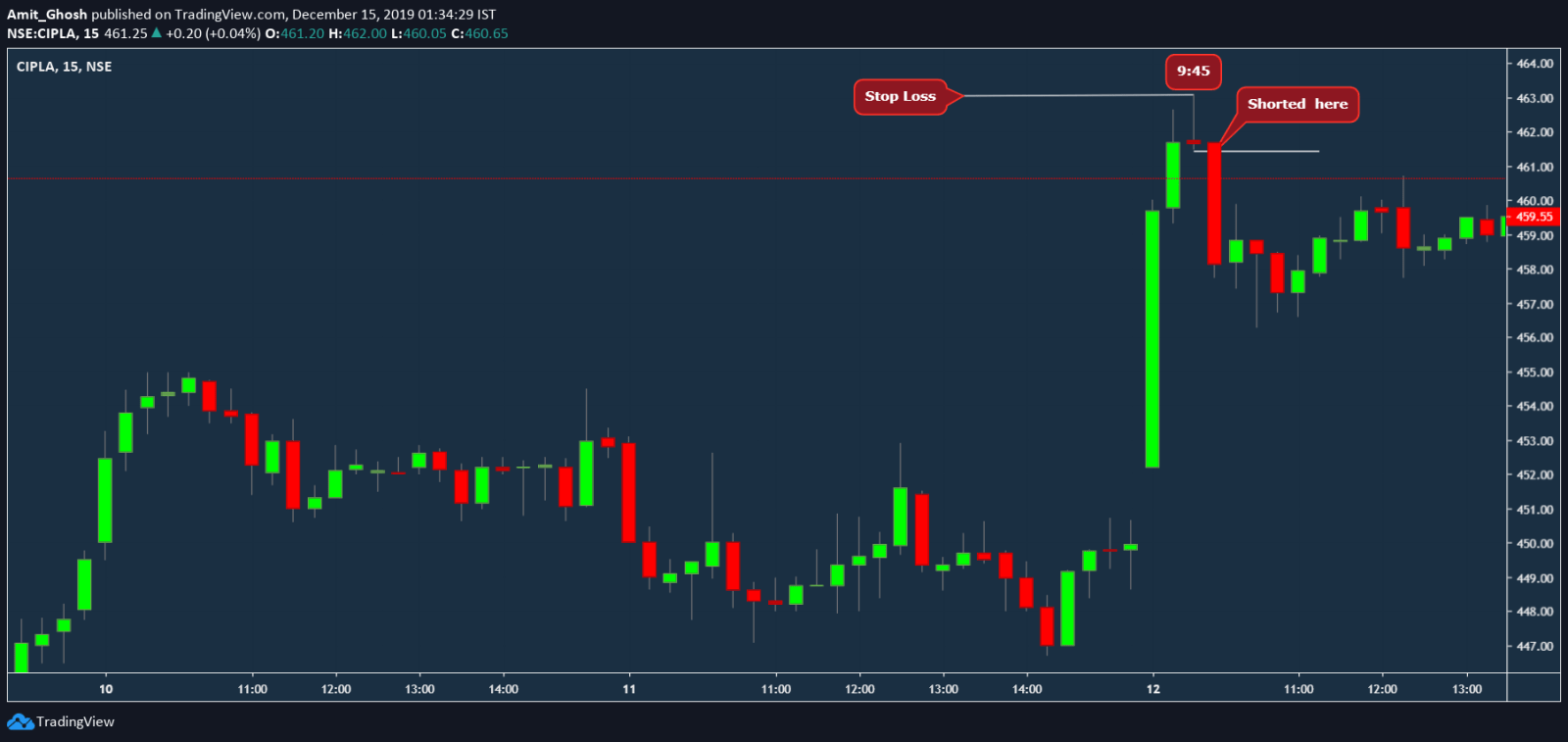

In this case, it looks like a fantastic trade. A mighty intraday trader has shorted it. Now, the psychology of where should be my stop loss will be applied to all such mighty intraday shorters.

The Human mind tends to follow the herd! Most of the shorters will keep their stop loss at the high of the day!

Volume order imbalance strategy:

All you need to do is read bid/ask data and apply the reverse psychology to buy at the point of probable stop losses.

And, You will get Turkey Events! Just scalp it and get out!

Its trade of seconds. These types of strategies mostly have time-based exit i.e. exit if the PNL is not growing at x rate in y minutes.

