Narrow Range (NR4, NR7) Trading Strategy

The Narrow Range (NR4, NR7) trading strategy is a breakout and reversal pattern that capitalizes on price breakouts following periods of consolidation characterized by narrow price ranges.

This strategy is based on the idea that after a period of tight price movement, a significant breakout is likely to occur in the direction of the breakout, leading to potential trading opportunities.

The term “NR” in “NR4” or “NR7” means “Narrow Range”.

Introduction to the NR4 and NR7 Strategy

The Narrow Range strategy finds its origins in the world of technical analysis and has been popularized by traders seeking to capture explosive price movements.

The NR4 and NR7 patterns are variations of this strategy that focus on specific time frames: the Narrow Range 4 (NR4) looks at the last four days’ price ranges, while the Narrow Range 7 (NR7) considers the last seven days.

Narrow Range Patterns was first coined in the book Day Trading With Short Term Price Patterns And Opening Range Breakout by Toby Crabel.

The book showcases an in-depth analysis of many theories and their subsequent patterns based on just Open, High, Low, Close of a said security and their statistical outcomes.

Despite being introduced in the 1990s, the NR4 and NR7 patterns continue to hold relevance in today’s dynamic trading environment.

Understanding NR4 and NR7 Patterns

The key concept underlying NR4 and NR7 patterns is the identification of days with exceptionally narrow price ranges. A narrow range indicates a period of consolidation where the market is “coiling” before making a potentially significant move. This can serve as a precursor to a breakout, as the market often builds up momentum during such periods.

NR4 Pattern:

The NR4 pattern occurs when the current day’s price range is the narrowest among the last four days. In this scenario, traders anticipate a breakout from this tight range.NR7 Pattern:

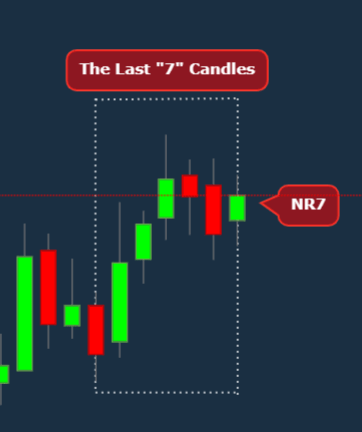

The NR7 pattern, on the other hand, focuses on a wider time frame of seven days. It identifies the day with the narrowest price range among the past seven days. This pattern often indicates a higher level of market coiling and the potential for a more significant breakout.How to Spot Narrow Range (NR7 and NR4) Days:

How to spot NR7 day:

NR7 is the term given to a day that has the daily range smallest of last 7 days including that day. Although NR Strategies started using prices of Daily Timeframe, The core theory is valid for all timeframes with more increasing uncertainty in smaller timeframes.

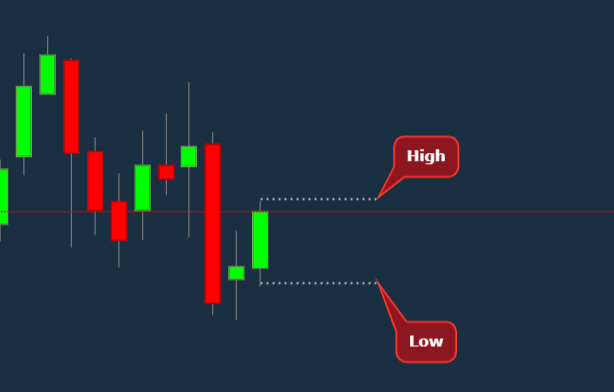

- Get high and low-price data of stock for the last seven days.

- Calculate the range for every day (range = high – low).

- Compare the range of today to the previous six days’ range.

- If today’s range is the smallest of the seven days, it is NR7 day; otherwise, not.

Note – Instead of referring to “day”, It is also referred as “bar”.

How to spot NR4 day:

Similarly, In, NR4 Strategy, we try to identify stocks where the range is narrowing and the current bar’s range is the lowest amongst 4 bars ( i.e. 3 bars excluding the current bar).

