Identify NR4 Candles for a stock Using Python and Zerodha

Narrow Range 4 (NR4) Pattern:

The Narrow Range 4 (NR4) pattern is a technical analysis pattern used by traders to identify potential breakouts or significant price moves in a financial instrument, such as a stock. This pattern focuses on the trading range or volatility of a stock over a specific period, typically four trading days.

Here’s how the NR4 pattern is defined:

- Narrow Range: The NR4 pattern occurs when the trading range (the difference between the high and low prices) of a particular trading day is narrower than the trading ranges of the previous three trading days.

- Four-Day Period: The NR4 pattern looks at a four-day period, including the current trading day and the previous three trading days.

- Breakout Signal: When an NR4 pattern is detected, traders often interpret it as a potential signal for an impending breakout. A breakout could be in either direction, meaning that the stock’s price may break out to the upside (bullish) or to the downside (bearish) shortly after the NR4 pattern appears.

- Volatility Contraction: The NR4 pattern suggests a contraction in price volatility, where the market is experiencing a period of relatively quiet or narrow trading ranges. Traders anticipate that this period of reduced volatility will be followed by a period of increased volatility, leading to a price movement.

# Iterate through historical data to detect NR4 candles for this batch

for i in range(3, len(historical_data)):

current_candle = historical_data[i]

# Calculate the trading range for the previous three candles

previous_candles = historical_data[i - 3:i]

trading_ranges = [candle['high'] - candle['low'] for candle in previous_candles]

# Check if the current candle has the narrowest range among the previous three

if min(trading_ranges) == trading_ranges[-1]:

nr4_candles.append(current_candle)

Detect NR4 Candles:

Iteration through Historical Data: We iterate through the historical price data for RELIANCE, starting from the fourth data point. This is because we need to assess the trading range of the previous three trading days for each candle.

# Iterate through historical data to detect NR4 candles for this batch

for i in range(3, len(historical_data)):

current_candle = historical_data[i]

Calculating Trading Ranges: For each candle, we calculate the trading ranges of the previous three trading days. These trading ranges are the differences between the high and low prices of those days.

# Calculate the trading range for the previous three candles

previous_candles = historical_data[i - 3:i]

trading_ranges = [candle['high'] - candle['low'] for candle in previous_candles]

Identifying NR4 Candle: We check if the current candle has the narrowest trading range among the previous three trading days. If the minimum trading range in the trading_ranges list corresponds to the current candle, it signifies that the current day’s price range is narrower than the previous three days.

# Check if the current candle has the narrowest range among the previous three

if min(trading_ranges) == trading_ranges[-1]:

nr4_candles.append(current_candle)

If the current candle meets the NR4 criteria, we add it to the nr4_candles list.

Final Code to detect NR4 Candles in Reliance

So, Here goes the complete code that will scan the Narrow Range 4 (NR4) candles accurately in Reliance –

from datetime import datetime, timedelta

# Define the date range

start_date = datetime.strptime('2023-01-01', '%Y-%m-%d')

end_date = datetime.strptime('2023-09-01', '%Y-%m-%d')

# Define the interval (in minutes)

interval = 'day'

# Initialize variables to track NR4 candles

nr4_candles = []

# Iterate through smaller date ranges (each within 60 days)

while start_date < end_date:

# Calculate the end date for the current batch (within 60 days)

batch_end_date = start_date + timedelta(days=60)

# Ensure that the batch end date does not exceed the overall end date

if batch_end_date > end_date:

batch_end_date = end_date

# Fetch historical data for the current batch

historical_data = kite.historical_data(instrument_token, start_date, batch_end_date, interval)

# Iterate through historical data to detect NR4 candles for this batch

for i in range(3, len(historical_data)):

current_candle = historical_data[i]

# Calculate the trading range for the previous three candles

previous_candles = historical_data[i - 3:i]

trading_ranges = [candle['high'] - candle['low'] for candle in previous_candles]

# Check if the current candle has the narrowest range among the previous three

if min(trading_ranges) == trading_ranges[-1]:

nr4_candles.append(current_candle)

# Move the start date for the next batch

start_date = batch_end_date

# Print or post detected NR4 candles for the entire date range

for candle in nr4_candles:

print(f"NR4 Candle detected at {candle['date']} for RELIANCE")

The output is fantastic –

NR4 Candle detected at 2023-01-10 00:00:00+05:30 for RELIANCE

NR4 Candle detected at 2023-01-13 00:00:00+05:30 for RELIANCE

NR4 Candle detected at 2023-01-18 00:00:00+05:30 for RELIANCE

...

