Step by Step Guide to Invest 5000 INR into Bitcoin and other Cryptos in India

Part I: The History of Bitcoin Crashes

Bitcoin broke 60k$ per BTC in terms of value while many are still in denial. Now, if We consider 30% crash as a significant crash, It has crashed violently many times in the past.

- June to November 2011, -93%

BTC fell from 29$ to 2$.

Reason: A hacker gained access to Mt.Gox (The biggest crypto exchange by that time) accounts and crashed BTC to $0.01 - August 2012, -56.7%

Reason: Bitcoin Savings and Trust, A Ponzi Scheme stopped their payouts completely. There are lots of Ponzi schemes in BTC that still floats and only growing YoY. - April 2013, -87%

Reason: Same Mt.Gox. Back then, they used to handle 70% of BTC transactions. After a huge rally of 4 months, When there was a technical crash, their system was unable to handle the trading volume.

And, Hackers did a timely DDOS attack on the site at the same time.

It was a violent crash. It dropped 52% in 6 hours like a stone. - December 2013 – January 2015, -84.6%

Reason: Mt. Gox again. BTC broke an all-time high of 260$ and shot up 5x to 1150$. Now, when they started to correct – Mt. Fox halted all withdrawals and filed for Bankruptcy.

They told – They have “lost” 850,000 bitcoins! It was half a billion that time itself. It is roughly worth 48.5 billion right now. - December 2017 – December 2018, -83.8%

Reason: BTC went from 20k$ from 1k$ and retraced back technically and slowly.

Now, When You are thinking to make an account and invest in crypto. It is quite indeed possible, that Bitcoin can go up to 1 million$ per BTC (Do not laugh as You read because those who were laughing when BTC was at 1$ are not laughing today.) as well as it can also crash 90%.

That’s the focus point –

- It can crash 90%.

- The exchange itself can stop your withdrawal as there is no governing regulation! And, they can declare themselves bankrupt.

It is possible because It happened multiple times in the past.

- So, diversifying with multiple exchanges does accommodate this risk of this nature.

- Diversifying with multiple currencies will also reduce the sharp volatility of a single currency (It is the same talk as equity investment but a cryptocurrency can rise 9000% in a week as well as can fall 99% in a week.).

- Allocate money that you can afford to lose completely. This is a new space with lots of complications as well as it rewards well for such complications too. Right?

Part II: Different avenues of Earning Money on Crypto Currency Ecosystem

Now, as a coin has two sides. It also has another side. There are multiple streams of revenue in cryptocurrencies because – Nature makes high-risk bets as high rewarding too! (Robbing a bank is a high reward job!)

Leverage: As cryptocurrency is not regulated, the exchanges offer tremendous leverage like 125x.

Commission: The commission is literally 0 in many places because exchange earn from many other avenue than brokerage.