- Get high and low-price data of stock for the last four days

- Calculate the range for every day (range = high – low)

- Compare the range of today to the previous four days’ range.

- If today’s range is the smallest of the four days, it is NR4 day; otherwise, not.

So, by definition –

- All NR7 bars are automatically NR4 bars.

- NR7 bars have more chance of expansion than NR4 bars based on our theory.

NR7 and NR4 Trading Strategy:

| Criteria | NR4 | NR7 |

|---|---|---|

| Definition | A bar with the narrowest range of the last 4 bars. | A bar with the narrowest range of the last 7 bars. |

| Significance | Often precedes a significant price move. | Indicates potential price volatility ahead. |

| Timeframe | Considers the last 4 bars. | Considers the last 7 bars. |

| Usage | Used to identify potential breakout or reversal setups. | Used to anticipate upcoming market volatility. |

| Application | Commonly used in technical analysis and trading strategies. | Useful for traders seeking volatility-based opportunities. |

Range

Here, Range means the difference between the high and low of the security in the absolute figure. Note –

- We are not concerned about where the security opened or closed.

- We are concerned about the range.

How to use NR7/NR4 strategy

The NR4 and NR7 patterns can be applied to various markets, including stocks, forex, and commodities. Here’s how to use this strategy:

- Pattern Recognition: Identify the NR4 or NR7 pattern on the price chart. Look for days where the price range is exceptionally narrow compared to the previous days.

- Breakout Confirmation: Once the narrow range day is identified, traders wait for a breakout in the direction of the anticipated move. A bullish breakout occurs when the price moves above the high of the narrow range day, while a bearish breakout happens when the price moves below the low of the narrow range day.

- Entry and Stop-Loss: Enter the trade once the breakout is confirmed, and set a stop-loss order to manage risk. The stop-loss can be placed just outside the narrow range’s high or low, depending on the direction of the breakout.

- Profit Target: The profit target can be set based on technical analysis techniques such as measuring the distance of the narrow range and projecting it in the direction of the breakout. Traders can also use support and resistance levels for guidance.

Benefits and Considerations

The NR4 and NR7 trading strategy offers several benefits, including the potential to capture strong trending moves after periods of consolidation. However, it’s important to consider the following points:

- False Breakouts: Not every narrow range day results in a successful breakout. Traders need to be cautious of false breakouts that can lead to losses.

- Volatility: Breakouts can be volatile, so risk management is crucial. Using appropriate position sizing and stop-loss levels is essential to control potential losses.

- Confirmation: Waiting for a confirmation of the breakout before entering the trade helps filter out false signals.

The Theory of Contraction and Expansion:

The market goes through contractions (i.e. daily trading range getting shorter and shorter) and expansions (i.e. daily trading range getting bigger) cycle. The author argues that after contraction, the probability of “breakouts” or expansions, occurring is higher.

The philosophy behind the pattern is similar to the Bollinger Band Squeeze: a volatility contraction is often followed by volatility expansion. In this case, Volatility is being quantified by “Range” of the prices.

Narrow Range is a Time Compression Pattern!

The Narrow Range strategy is considered a time compression pattern due to the way it harnesses the concept of condensed price action within a narrow range. This compression signifies a temporary equilibrium between buying and selling forces, resulting in reduced volatility and limited price movement.

When such compression occurs, it’s analogous to winding a spring – the tighter the coil, the more energy it holds for an eventual release. In the context of trading, the narrow range acts as a pressure cooker!

As price is compressed within a smaller range, it represents a period of uncertainty and indecision among traders. However, markets are dynamic and ever-changing. The calm before the storm is often a precursor to a substantial price movement, as pent-up buying or selling interest seeks an outlet.

- When the market finally decides on a direction and a breakout occurs from the narrow range, it signifies the release of that pent-up energy.

- This breakout can trigger a significant price move in the chosen direction, catching traders off-guard who might have underestimated the potential for a substantial movement.

Thus, the narrow range strategy, as a time compression pattern, seeks to capitalize on these moments of compressed volatility, aiming to capture the ensuing trend that often follows such a release of energy.