Building An Market-Weight Adjusted N50 Index Fund – Part II

The N50 Index Fund

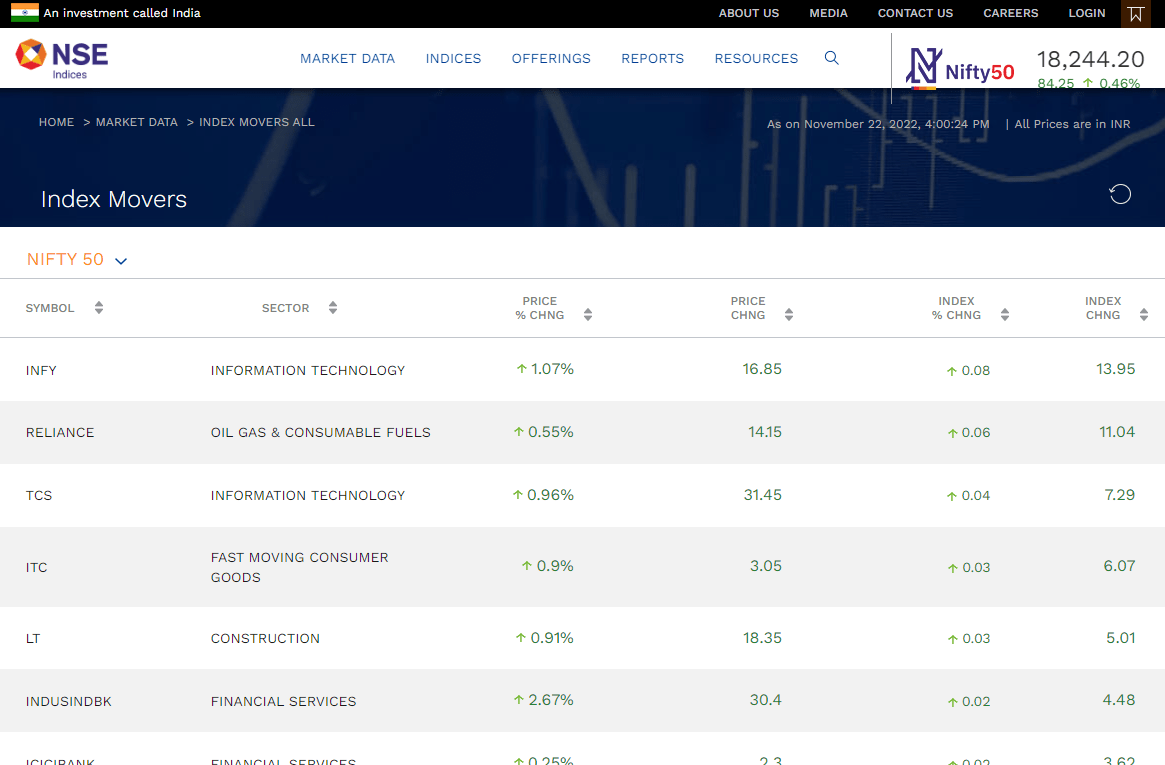

Our goal is to make an index fund that will allocate the fund towards buying equities in the same ratio it is present in the NIFTY 50. The stock’s weight changes each day in NIFTY. What is the correct allocation of the shares to buy is the agenda of this entire discussion.

Framing the Data Source to Dataframe

https://iislliveblob.niftyindices.com/jsonfiles/HeatmapDetail/FinalHeatmapNIFTY%2050.json from where the data is coming. So Let’s run a small patch of code that fetches the data –

import pandas as pd

df=pd.read_json('https://iislliveblob.niftyindices.com/jsonfiles/HeatmapDetail/FinalHeatmapNIFTY%2050.json')

df.head()

Output –

per ptsC change high low previousClose sector time iislPtsChange iislPercChange ... indexDivisor sharesOutstanding symbol investableWeightFactor Indexmcap_yst Indexmcap_today priceperchange NewIndexValue pointchange perchange

0 1.19 18.70 18.70 1588.00 1562.00 1568.20 Information Technology Nov 22, 2022 16:00:24 16.85 1.07 ... 4.422462e+09 4207753474 INFY 0.87 5740781128196 5802464690248 1.19 18173.916251 13.95 0.08

1 0.55 14.00 14.00 2568.50 2536.50 2550.90 Oil Gas & Consumable Fuels Nov 22, 2022 16:00:24 14.15 0.55 ... 4.422462e+09 6765355933 RELIANCE 0.51 8801450689240 8850272880330 0.55 18171.008059 11.04 0.06