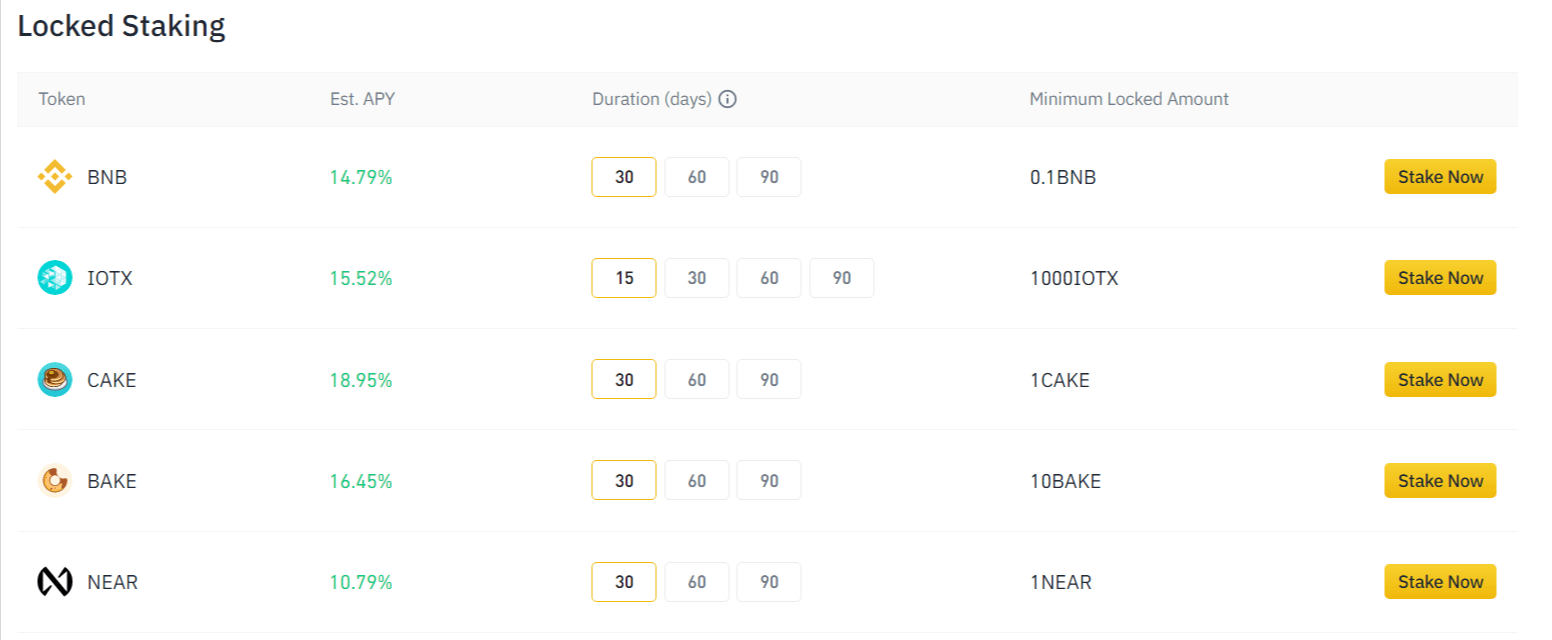

Stake: This is new age fixed deposit which high annual returns.

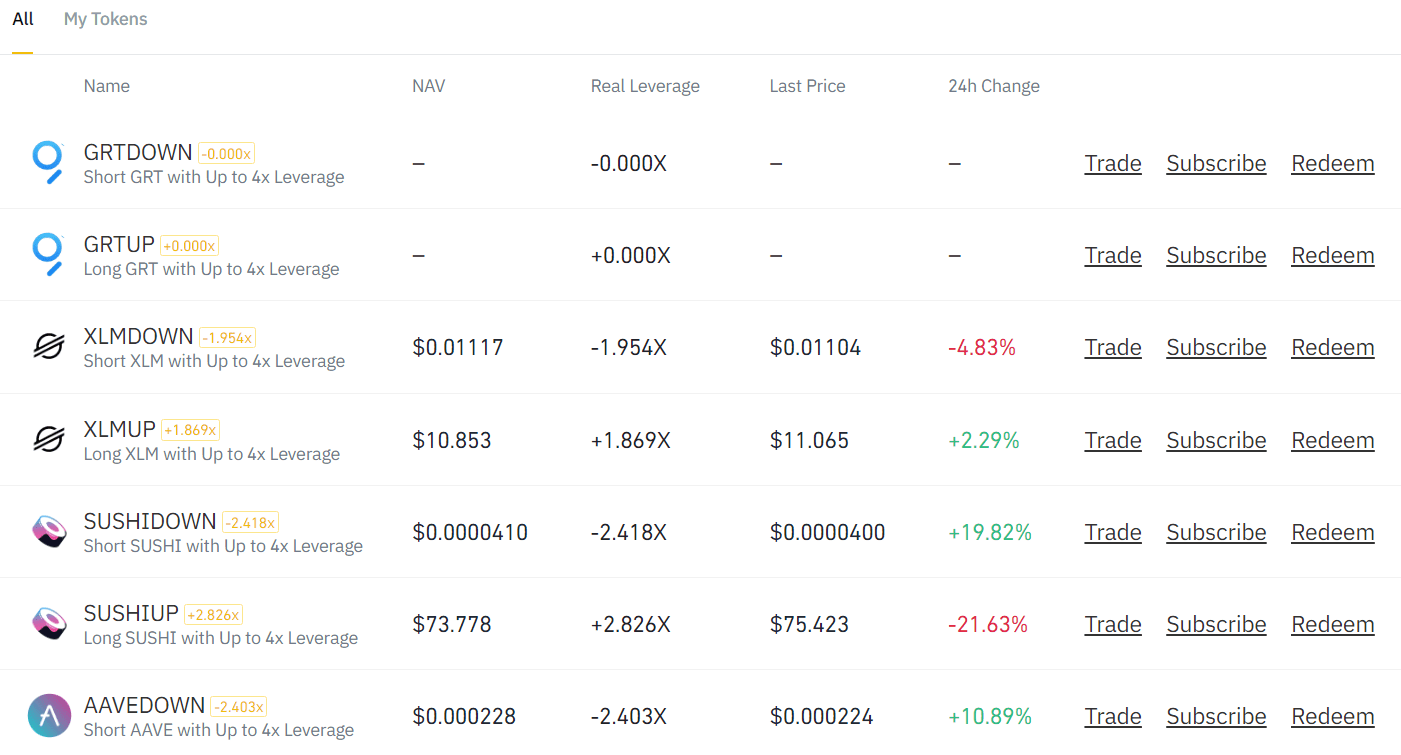

Leveraged Tokens:

Suppose You have 1000 INR. Reliance is trading at 2000 INR. You can not buy or sell Reliance with 1000 INR because there is no leverage.

But what If You short 10 quantities of Reliance with a maximum loss of 1000 INR? You can short till Reliance reaches 2100 INR right?

Similarly, If you are allowed to long 5 quantities of Reliance, then You can hold till Reliance reaches 1800 INR.

