Discussion on Support And Resistance Newton Course Live Trade

I always like to trade short opportunities.

Now, If you have undergone my course of “Support And Resistance”, there are three ways to trade an SnR trade.

- Selling near Resistance

- Selling when Support is broken.

- Selling when Support is broken and it is re-tested.

My favorite is Selling when it is near Resistance with a minor stop loss. It is because the stop loss is small. That’s it.

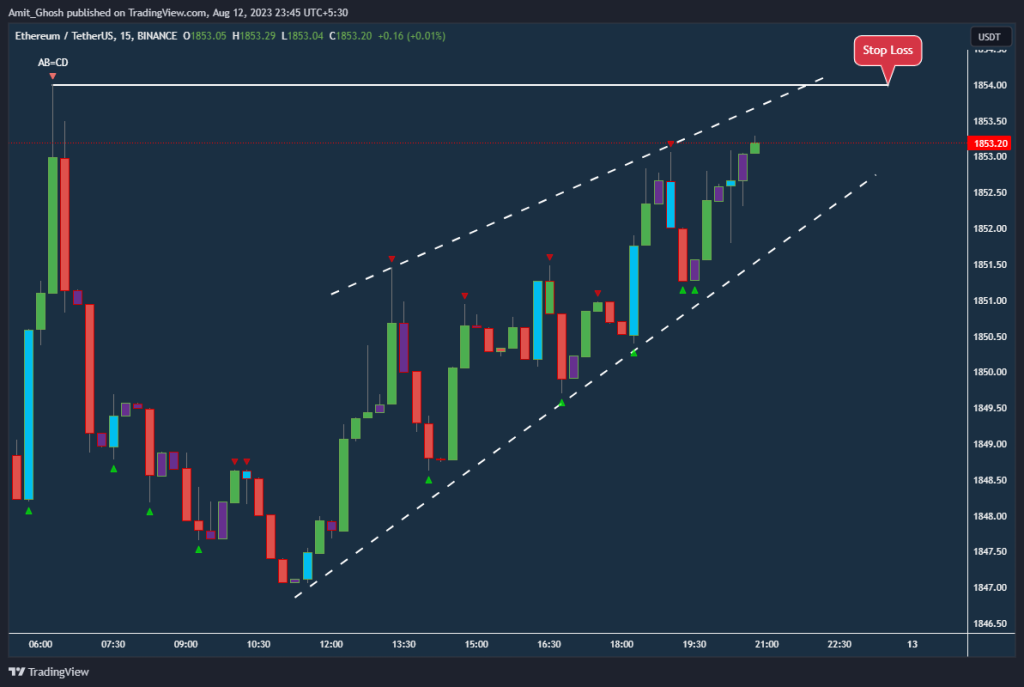

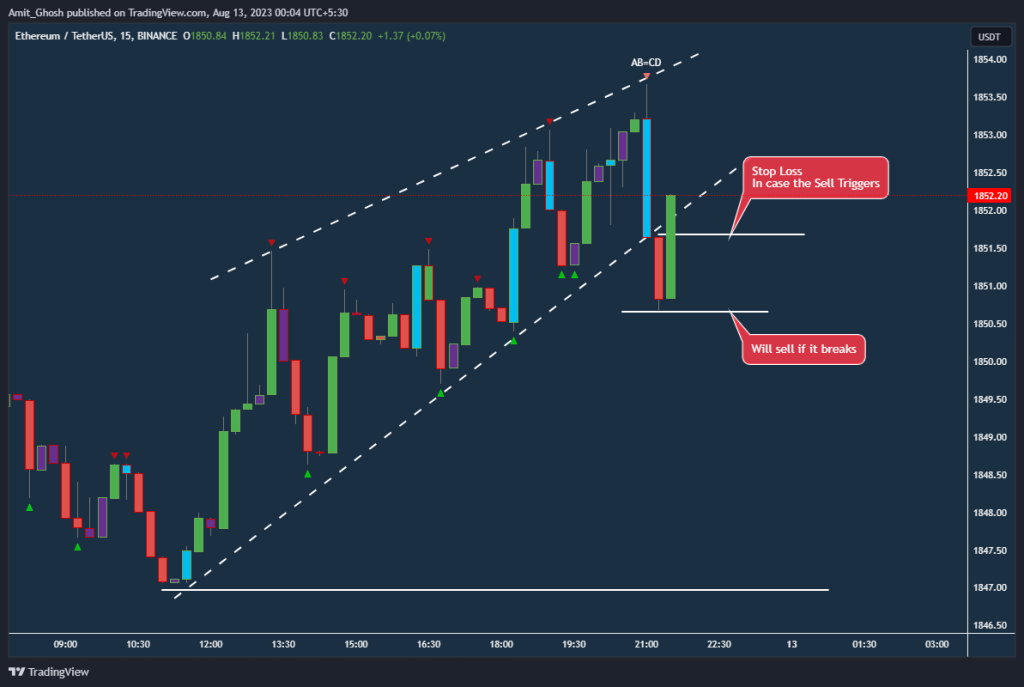

In the above image, You can see it is following a “sort-of” converging parallel channel near the resistance. So the trade is –

I chose the horizontal resistance as a stoploss for this trade.

The high of the channel is also a resistance which is marked below as “Another Hypothetical Stop Loss”.

The distance between the horizontal resistance and the “slanted” parallel channel’s upper channel resistance is low. Horizontal resistance is more important anyway, so it makes sense to take slightly more risk.

Dumber Explanation – It means if my stop loss is hit, I will lose more money as it is slightly farther away; but there is a high chance of the Upper Parallel Channel to get a fake wick in the case I chose the Upper Parallel Channel as Stop Loss.

