Building An Market-Weight Adjusted N50 Index Fund – Part I

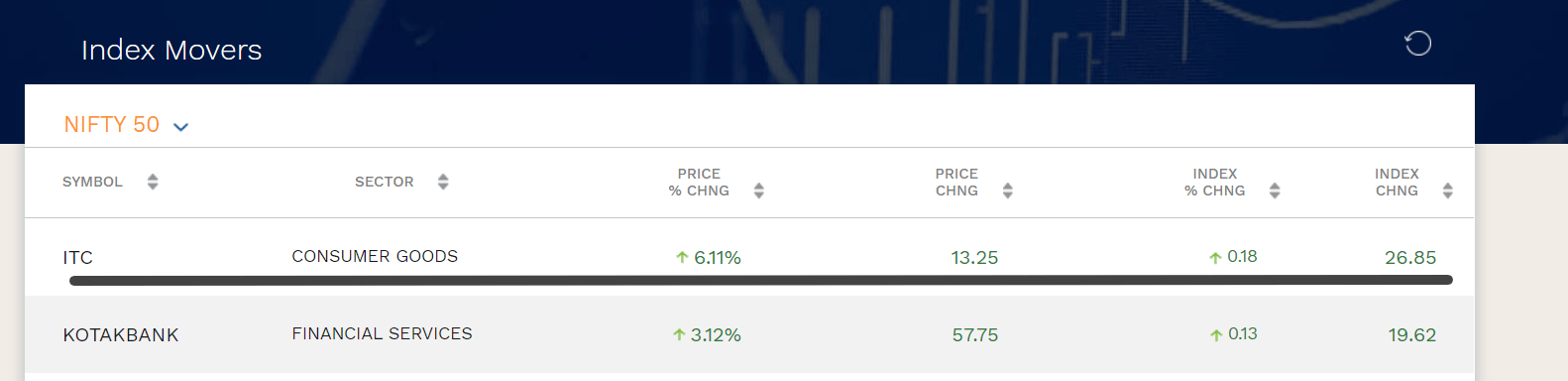

If ITC went up 6.11%, Index goes up 0.18%

We can get into more accurate details if we do using points

If Reliance falls -0.5%, the index falls 0.05%. Now, assumption says, If Reliance rise -0.5% the index should rise 0.05% Will it ?

Here is the fault of the % system as We are not thinking mathematically!

Because when you fall 20%, You need to make back 25% to go back up.

Market Capitalization Weighted Method

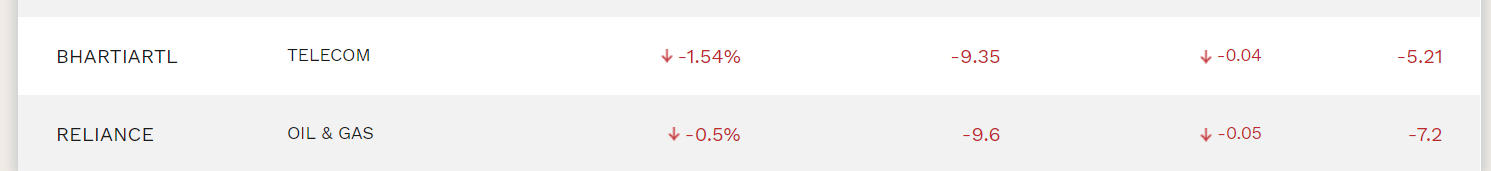

Check out this document now – NIFTY Method Equity Index

In this document, first go to Page number 16 –

- Beginning June 26, 2009, the NIFTY 50 is being computed using float-adjusted market capitalization weighted method, wherein the level of index reflects the float-adjusted market capitalization of all stocks in the Index

How to Calculate NIFTY

So, Writing again in plain English –

- Market Capitalization = Equity Capital x Price

- Free float market capitalization = Equity Capital x Price x IWF (Investible Weight Factor, a factor used to determine the number of shares that are tradeable)

- Index Value = Current market value/ Base Market Value x Base Index Value (1000)

Now, Lets decode the few terms in a layman’s way –

Base Capital

- The base period for the NIFTY 50 index is November 3, 1995, which marked the completion of one year of operations of NSE’s Capital Market Segment.

- The base value of the index has been set at 1000, and a base capital of Rs 2.06 trillion

Base Value

You can see the Base Value from NSE Website. It is an arbitrary figure used as the initial value of an index. (Using such arbitrary figure is quite common practice.)

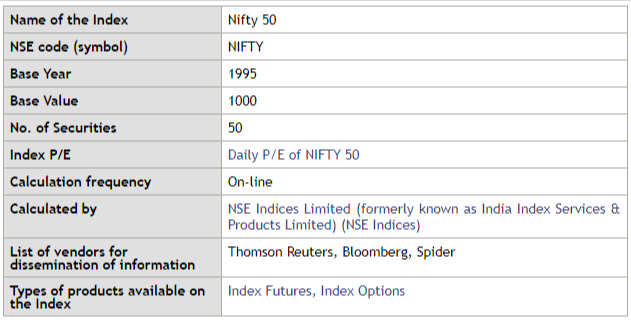

Investible Weight Factors (IWFs)

- Shareholding of promoter and promoter group

- Government holding in the capacity of strategic investor

- Shares held by promoters through ADR/GDRs.

- Strategic stakes by corporate bodies

- Investments under FDI category

- Equity held by associate/group companies (cross-holdings)

- Employee Welfare Trusts

- Shares under lock-in category

The IWFs for each company in the index is determined based on the public shareholding of the companies as disclosed in the shareholding pattern submitted to the stock exchanges on a quarterly basis.

So, IWF changes each quarter.

There is a nice illustration showing the proper calculation in the NSE Website that shows us how to calculate IWF properly.

To be Continued...

This is a part of the live discussion that happened on Unofficed Discussion Forum. Feel free to participate and engage in future discussions. Here are some agenda to be discussed later –

- Is there any API that gives us IWF Values directly?

- Would be able to calculate the NIFTY Value directly from the prices of the stocks in real-time?

- And, Will there be an arbitrage opportunity if there is a difference in the value?

Let’s discuss this further in the next part of this discussion. Don’t shy away to share your code snippets or variations in the forum if You trying something

[…] You can see it provides with the data of IWF i.e. Investable Weight Factor too which was discussed in the last article. […]