This level of micro leverage trades where both sides are allowed makes an avenue of a completely new type of trading ecosystem within a defined risk.

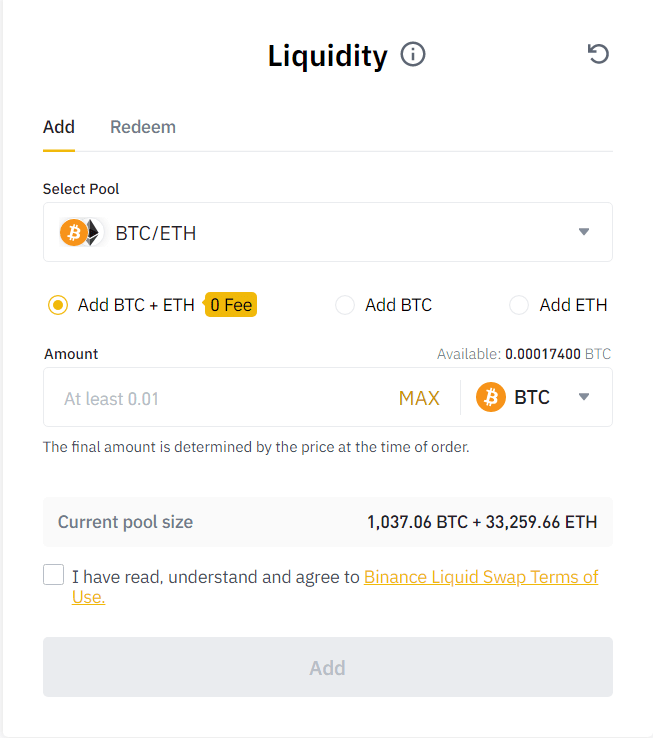

Liquidity Provider: You can become a liquidity provider for this pair by adding assets to the liquid asset pool. The liquidity provider can enjoy the transaction fee (i.e. brokerage) income of users in the pool. If You’re holding BTC and ETH both anyways, this is like risk-free income on top of that!

If You’re holding BTC and ETH both anyways, this is like risk-free income on top of that!

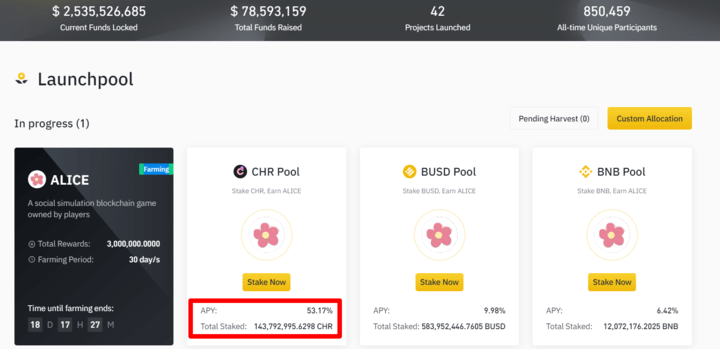

Launch Pool:

Investing in BTC and ETH is already considered an ultimate risk. What is “more risk” than that is new coins. Try to stay in the coins having the highest market volume. Now, coming to the coins which are considered an even greater risk. They will have even more weird offerings. Like –

This is like an IPO listing of a coin named “Alice”.

Anyways, We discussed few products, and trust me – This is just the tip of the iceberg. You will be amazed to see the versatility of the options and products as You move forward in your journey.

Part III: Opening an Account in Crypto Exchange

When We discussed crypto exchanges last time, I opted for Wazirx. Binance was not allowing their P2P method back then. Now, Wazirx is acquired by Binance.

Binance offers more products and services, has higher liquidity, less fees. In short, Wazirx is inferior product.

Investing 5000 INR into a basket of Cryptocurrencies using Binance –

Unofficed has partnered with Binance. I’ve developed different trading bots, telegram bots, risk management algorithms, auto investment apps for Binance for the outside markets. I will soon brand them and port them to the Indian Community.

If You sign up through Unofficed, You get a 10% brokerage kickback for a lifetime as well as access to the products when launched.

Binance P2P System:

So, let’s talk about how the money transfer really works here.

Deposit – Suppose I want to buy 50 USDT. (or 50 ETH, any cryptocurrency)

- I will place an order.

- I will UPI the amount in INR to a random guy on the Internet who is selling.

- He will confirm it and release the USDTs.

Note: Seller’s cryptocurrencies are always locked in the exchange while the order is getting processed. So, You have no risk of losing money. In a dispute, You can produce a screenshot/video/proof in the chat section which will be validated by the Binance team in the worst case.

Withdrawal – Same process as a deposit.

- First, you submit your currencies you want to withdraw in exchange. Let’s say you want to withdraw 50 USDT at a rate of 70.25 INR. When you place a sell order, Your USDTs will be blocked by the exchange.

- When the buyer accepts the order, he will send you money. Click on “release” when You verify the payment.

Taxation of India –

The bank transfers here will look like few random guys are sending random money to each other. There is no sign of “Crypto” anywhere.