2 0.84 27.50 27.50 3318.95 3255.25 3283.50 Information Technology Nov 22, 2022 16:00:24 31.45 0.96 ... 4.422462e+09 3659051373 TCS 0.28 3364058651309 3396280257699 0.84 18167.254361 7.29 0.04

3 0.83 2.80 2.80 341.00 335.70 337.20 Fast Moving Consumer Goods Nov 22, 2022 16:00:24 3.05 0.90 ... 4.422462e+09 12399178702 ITC 0.71 2968512171403 2995362592882 0.83 18166.039838 6.07 0.03

4 0.82 16.55 16.55 2033.15 2019.60 2011.45 Construction Nov 22, 2022 16:00:24 18.35 0.91 ... 4.422462e+09 1405191199 LT 0.86 2430765780017 2452941102328 0.82 18164.982712 5.01 0.03

5 rows × 24 columns

Another small code to list the name of the columns here –

df.columns

Output –

Index(['per', 'ptsC', 'change', 'high', 'low', 'previousClose', 'sector',

'time', 'iislPtsChange', 'iislPercChange', 'ltP', 'cappingFactor',

'adjustedClosePrice', 'dayEndClose', 'indexDivisor',

'sharesOutstanding', 'symbol', 'investableWeightFactor',

'Indexmcap_yst', 'Indexmcap_today', 'priceperchange', 'NewIndexValue',

'pointchange', 'perchange'],

dtype='object')

You can see it provides with the data of IWF i.e. Investable Weight Factor too which was discussed in the last article.

Defining "Index Weight"

As you can see above, in the list of the column names, there is an entry namedIndexmcap_today.

Now we can easily reverse engineer this data to check the exact % of allocation of any stock in the index today. Lets define that variable as IndexWeight.

Net_Indexmcap_today = df['Indexmcap_today'].sum()

df['IndexWeight']=(df['Indexmcap_today']*100)/(Net_Indexmcap_today)

IndexWeight.

symbol ltP IndexWeight

17 IOC 116.85 0.435662

27 COALINDIA 156.00 0.480076

35 SBILIFE 980.75 0.561291

24 EICHERMOT 2761.00 0.565857

31 SHREECEM 28847.00 0.567727

26 HEROMOTOCO 3057.90 0.582835

12 BRITANNIA 3597.35 0.624342

15 TATACONSUM 709.05 0.625029

16 BPCL 489.50 0.667793

29 ONGC 125.00 0.668707

22 UPL 853.00 0.689627

11 CIPLA 954.00 0.711691

23 DIVISLAB 4245.05 0.793737

28 NTPC 116.40 0.810883

21 BAJAJ-AUTO 4268.95 0.816606

41 HINDALCO 388.00 0.831650

10 HDFCLIFE 691.50 0.839328

25 GRASIM 1502.05 0.842475

32 INDUSINDBK 1019.10 0.845643

36 POWERGRID 234.10 0.881194

30 NESTLEIND 17484.00 0.915986

7 TATAMOTORS 356.50 0.928907

34 ADANIPORTS 874.90 0.939112

14 DRREDDY 5287.00 0.940484

6 TECHM 1058.00 0.962694

39 JSWSTEEL 706.35 1.004699

37 BAJAJFINSV 11725.40 1.042082

8 TITAN 1710.00 1.049470

19 SUNPHARMA 679.70 1.076333

18 M&M 807.75 1.135777

38 ULTRACEMCO 6789.00 1.152134

20 WIPRO 551.30 1.196309

43 TATASTEEL 1110.00 1.269242

9 MARUTI 7336.95 1.432227

3 HCLTECH 967.00 1.541934

33 ASIANPAINT 2925.00 1.937540

1 BHARTIARTL 547.50 1.940650

13 BAJFINANCE 5746.85 2.241205

44 SBIN 427.40 2.407811

2 ITC 213.80 2.742063

40 LT 1549.95 2.748065

42 AXISBANK 745.45 2.753537

4 HINDUNILVR 2358.00 3.093373

45 KOTAKBANK 1792.00 3.862774

5 TCS 3199.35 4.868017

46 ICICIBANK 642.95 6.524685

48 HDFC 2555.00 6.757776

0 INFY 1414.00 7.690907

49 HDFCBANK 1483.00 9.486076

47 RELIANCE 2211.50 10.515982

The Base Value of our Fund

- The fat way of doing this is to start the program allocation from

df['ltP].total()and keep increasing 1 INR till the “Qty” of all stocks is at least one. - The other approach which I have followed here is similar of LCM method which we have learnt in the elementary school