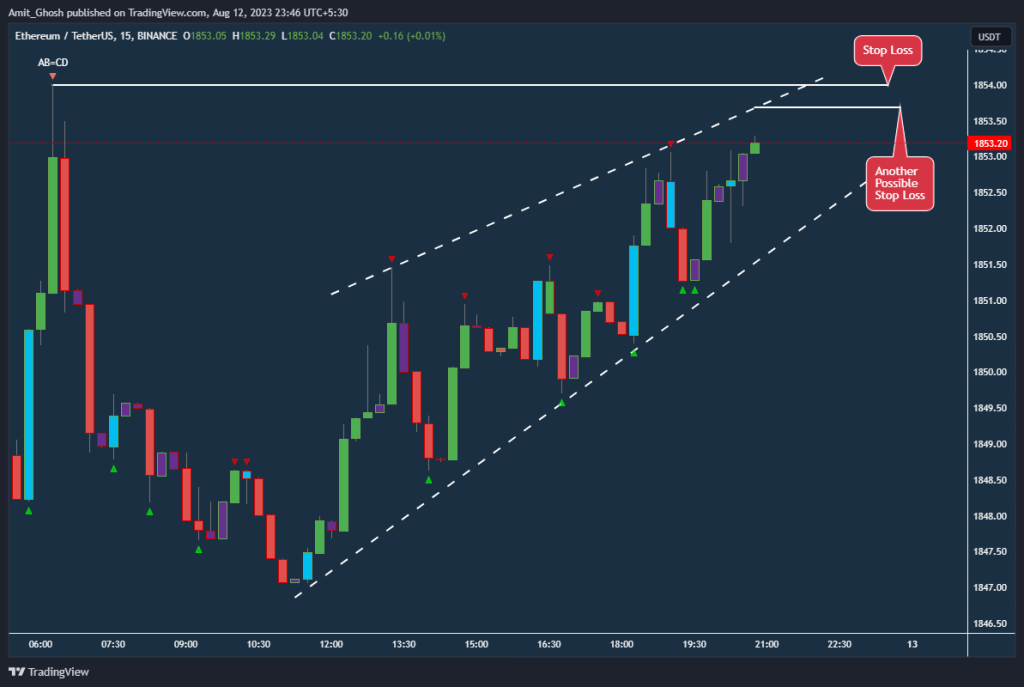

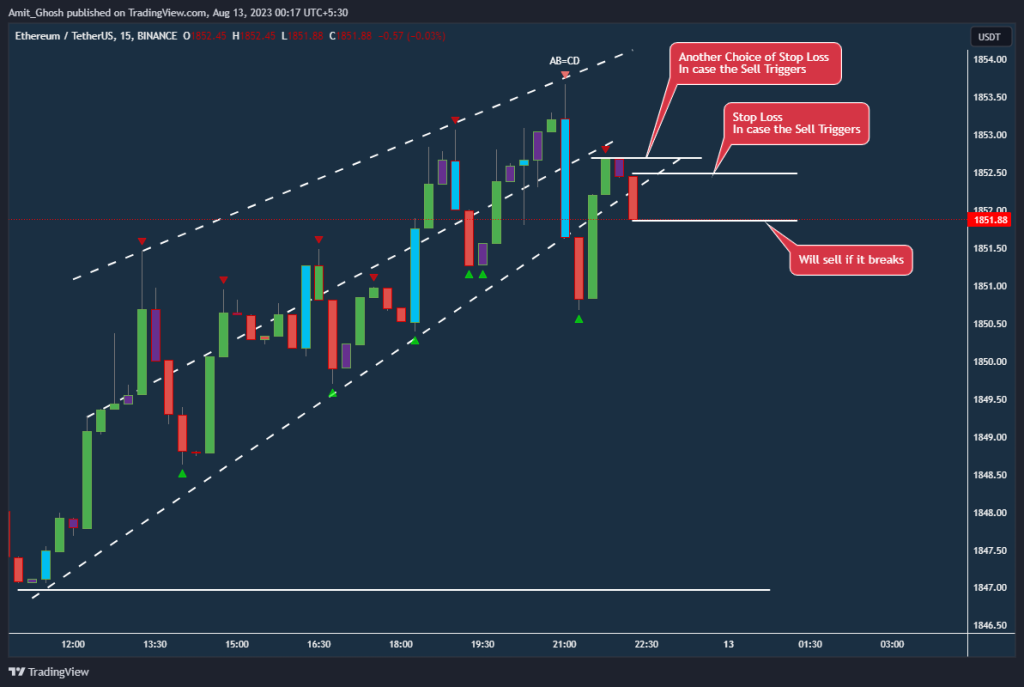

What happened next is, it fell perfectly.

But, it fell after hitting the line of “Another hypothetical Stoploss”.

Understanding this psychology beforehand is what comes from intuition. You have to play the reverse psychology here. As every retail algos will keep a stop loss at the high of the parallel channel, it is hit first.

Dumb Note – Usually in algos, people code to take “recent high” as a stop loss in a short trade which almost captures the high of the channels but almost always also misses to take account of other “recent highs”.

