Inside bar trading patterns

Inside Bar Trading patterns: How to trade Inside Bar Trading Patterns?

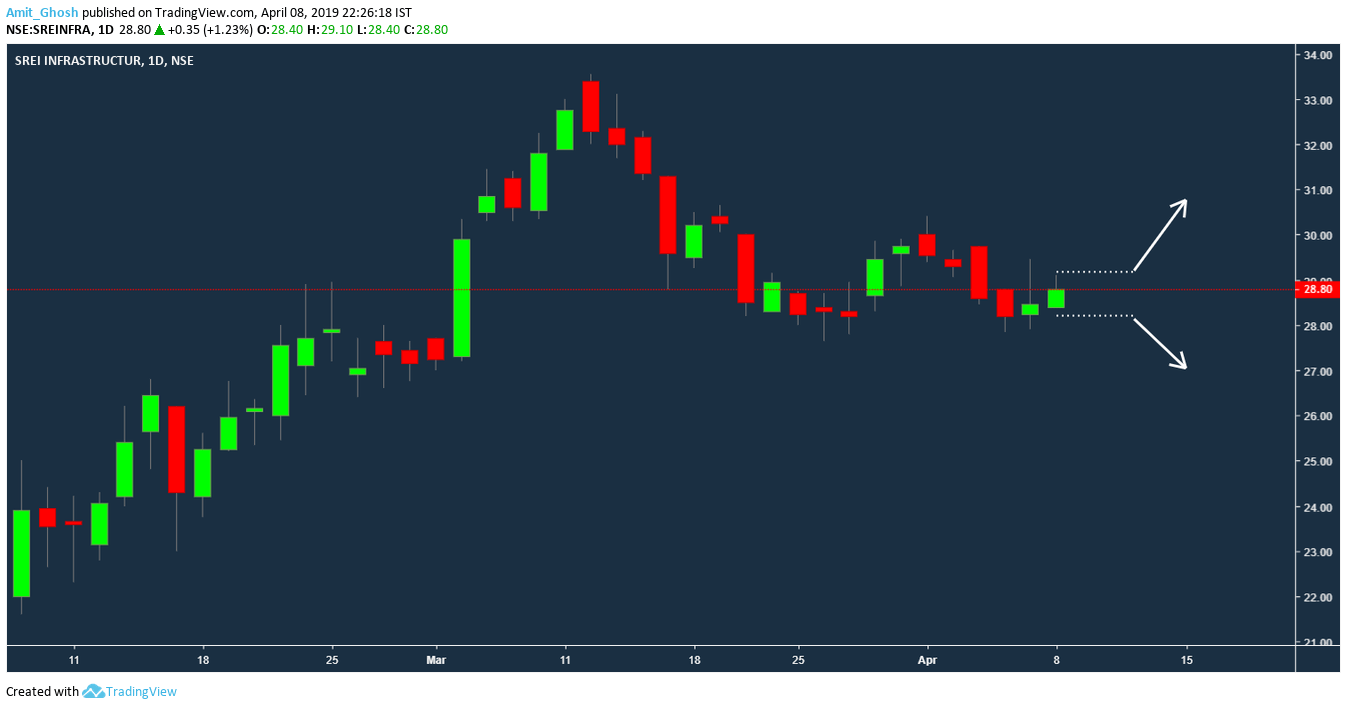

In case we are spotting the Inside Bar in Daily time frame, the inside bar will only form after the candle is finished which is at the end of the market. So, We will trade only in tomorrow.

The basic theory for inside bar trading is –

- Short if it breaks the low of the previous day with a stop loss at the previous day’s high.

- Long if it breaks the high of the previous day with a stop loss at the previous day’s low.

As simple as that.

Because the inside bar has to have a small range (Range means high-low) to be an inside bar; the stop loss is hence, small by the construction of inside bar itself!

Now the next question is – Why the theory exists at the very first place? Why we are spotting this and doing this? What is the rationale?

The Psychology behind Inside Bar

The Market is made because of the price. Price is made because of people. Candlesticks are one of the instruments that are helping us to visualize the price. By observing repetitive patterns on a different set of conditions, It is helping to quantify the psychology of price movement with a probability. The important question that will come here – that why the price pattern working in the first place?

