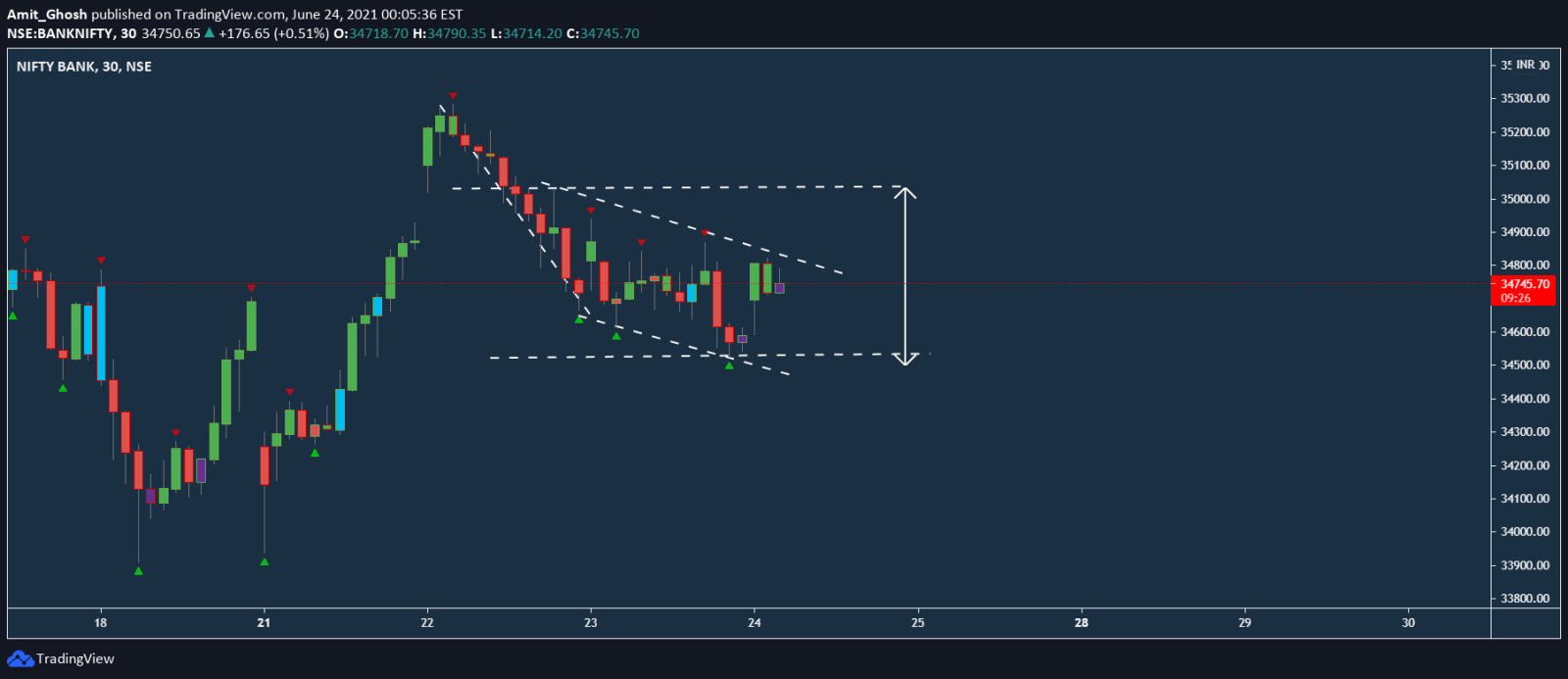

Flag Patterns: Part VIII – Case Study of Options Trading

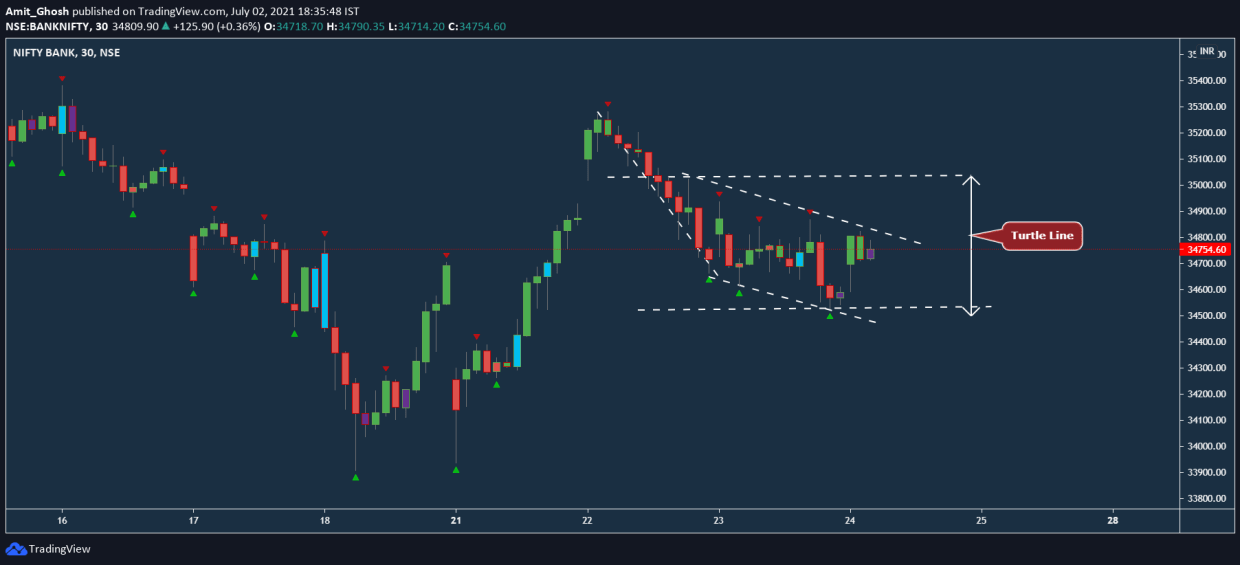

- It is a bear flag.

- It is not perfect because as You can see the bear flag actually formed at the end of Uptrend’s retracement instead of a proper downtrend.

As You have seen before in our past discussion, [Revisit – https://unofficed.com/lessons/how-to-identify-bull-or-bear-flag-patterns/]

We bet on the breakdown of a proper bear flag that is formed after a down trend.

But, in this case, We are giving more gravity on the outcome of a breakout.

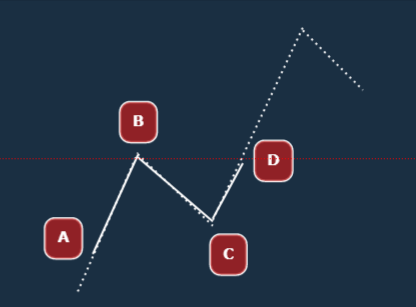

Also, If you see deeply,

- ABC forms a Perfect Bullish Flag.

- BCD forms an Imperfect Bearish Flag.

The Bullish Flag’s breakout is actually causing The Bearish Flag. Its quite impressive.