...

...

...

NR4 Candle detected at 2023-08-21 00:00:00+05:30 for RELIANCE

NR4 Candle detected at 2023-08-28 00:00:00+05:30 for RELIANCE

NR4 Candle detected at 2023-08-29 00:00:00+05:30 for RELIANCE

Running NR4 Scanner on Cipla

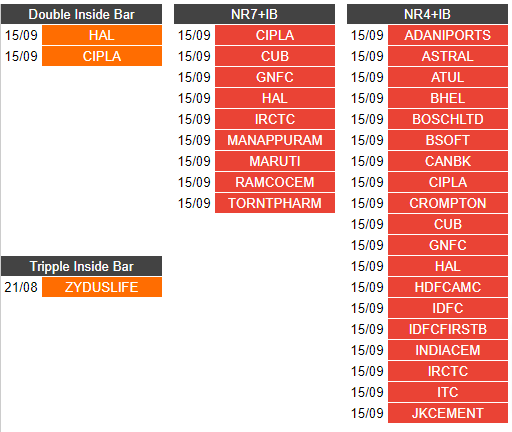

Here is a snapshot of our Buddha Scanner where it shows that the stock “Cipla” has NR7 as well as Inside Bar Pattern.

As all NR7 Patterns are by default NR4 too, Let’s checkout for CIPLA in our scanner.

Till now, in the example, We are using the date range as 1st Jan, 2023 to 1st Sept 2023.

Lets change the ending date to today’s as CIPLA popped up in our scanner on 15th.

Here is the modified code –

from datetime import datetime, timedelta

# Define the date range

start_date = datetime.strptime('2023-01-01', '%Y-%m-%d')

end_date = datetime.strptime('2023-09-18', '%Y-%m-%d')

# Define the interval (in minutes)

interval = 'day'

# Initialize variables to track NR4 candles

nr4_candles = []

# Define the stock symbol for CIPLA

symbol = 'NSE:CIPLA'

# Fetch instrument data for CIPLA

instruments = kite.ltp([symbol])

# Check if the instrument token for CIPLA is in the instruments dictionary

if symbol in instruments:

instrument_token = instruments[symbol]['instrument_token']

# Iterate through smaller date ranges (each within 60 days)

while start_date < end_date:

# Calculate the end date for the current batch (within 60 days)

batch_end_date = start_date + timedelta(days=60)

# Ensure that the batch end date does not exceed the overall end date

if batch_end_date > end_date:

batch_end_date = end_date

# Fetch historical data for the current batch

historical_data = kite.historical_data(instrument_token, start_date, batch_end_date, interval)

# Iterate through historical data to detect NR4 candles for this batch

for i in range(3, len(historical_data)):

current_candle = historical_data[i]

# Calculate the trading range for the previous three candles

previous_candles = historical_data[i - 3:i]

trading_ranges = [candle['high'] - candle['low'] for candle in previous_candles]

# Check if the current candle has the narrowest range among the previous three

if min(trading_ranges) == trading_ranges[-1]:

nr4_candles.append(current_candle)

# Move the start date for the next batch

start_date = batch_end_date

# Print or post detected NR4 candles for CIPLA in the entire date range

for candle in nr4_candles:

print(f"NR4 Candle detected at {candle['date']} for CIPLA")

else:

print("Instrument token not found for CIPLA")

The Output shows CIPLA in the same date !!

NR4 Candle detected at 2023-01-11 00:00:00+05:30 for CIPLA

NR4 Candle detected at 2023-01-16 00:00:00+05:30 for CIPLA

NR4 Candle detected at 2023-01-19 00:00:00+05:30 for CIPLA

NR4 Candle detected at 2023-01-20 00:00:00+05:30 for CIPLA

...

...

...

...

NR4 Candle detected at 2023-08-28 00:00:00+05:30 for CIPLA

NR4 Candle detected at 2023-09-05 00:00:00+05:30 for CIPLA

NR4 Candle detected at 2023-09-08 00:00:00+05:30 for CIPLA

NR4 Candle detected at 2023-09-15 00:00:00+05:30 for CIPLA