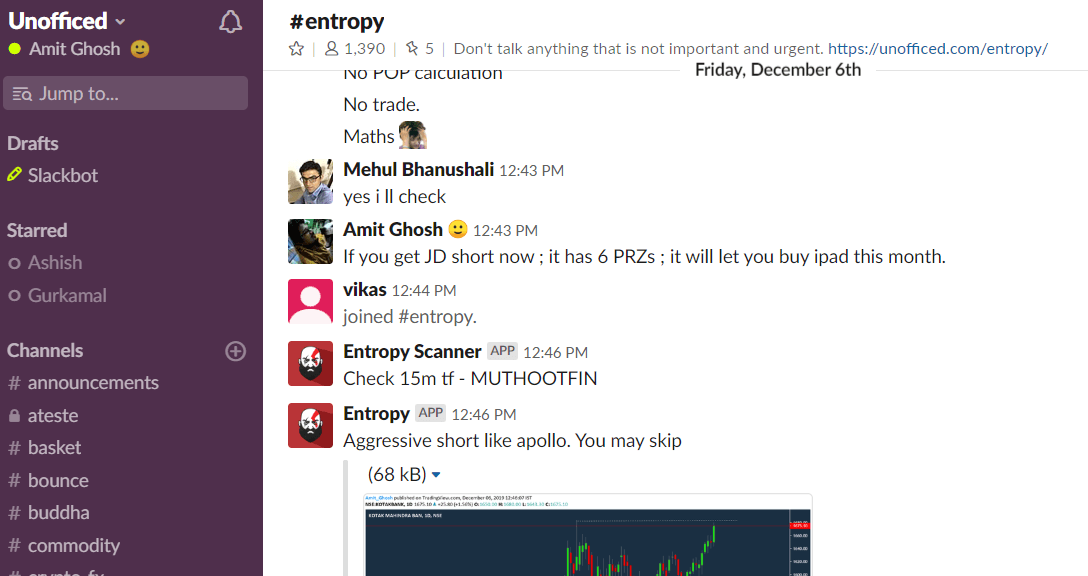

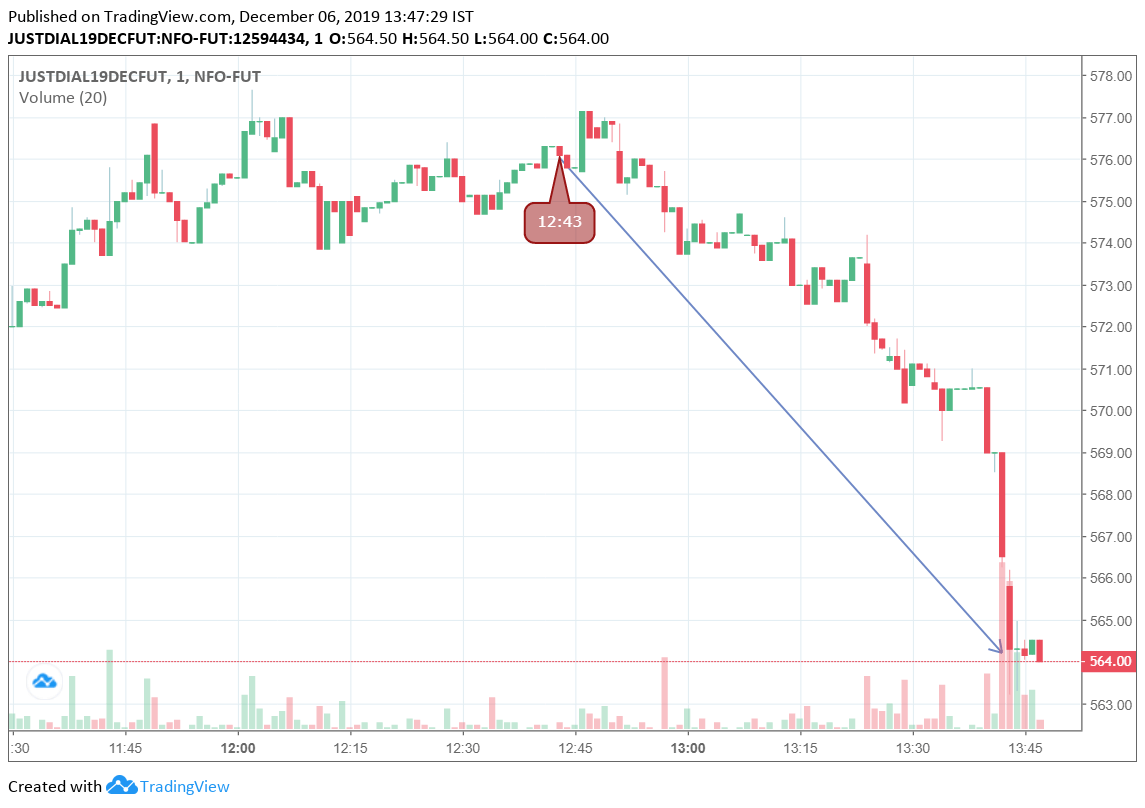

This type of use of reverse psychology is pretty amazing. Here is one trade we were discussing in our forum –

I was trading Justdial and spotted huge order in a price band which is either SL for buyers or entry for sellers. As well as, there was a huge sell order in the upside.

