Calculate any Option Greek using Black Scholes Formula in Python

Inputs in Black-Scholes Option Pricing Model Formula

- S0 = underlying price

- X = strike price

- σ = volatility

- r = continuously compounded risk-free interest rate

- q = continuously compounded dividend yield

- t = time to expiration

For,

- σ = Volatility = India VIX has been taken.

- r = 10% (As per NSE Website, it is fixed.)

- q = 0.00% (Assumed No Dividend)

Note: In many resources, you can find different symbols for some of these parameters in the Black Scholes Formula.

For example,

- The strike price is often denoted

K(here it isX). - Underlying price is often denoted

S(without the zero) - Time to expiration is often denoted

T – t(difference between expiration and now).

Python Code

import math

from scipy.stats import norm

def black_scholes_dexter(S0,X,t,σ="",r=10,q=0.0,td=365):

if(σ==""):σ =indiavix()

S0,X,σ,r,q,t = float(S0),float(X),float(σ/100),float(r/100),float(q/100),float(t/td)

#https://unofficed.com/black-scholes-model-options-calculator-google-sheet/

d1 = (math.log(S0/X)+(r-q+0.5*σ**2)*t)/(σ*math.sqrt(t))

#stackoverflow.com/questions/34258537/python-typeerror-unsupported-operand-types-for-float-and-int

#stackoverflow.com/questions/809362/how-to-calculate-cumulative-normal-distribution

Nd1 = (math.exp((-d1**2)/2))/math.sqrt(2*math.pi)

d2 = d1-σ*math.sqrt(t)

Nd2 = norm.cdf(d2)

call_theta =(-((S0*σ*math.exp(-q*t))/(2*math.sqrt(t))*(1/(math.sqrt(2*math.pi)))*math.exp(-(d1*d1)/2))-(r*X*math.exp(-r*t)*norm.cdf(d2))+(q*math.exp(-q*t)*S0*norm.cdf(d1)))/td

put_theta =(-((S0*σ*math.exp(-q*t))/(2*math.sqrt(t))*(1/(math.sqrt(2*math.pi)))*math.exp(-(d1*d1)/2))+(r*X*math.exp(-r*t)*norm.cdf(-d2))-(q*math.exp(-q*t)*S0*norm.cdf(-d1)))/td

call_premium =math.exp(-q*t)*S0*norm.cdf(d1)-X*math.exp(-r*t)*norm.cdf(d1-σ*math.sqrt(t))

put_premium =X*math.exp(-r*t)*norm.cdf(-d2)-math.exp(-q*t)*S0*norm.cdf(-d1)

call_delta =math.exp(-q*t)*norm.cdf(d1)

put_delta =math.exp(-q*t)*(norm.cdf(d1)-1)

gamma =(math.exp(-r*t)/(S0*σ*math.sqrt(t)))*(1/(math.sqrt(2*math.pi)))*math.exp(-(d1*d1)/2)

vega = ((1/100)*S0*math.exp(-r*t)*math.sqrt(t))*(1/(math.sqrt(2*math.pi))*math.exp(-(d1*d1)/2))

call_rho =(1/100)*X*t*math.exp(-r*t)*norm.cdf(d2)

put_rho =(-1/100)*X*t*math.exp(-r*t)*norm.cdf(-d2)

return call_theta,put_theta,call_premium,put_premium,call_delta,put_delta,gamma,vega,call_rho,put_rho

Usage

S0 = 34950.60

X = 35000.00

σ = 14.72

t = 3

call_theta,put_theta,call_premium,put_premium,call_delta,put_delta,gamma,vega,call_rho,put_rho=black_scholes_dexter(S0,X,t,σ="",r=10,q=0.0,td=365)

print(call_theta)

print(put_theta)

print(call_premium)

print(put_premium)

print(call_delta)

print(put_delta)

print(gamma)

print(vega)

print(call_rho)

print(put_rho)

Output

-35.57594968706057

-25.994786756764814

175.92468507293597

196.56938065246504

0.4850057898780081

-0.514994210121992

0.0008543132102275919

12.621618527502404

1.378793315723619

-1.495555563365108

Call and Put Option Price Formulas

Call option C and put option P prices are calculated using the following formulas:

![]()

![]()

where N(x) is the standard normal cumulative distribution function.

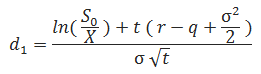

The formulas for d1 and d2 are:

![]()

Original Black-Scholes vs. Merton’s Formulas

In the original Black-Scholes model, which doesn’t account for dividends, the equations are the same as above except:

- There is just

S0in place ofS0 e-qt - There is no

qin the formula ford1

Therefore, if the dividend yield is zero, then e-qt = 1 and the models are identical.

Black-Scholes Formulas for Option Greeks

Delta

![]()

![]()

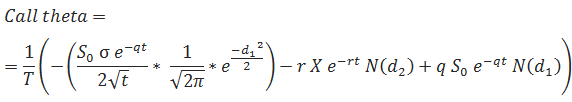

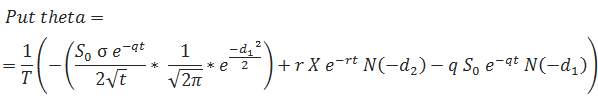

Theta

… where T is the number of days per year (calendar or trading days, depending on what you are using).

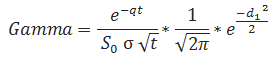

Gamma

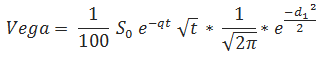

Vega

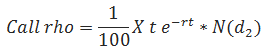

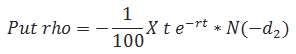

Rho

The function to find the option price using Black-Sholes model refers to indiavix() function but the function’s definition is not found in the code. Where can I find the indiavix() function?

Check the library used.