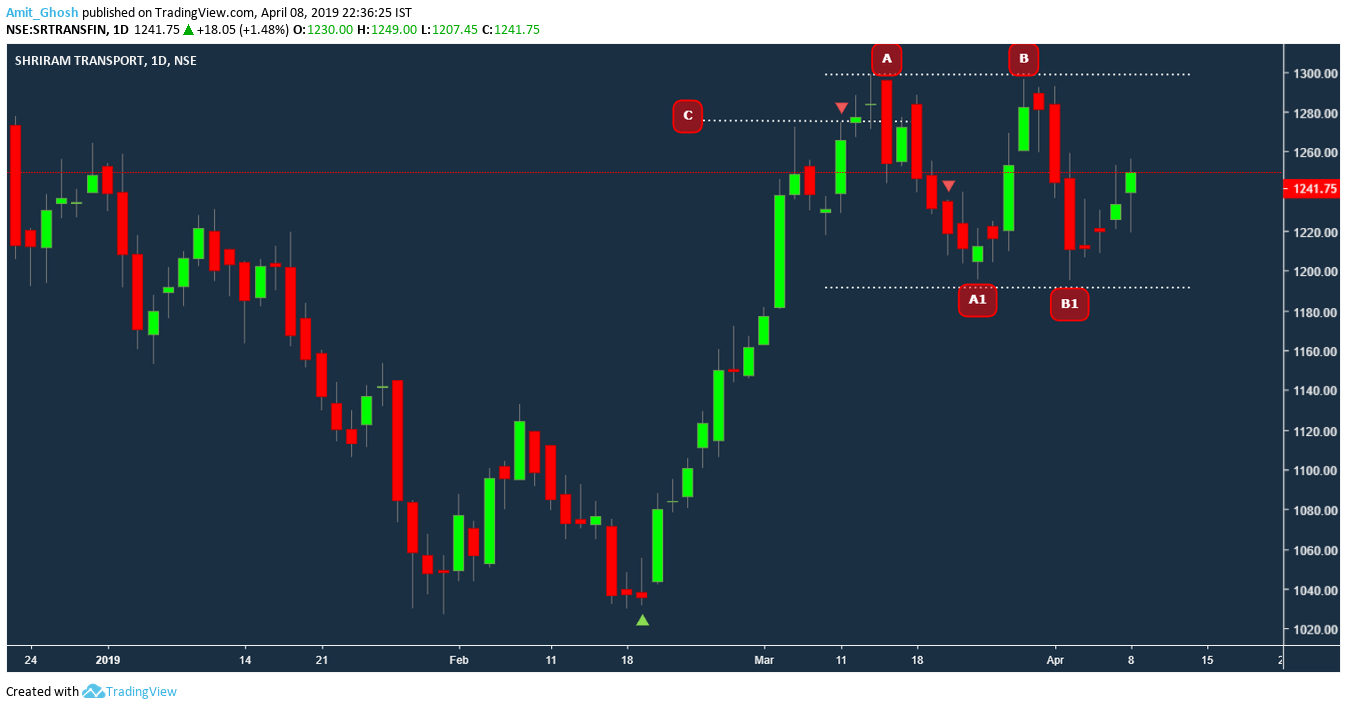

A few days ago, We took Shriram Transport long at 1200. You can see how beautifully, B is almost at a similar place at A’s. You can also see how beautifully, B1 is at a similar place at A1’s. Also, you can see while falling in the “initial days” (just a way to say) the mighty line of C acted as mini resistance too.

These levels are important for a day trader because we use leverage and a small movement will translate into big profit(or loss). The stop loss is very small and the rewards are very good.

Simple. History says It bounced up after coming in 1200. So, A rough bet (better-called gamble) is taken that it will do the same this time too. This is the principle of induction.

Simple. History says It bounced up after coming in 1200. So, A rough bet (better-called gamble) is taken that it will do the same this time too. This is the principle of induction.

It is working because it works.

But like you, there will be lots of Toms, Dicks, and Harrys who will think the same. That’s how we created the supports and resistances ourselves!

This psychological aspect can be better explained with the Monkey-Ladder Experiment.

Like NIFTY CMP is 11604.5. Without seeing the chart, we can easily tell that 11500 will be a support. There will be people who will buy with small stop loss creating a momentum. Also, one can see the huge open interest created at that strike price in weekly put options.

Now we come back to our discussion of Inside Bar.

Inside Bar deals with impatience. A volatility expansion is often followed by volatility contraction. Suppose a trader has a share at 100 INR and it is moving within 1% range since 9 days. Obviously, the person will exit at some point irrespective of profit or loss. The time value is an important factor here. This kind of trading decisions is triggered by situations like breaking of range. At that time, other intraday traders also jump with a small stop loss to ride the breakout or breakdown creating more volatility.

The purpose here is to determine such tradable market tendencies. As the range is small, the risk is anyways small compared to other strategies.