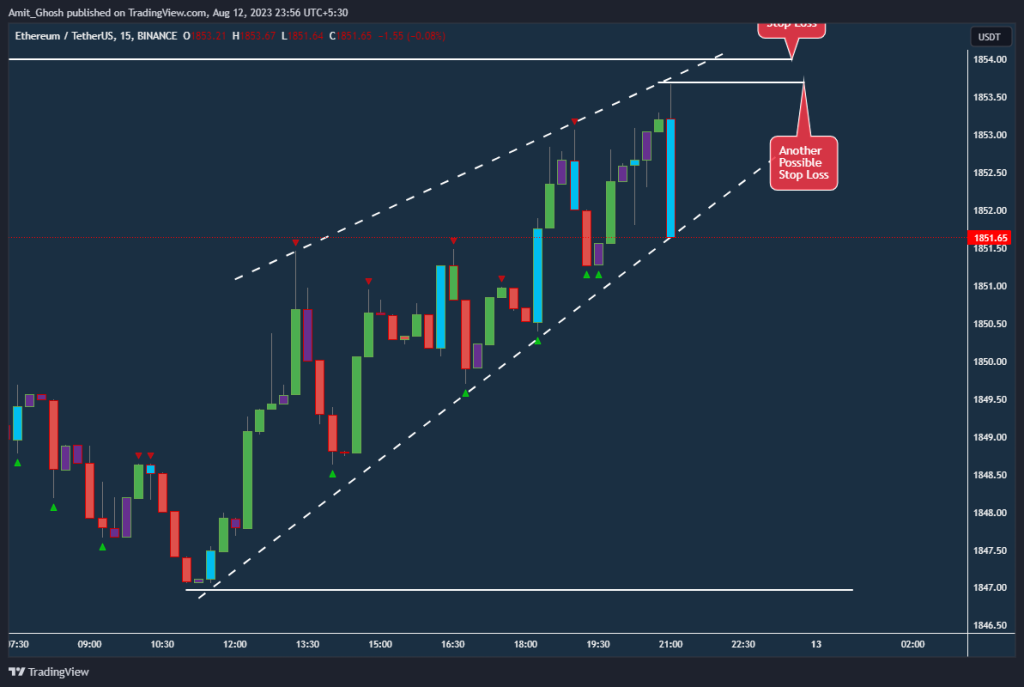

Now, it broke the channel as well.

But this is where most of us make mistakes while taking a trade when a support and resistance zone is broken. Although the channel is broken, it has not been confirmed.

So,

For someone who is following the approach of shorting a trade when Support breaks, the correct way to trade is to short only if the low of the candle which closed outside the channel breaks in the subsequent candles!

In that case,

the stop loss will be the high of the candle which closed outside the channel.

The cautiousness paid off.

A massive green candle is formed trapping all the quick shorters. It actually went up for the next two candles afterward before breaking the channel one more time.

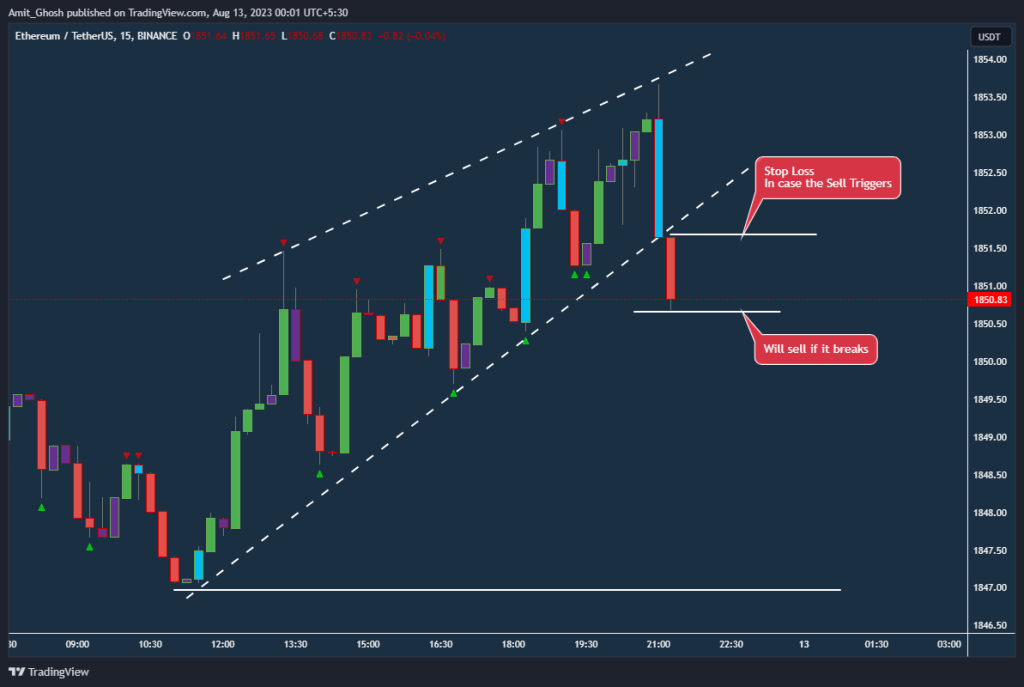

Now, We followed the same routine.

In Price Action, it is all about psychology. Both scenarios are different. Because in this case, You can actually have two stop loss.

In the first case, the channel broke after that huge blue candle. [See the last blue candle formed in the image carefully if you are not getting the context] But in the second case, we have a small inside bar.

Now, if we again see carefully, We will notice it is making an Andrew’s Pitchfork.

Don’t worry and get pitchforked with the nomenclature.