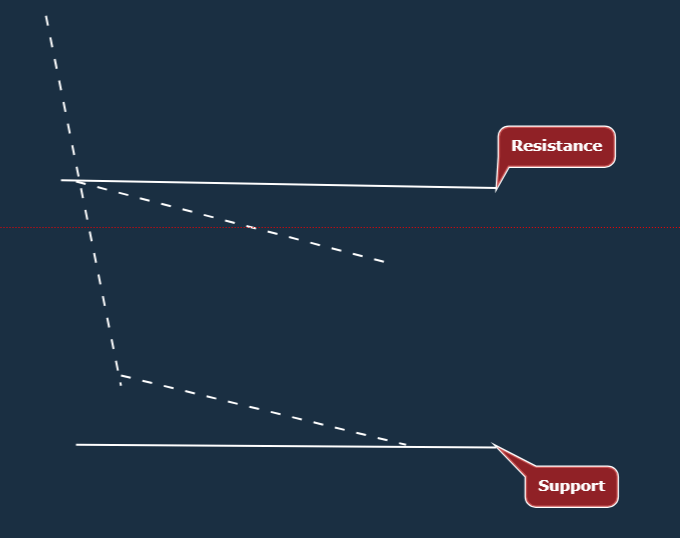

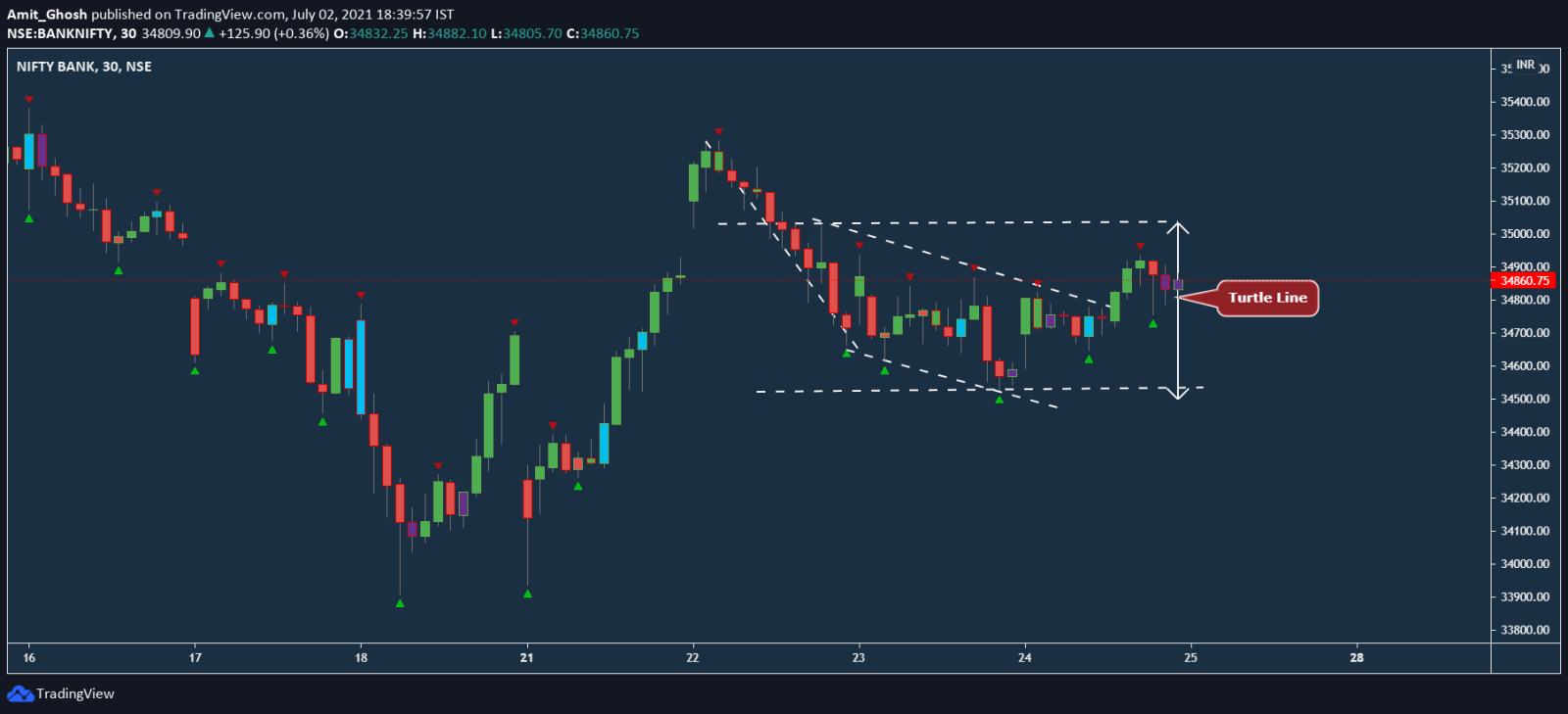

Anyways, That’s the prologue of psychological aspect why the Support and Resistance is drawn this way in this trade. It is because – Upside breakout of the Bear Flag was expected.

Turtle Line

Also, there was high OI in the upper resistance at the time of posting the trade (You can read that info in the description when it was posted.)

So, Although it is a minor detail which does not matter much but It was also expected that it will break that level to scare off people (Maximum pain to retailers?)

