Indicator

This article is outdated. Please refer to the updated content.

Do you know that most of the Technical analysis is either done by price action or are done through indicators? Well, it may sound confusing but some indicators are created based on price action itself.

By here indicators I put those data as well which can not be derived from the historical price of the security.

An indicator is anything that can be used to predict future financial or economic trends. Change of price of a security falls into the financial trend. I will come to the economic trend later on.

There are 16 major economic trends based on which we trade on international currency pairs in the forex market. It cost me over huge burnings of 400K$+ to master them. But here we shall stick to financial trends.

Indicators are in fact a great help for making informed trading decisions and informed trading decisions carry less risk.

So in a short, it gives buy, sells or do nothing signals. So indicators have more weightage than others. So we combine more indicators to increase our probability of profit.

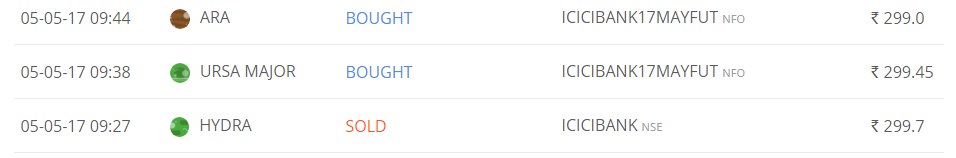

Zerodha Open trade is a platform where start traders of Zerodha share their trades live and you can follow them paying some respect towards Zerodha.

As you can see, different weightage given to different indicators caused a tension full trade on the same very stock. But the weird thing is they all are right in their trade setup. Yesterday people bought Bank of India as well as sold it. In some cases, some made money in both cases. In some case, some got slaughtered in both cases.

It’s because of the exit strategy.

So price action indicators are constructed with four elements of the securities – Open, High, Low, Close. Non-price action indicators have the privilege to add volume and open interest in the securities.

Q. By slaughtering you mean they exit at the wrong time?

A. By slaughtered I meant a loss. There are four cases of loss – wrong entry, wrong exit. Both entry and exit depend. It’s proven in the last session with the Titan Futures that people tend to not enter the same trade which they have exited at a loss. So if someone has exited a trade and is not entering the same trade to complete the whole trade cycle is also an example of loss.

If one is exiting with price action in the middle of the trade. He must enter again with price action or whatever method his trade setup follows during the time frame of his trading opportunity.

Q. We are talking entry and exit based on Bollinger? Or is it some general theory?

A. General. In our Bollinger Trade Setup, we are entering based on Bollinger’s and exiting based on price action. But if exited in the middle and there exists a trade opportunity window, we are entering the same trade with price action.

But if you see our ICICI trade, there is a case of trailing stop loss. This case of trailing stop loss arises when the main trading opportunity is gone and another trading opportunity arises based on other indicators or the other timeframe of the same indicator which has less probability of profit. In such case, you’re risking your past profit made and moving ahead.