Correlation and Co integration is not same thing!

Correlation and Cointegration is not the same thing!

Correlation – If two stocks are correlated then if stock A has an up day then stock B will have an up day

Cointegration – If two stocks are cointegrated then it is possible to form a stationary pair from some linear combination of stock A and B

How to explain Cointegration?

One of the best explanations of cointegration is as follows: “A man leaves a pub to go home with his dog, the man is drunk and goes on a random walk, the dog also goes on a random walk. They approach a busy road and the man puts his dog on a lead, the man and the dog are now cointegrated. They can both go on random walks but the maximum distance they can move away from each other is fixed the length of the lead”

Since they are both in a random walk, we don’t need them to be correlated at all but in the end, the spread is “fixed” and that if the spread deviates from the “fixing” then it will mean revert.

Why don’t we use Correlation in Stat Arbitrage?

With correlated stocks they will move in the same direction most of the time, however, the magnitude of the moves is unknown, this means that if you’re trading the spread between two stocks then the spread can keep growing and growing to show no signs of mean reversion.

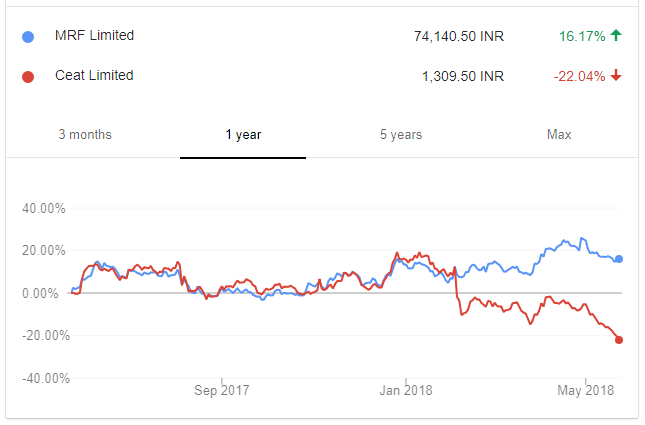

That’s what happened with Ceat and MRF. Ceat is still moving down when MRF is moving down but there is a change of magnitude now.