MinCapital = max(df['ltP']/df['IndexWeight'])*50

MinCapital

Output –

1130084.2519603972

Now, Lets find the allocatable quantity of the stocks –

df['Qty'] = round((max(df['ltP']/df['IndexWeight']))/df['ltP'])

df['Value'] = df['Qty']*df['ltP']

Sorting the dataframe and printing it –

df[['symbol','ltP','IndexWeight','Qty','Value']].sort_values('IndexWeight', ascending=False)

The Final Output of Our Index Fund

Running the above code will result in the following output –

symbol ltP IndexWeight Qty Value

1 RELIANCE 2564.90 10.969006 9.0 23084.10

49 HDFCBANK 1597.00 8.698620 14.0 22358.00

6 ICICIBANK 922.65 7.976526 24.0 22143.60

0 INFY 1586.90 7.191560 14.0 22216.60

10 HDFC 2630.00 5.901042 9.0 23670.00

2 TCS 3311.00 4.209341 7.0 23177.00

3 ITC 340.00 3.712445 66.0 22440.00

47 KOTAKBANK 1936.00 3.532555 12.0 23232.00

4 LT 2028.00 3.040169 11.0 22308.00

29 SBIN 599.00 2.849494 38.0 22762.00

38 AXISBANK 869.80 2.848814 26.0 22614.80

8 HINDUNILVR 2511.00 2.783847 9.0 22599.00

48 BHARTIARTL 847.00 2.571469 27.0 22869.00

30 BAJFINANCE 6696.00 2.207147 3.0 20088.00

28 ASIANPAINT 3104.80 1.734273 7.0 21733.60

32 MARUTI 8887.15 1.461815 3.0 26661.45

13 M&M 1234.00 1.457462 18.0 22212.00

15 HCLTECH 1105.35 1.447320 20.0 22107.00

14 ADANIENT 4034.90 1.367927 6.0 24209.40

18 SUNPHARMA 1011.00 1.351694 22.0 22242.00

7 TITAN 2607.50 1.347797 9.0 23467.50

26 BAJAJFINSV 1645.05 1.232792 14.0 23030.70

17 TATASTEEL 105.35 1.051682 215.0 22650.25

9 NTPC 167.10 0.983729 135.0 22558.50

12 ULTRACEMCO 6855.00 0.979321 3.0 20565.00

21 TATAMOTORS 424.50 0.944014 53.0 22498.50

5 INDUSINDBK 1172.45 0.943802 19.0 22276.55

45 POWERGRID 218.25 0.922650 104.0 22698.00

46 NESTLEIND 19600.00 0.867192 1.0 19600.00

11 JSWSTEEL 709.70 0.827519 32.0 22710.40

23 TECHM 1051.85 0.823694 21.0 22088.85

20 GRASIM 1700.00 0.790482 13.0 22100.00

16 ADANIPORTS 881.25 0.785507 26.0 22912.50

37 HINDALCO 430.45 0.779624 53.0 22813.85

40 CIPLA 1103.95 0.739892 20.0 22079.00

36 WIPRO 389.00 0.713697 58.0 22562.00

33 SBILIFE 1232.00 0.685966 18.0 22176.00

31 DRREDDY 4383.00 0.656975 5.0 21915.00

43 ONGC 135.25 0.653490 167.0 22586.75

19 HDFCLIFE 540.00 0.632797 42.0 22680.00

27 BRITANNIA 4151.00 0.608176 5.0 20755.00

42 COALINDIA 229.40 0.594960 99.0 22710.60

41 EICHERMOT 3378.00 0.583375 7.0 23646.00

39 BAJAJ-AUTO 3619.00 0.575055 6.0 21714.00

35 TATACONSUM 772.00 0.572621 29.0 22388.00

22 APOLLOHOSP 4479.00 0.565548 5.0 22395.00

24 DIVISLAB 3306.00 0.522054 7.0 23142.00

25 UPL 768.00 0.507770 29.0 22272.00

34 HEROMOTOCO 2676.90 0.432300 8.0 21415.20

44 BPCL 306.50 0.362994 74.0 22681.00

The net allocated capital will be slightly less because we have rounded down the quantity when it became fractions.

AllocatedCapital = df['Value'].sum()

AllocatedCapital

It will come around –

1123815.7000000002

To be Continued...

This is a part of the live discussion that happened on Unofficed Discussion Forum. Feel free to participate and engage in future discussions. Here are some agenda to be discussed later –

- Would be able to calculate the NIFTY Value directly from the prices of the stocks in real-time?

- And, Will there be an arbitrage opportunity if there is a difference in the value?

Let’s discuss this further in the next part of this discussion. Don’t shy away to share your code snippets or variations in the forum if You trying something