Flag Patterns: Part II – How to identify Bull or Bear Flag patterns

- How to identify Bull or Bear Flag patterns

- Classic Bull Flag Pattern

- Classic Bear Flag Pattern

Classic Bull Flag Pattern

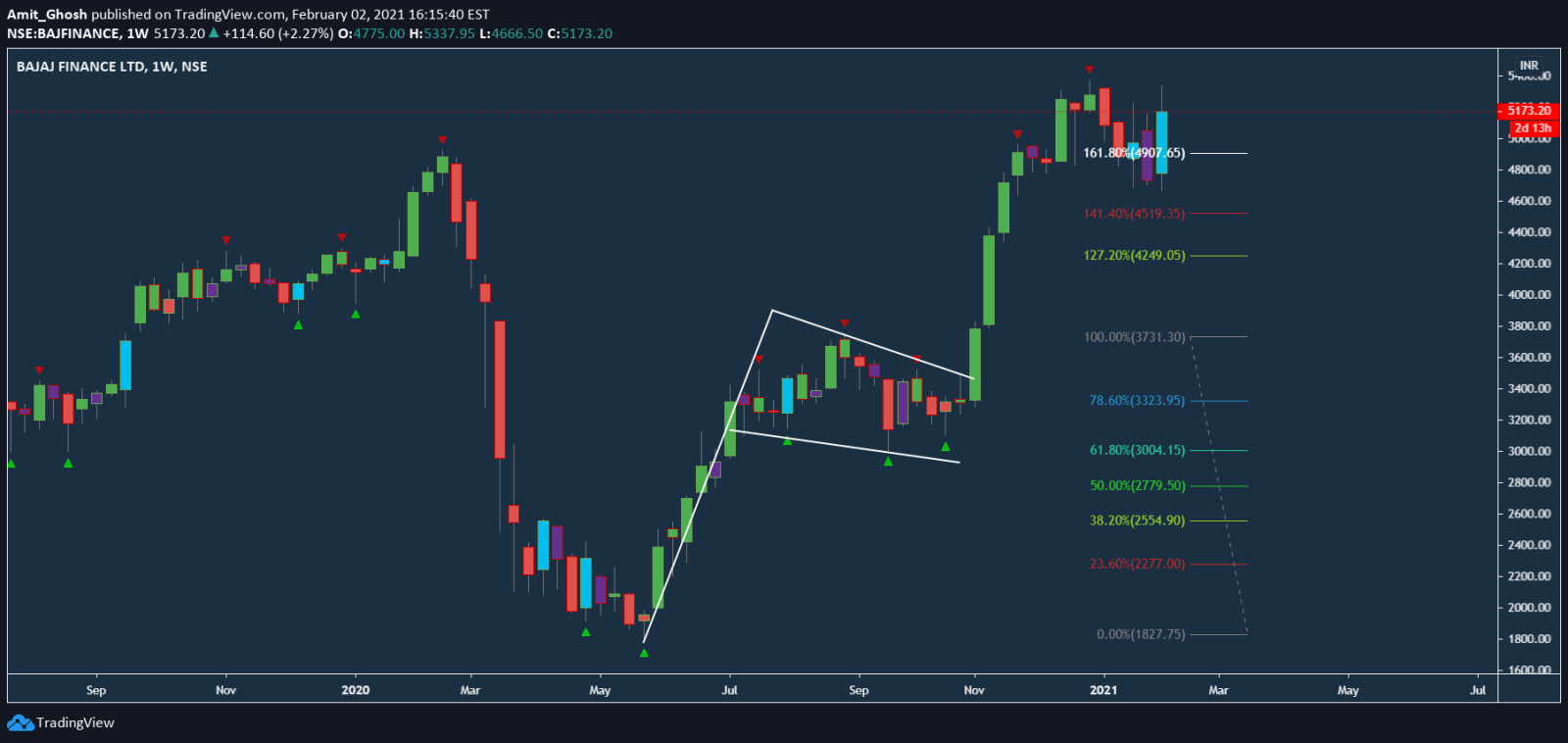

In this chart, As You can see Bajaj Finance follows a 50% retracement after a strong uptrend.

