Fibonacci Retracement trade in Justdial June Contract

Fibonacci Retracement in Justdial: Justdial is the next RCOM and will go to zero after few years.

The company has no future ahead. Just a single building full of employees cold calling local vendors to extract money. Google Maps disrupted their business totally unlike IndiaMart which is focused on the B2B segment only.

Justdial is trading in the range of 300–600 for two years. Every time the results come up; it ends to the moon and slowly deteriorates to hell. So there are four results season, avoid it that time. Rest time, just keep selling it with a stop loss. It will make nice money.

This month should be the deterioration month.

Price Action

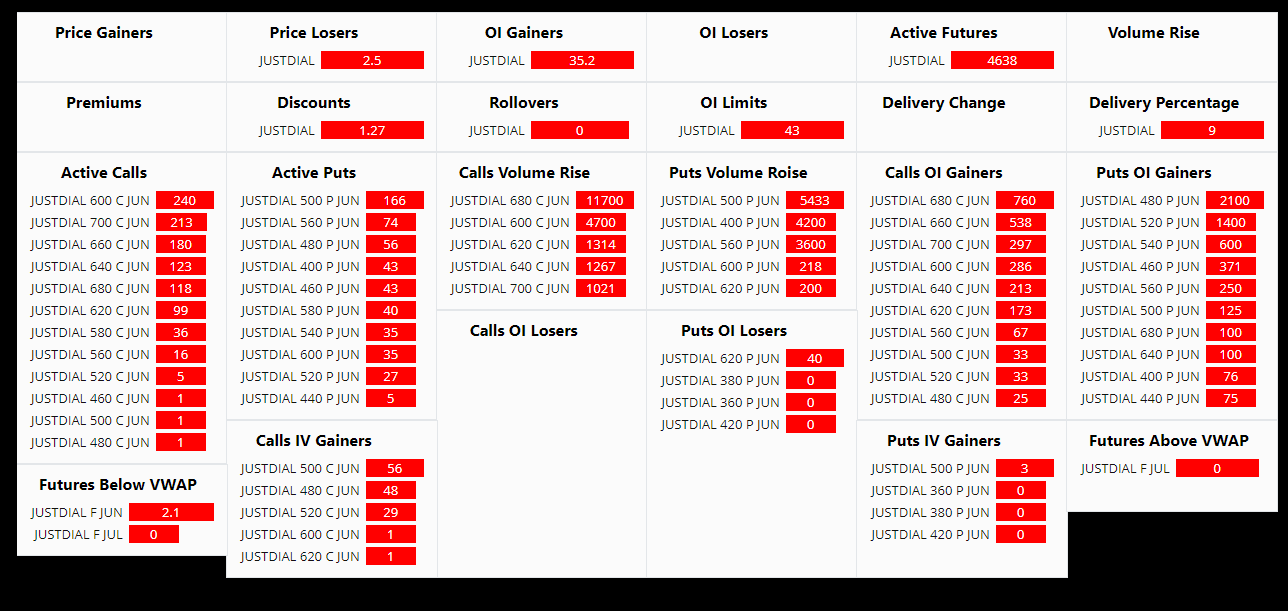

FNO Analysis

- Looking at the Open Interest, We can see huge call options of 680 strike price has been already written followed by 480 put options. Also, we can spot put unwinding at the current levels.

- The delivery percentage is weirdly low. Only insane momentum investors will buy Justdial at this level.

- On Friday, the price fell with a good gain in open interest showing firmness on the direction.

It’s one of those stocks for which I will be happy if it goes up as well as if it goes down. Going more up means we will be a better vantage point to short it right?

Let’s sell 680 call options clubbed with a PE buy with the same premium.

[…] Analysis Case Studies: Theta Decay Trade on Ascending Triangle consolidation of Axis Bank Fibonacci Retracement trade in Justdial June Contract Views on Nifty Futures for June series expiry The art of scalping using Handles in Day Trading […]