Pure mathematical decisions. Price action would’ve caught late.

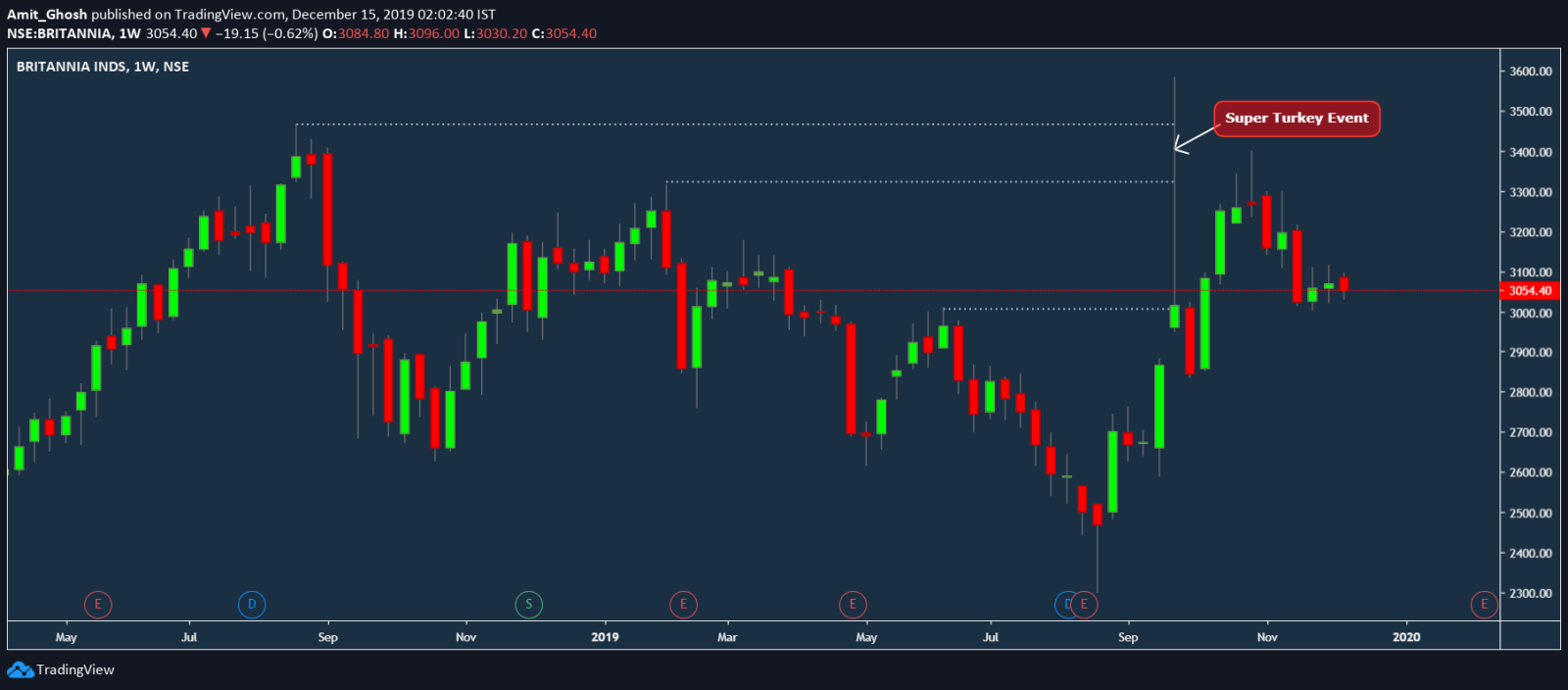

These happen more magically in illiquid stocks like Britannia and also in weekly options during expiry day.

Imagine the quantum of loss here. It literally blew up every stop loss and came back smartly the next day.

Moral: Never Keep your stop losses at day high. Always put a random number multiplied with your stop loss to avoid this chaos!

All of the chapters are super simple in langauge. But this chapter seems latin and greek to me. Can you please elaborate more on this. It’s just a request. Keep up doing the great work. Cheers

Google “taleb turkey problem” and read 🙂

Ok bro thank you