Anyways, We can leave that part out of the discussion as We are seeing from a price action perspective.

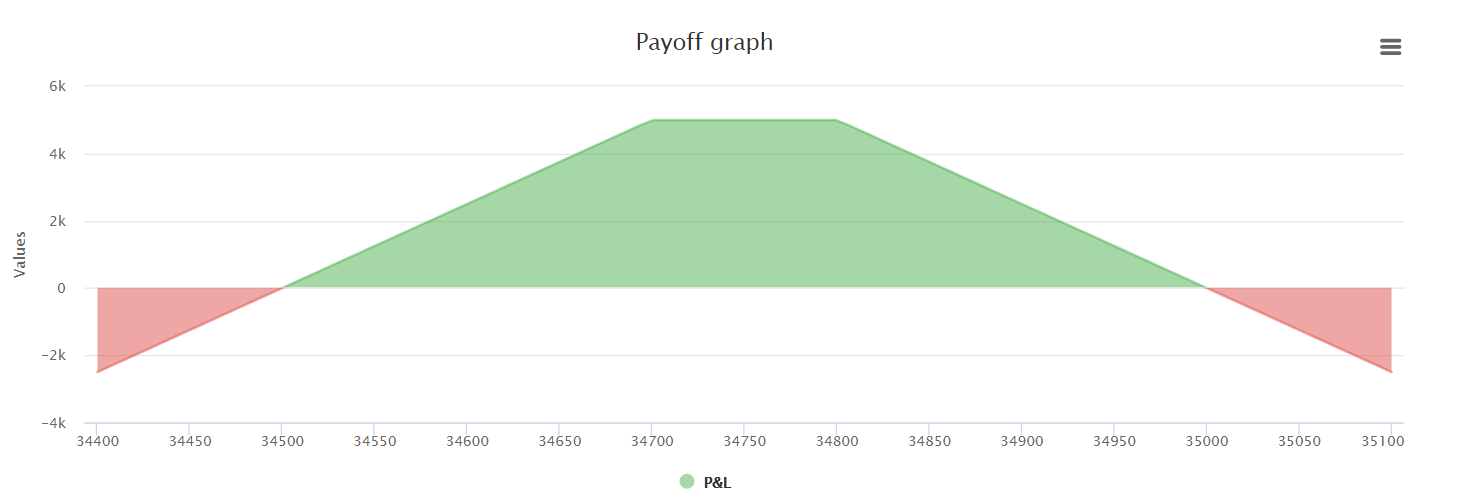

- Sell BankNIFTY 34800CE at 100.

- Sell BankNIFTY 34700PE at 100.

34500-35000.

So, This discussion shows How you can combine Flag Patterns into options in a more innovative way.

Also, it discusses complexity of the thought process of the flag’s outcome based on the psychological aspect. It will break down or up!