It consolidates within a rectangular range which is sloped downwards.

This is an example of a Classic Bull Flag Pattern.

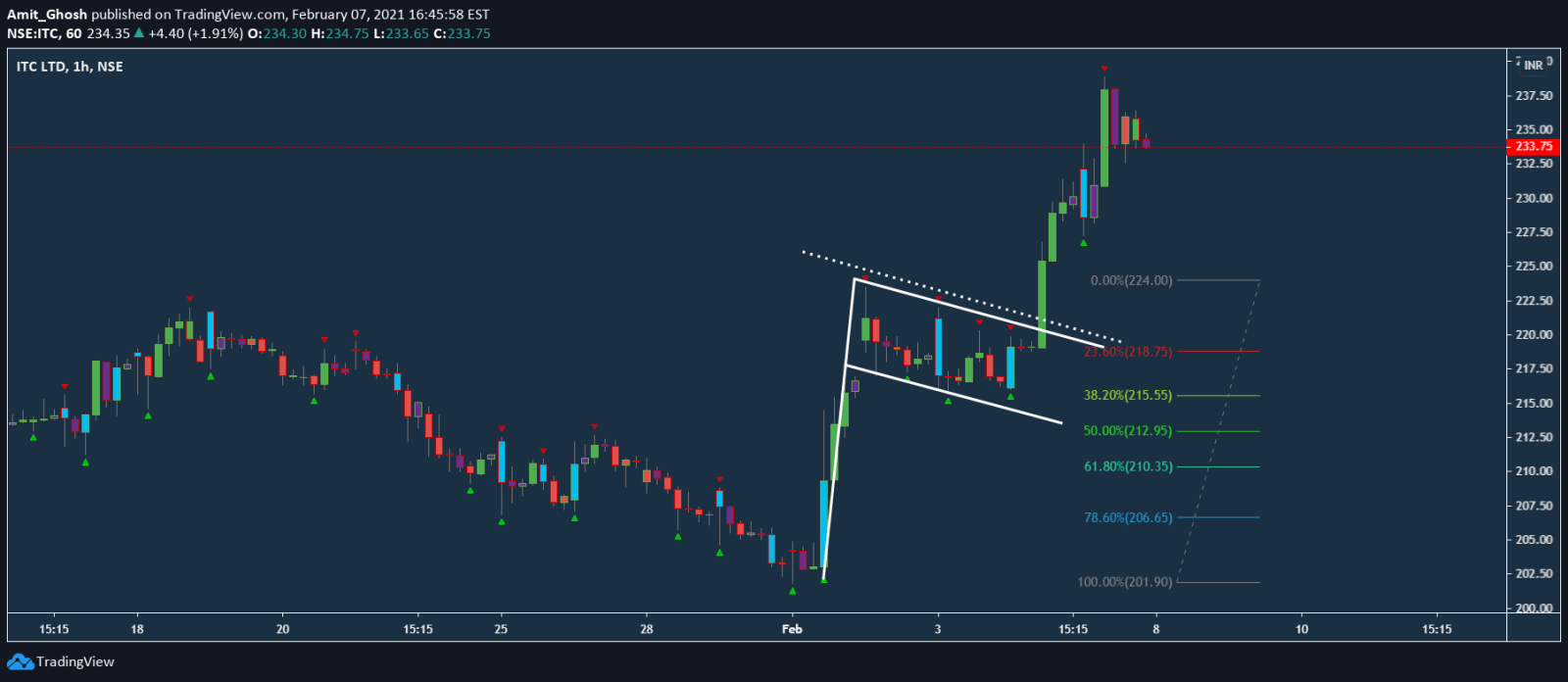

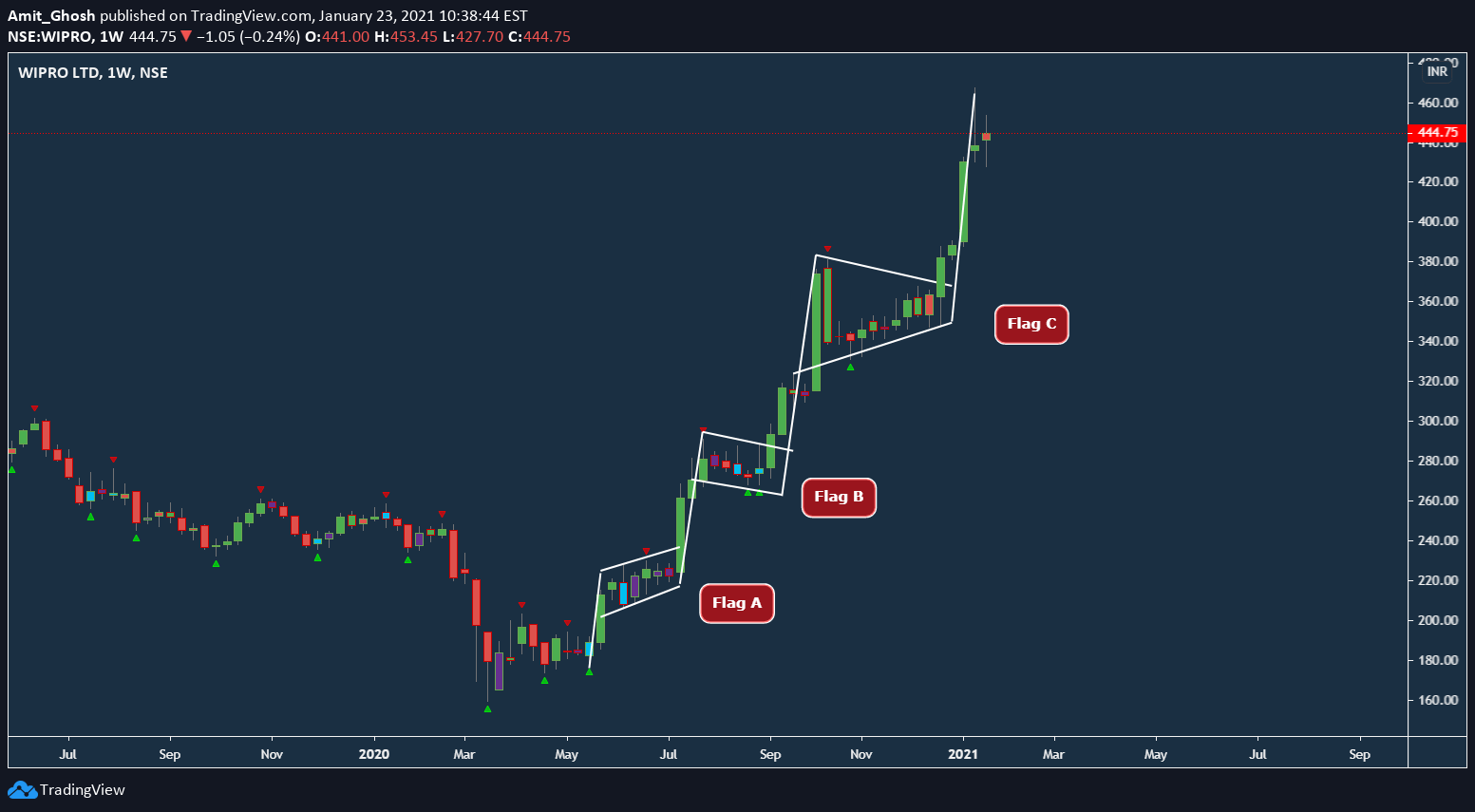

In this case, We can study multiple Flags within one single chart.

So, after making a range, it is expected to break out of that range continuing the uptrend.

This is why it is called a continuation pattern. The Classic Bull Flag Pattern is giving us the opportunity to enter the uptrend in the middle of the trend occurrence.