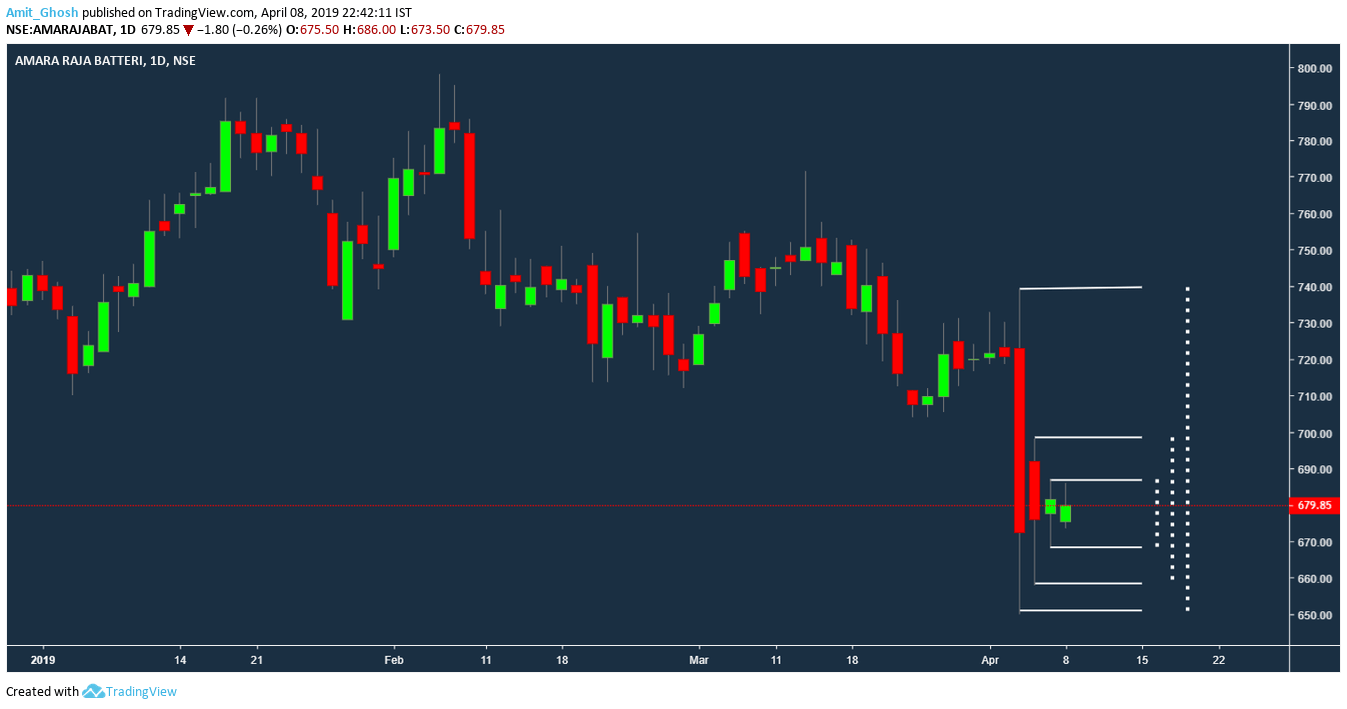

This is a chart of Amara Raja Battery in the daily time frame as shared before.

- Trend follower trader will like to short it. They are waiting for lower highs.

- Mean reversion trader will like to long it. They are waiting for confirmation.

Before we think as yourself of the trader, let’s use reverse psychology and think of the trader who is sitting on the money!

Wait, Who’s sitting on money? Obviously, the guy who shorted when it fell!

Now as the inside bars are forming, he is getting bored and impatient. Youtuber Vsauce made an amazing video on this topic. In short, a landmark study at Havard and Virginia Universities found that students prefer to experience physical pain over 15 minutes of boredom. So, Our trader is Impatient to book the position. Or, Impatient to over lot more. The net story is – something big will happen as there are lots of guys like him. That’s why nested Inside bars always give big breakout or breakdowns.

Now as the inside bars are forming, he is getting bored and impatient. Youtuber Vsauce made an amazing video on this topic. In short, a landmark study at Havard and Virginia Universities found that students prefer to experience physical pain over 15 minutes of boredom. So, Our trader is Impatient to book the position. Or, Impatient to over lot more. The net story is – something big will happen as there are lots of guys like him. That’s why nested Inside bars always give big breakout or breakdowns.

Now we shall go back to the discussion on the question “which” one will have more probability of profit. We already know “what” and “why” and “how”.

Inside Bar = Impatience.