It just means it is another important line which usually happens in the middle of a long channel where it becomes a “mini” support and resistance. It means that instead of the prices moving freely from top to bottom to top of the channel; sometimes it bounces off from the middle too.

So, this line is important and can be used as a stop loss too. But it is not important enough like our old case of “Horizontal Resistance”.

The entire saga is to demonstrate the choices we face. As the difference is again low here, I, personally do not take it into account.

Your opinion may differ though.

There is no harm here if you have a different opinion and choose the “Another choice of stop loss” instead of my choice in this case. But, in the cases of the first case where the stop loss is near a horizontal stop loss, You must give that priority.

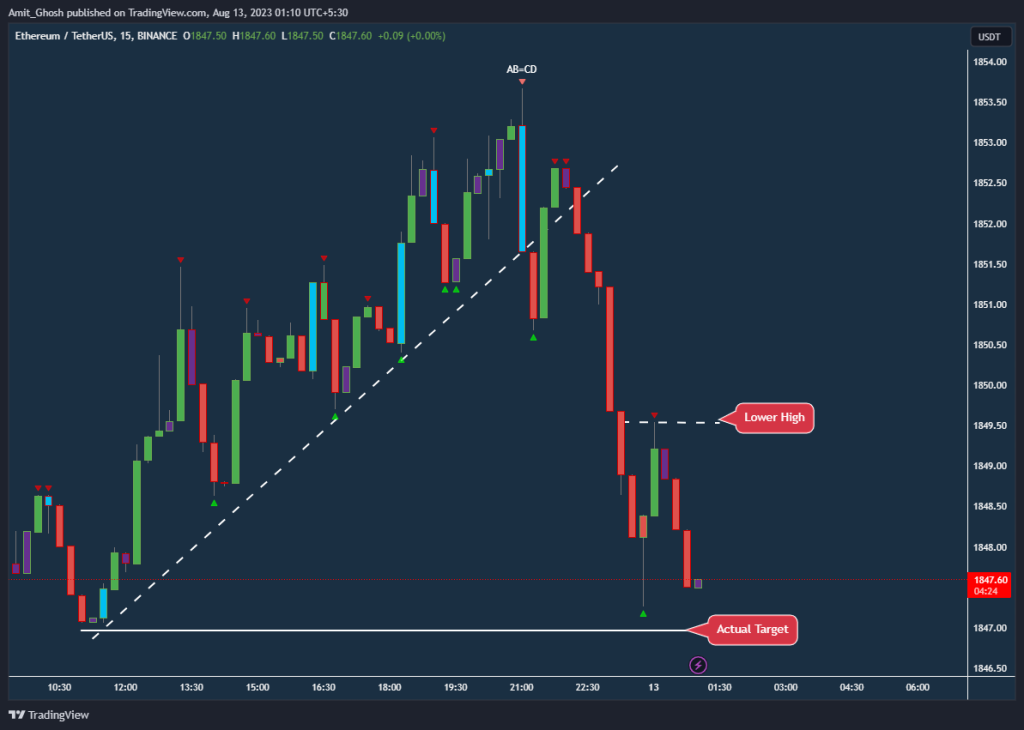

Now, comes the part of exit.

The correct approach is to go with trailing stop loss. Anyways, We need to be cautious when it nears 100% retracement. Like in the case, You can see there is a buying pressure just from the fierce wick.

This is where one should exit a trade immediately.

Side Note – This exit, as you are assuming a sharp bounce or support from the area of 100% retracement and were watching anyways, You can get a scalp buy trade with a small stop loss. The crypto world gives a huge amount of leverage. With High Leverage, Small Trade but Correct Trade will be enough!

It is written “scalp” because it usually bounces up from here and then creates a lower high and continues to fall again!

The subsequent trades that come after these trades are all of low quality.

Low quality = High stop loss or Low probability of profit.

In this case, it turned out to take support in the “Actual Target” like. There can not be any trade here because both long and short have no good sight of probability.

This document is a part of a live trade session that is taken for the Newton Course.

Newton’s price action trading course is designed for beginners with a focus on positional and swing trading. The 8-week course includes archived sessions, assignments, premium tools, scanners, and access to a trading community.

Enroll now @ https://unofficed.com/newton/