Classic Bear Flag Pattern

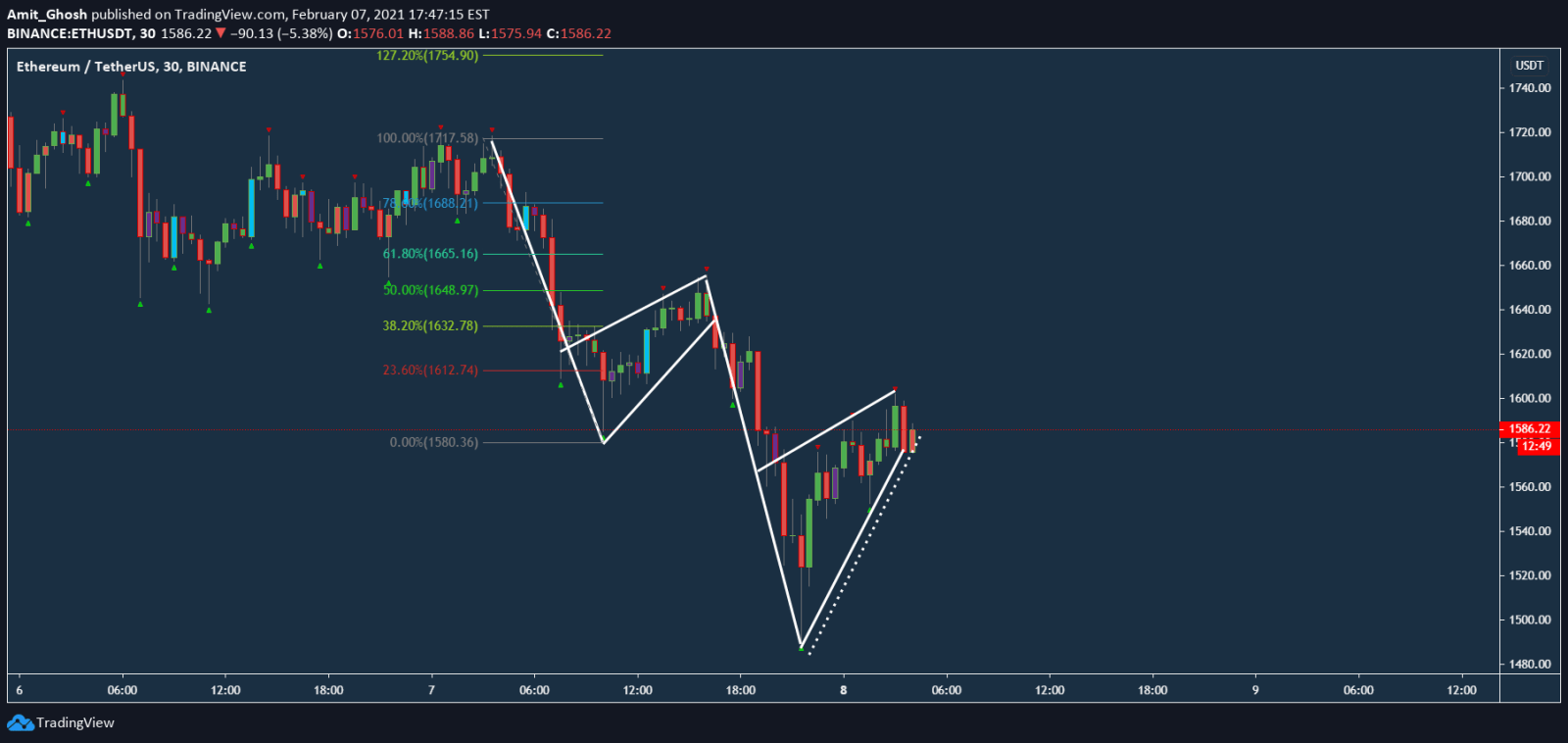

Similarly, In the Classic Bearish Flag Pattern, exactly the opposite thing happens!

It consolidates within a rectangular range which is sloped upwards.

Strangely, in this ETHUSDT chart, We can see it has done 50% retracement before breaking the range and continuing the downtrend.