Buy on RSI Strategy Coding in Python using Zerodha

This is a programming lesson. So there will be very less amount of explanation and more code. If you’re stuck somewhere, feel free to comment.

Objective

Execute a buy order for Sun Pharma stock based on specific conditions –

- Trigger the buy order when the Relative Strength Index (RSI) surpasses 30.

- Additionally, require that the current high of a candlestick is higher than the previous high of the candlestick.

If these conditions are satisfied, then place a limit order for Sun Pharma stock.

Note – The structure of historical data and live data from Zerodha is identical. During the development and testing of functions, it’s not feasible to wait for days or months to validate their performance using live data.

To address this, we’ll initially test and validate our functions using historical data. Once we have confirmed that the functions generate accurate signals and execute trades correctly with historical data, we can seamlessly transition to using live data for real-time trading.

Python Code

def get_historical_data(kite, instrument_token, start_date, end_date, interval):

return kite.historical_data(instrument_token, start_date, end_date, interval, 0)

def calculate_rsi(za):

rsi_period = 14

chg = za["close"].diff(1)

gain = chg.mask(chg < 0, 0)

loss = chg.mask(chg > 0, 0)

avg_gain = gain.ewm(com=rsi_period - 1, min_periods=rsi_period).mean()

avg_loss = loss.ewm(com=rsi_period - 1, min_periods=rsi_period).mean()

rs = abs(avg_gain / avg_loss)

rsi = 100 - (100 / (1 + rs))

za['rsi'] = rsi

return za.iloc[-1, 6]

def place_order(kite, symbol, quantity, price, transaction_type):

kite.place_order(

variety="regular",

tradingsymbol=symbol,

quantity=quantity,

exchange='NSE',

order_type='LIMIT',

price=price,

transaction_type=transaction_type,

product='CNC'

)

print("One order placed")

def livedata():

while True:

km = datetime.datetime.now().minute

ks = datetime.datetime.now().second

if km % 1 == 0 and ks == 1:

historical_data = get_historical_data(kite, 857857, "2019-01-05", "2019-06-02", "minute")

za = pd.DataFrame(historical_data)

rsi_value = calculate_rsi(za)

if rsi_value > 30 and za.iloc[-2, 2] > za.iloc[-1, 2]:

place_order(kite, 'SUNPHARMA', 1, 453, 'BUY')

break

else:

pass

time.sleep(60)

livedata()

Output –

File ~/apps/zerodha/../kiteconnect/connect.py:671, in KiteConnect._request(self, route, method, parameters)

669 # native Kite errors

670 exp = getattr(ex, data["error_type"], ex.GeneralException)

--> 671 raise exp(data["message"], code=r.status_code)

673 return data["data"]

674 elif "csv" in r.headers["content-type"]:

InputException: interval exceeds max limit: 60 days

The error message indicates that the specified time interval for data retrieval exceeds the maximum limit, which is set to 60 days. This means you cannot retrieve data for a period longer than 60 days using the given interval.

So, Let’s modify the historical_data request to fetch data for today and the past 50 days.

start_date = (datetime.date.today() - datetime.timedelta(days=50)).strftime("%Y-%m-%d")

end_date = datetime.date.today().strftime("%Y-%m-%d")

def livedata():

while True:

km = datetime.datetime.now().minute

ks = datetime.datetime.now().second

if km % 1 == 0 and ks == 1:

historical_data = get_historical_data(kite, 857857, start_date, end_date, "minute")

za = pd.DataFrame(historical_data)

rsi_value = calculate_rsi(za)

if rsi_value > 30 and za.iloc[-2, 2] > za.iloc[-1, 2]:

print("RSI Value is " +str(rsi_value))

place_order(kite, 'SUNPHARMA', 1, 453, 'BUY')

break

else:

pass

time.sleep(60)

livedata()

Output –

RSI Value is 35.53216733131616

One order placed

Plot RSI Graph Part I

import matplotlib.pyplot as plt

historical_data = get_historical_data(kite, 857857, start_date, end_date, "minute")

za = pd.DataFrame(historical_data)

rsi_values = [] # List to store RSI values

for i in range(len(za)):

# Create a DataFrame containing a single row from 'za'

single_row = pd.DataFrame(za.iloc[i]).T

rsi_value = calculate_rsi(single_row)

rsi_values.append(rsi_value)

plt.figure(figsize=(12, 6))

plt.plot(za["date"], rsi_values, label="RSI", color='blue')

plt.axhline(y=30, color='red', linestyle='--', label="RSI 30")

plt.axhline(y=70, color='green', linestyle='--', label="RSI 70")

plt.title("RSI Between {} and {}".format(start_date, end_date))

plt.xlabel("Date")

plt.ylabel("RSI Value")

plt.legend()

plt.grid(True)

plt.show()

Output –

So, Let’s debug –

print(za)

Output –

date open high low close volume

0 2023-10-05 09:15:00+05:30 1124.65 1128.65 1122.80 1124.45 19041

1 2023-10-05 09:16:00+05:30 1125.20 1126.50 1125.05 1126.50 7274

2 2023-10-05 09:17:00+05:30 1126.10 1127.45 1125.50 1127.00 6414

3 2023-10-05 09:18:00+05:30 1127.00 1128.05 1125.85 1125.85 3172

4 2023-10-05 09:19:00+05:30 1125.85 1126.35 1125.00 1125.65 5333

... ... ... ... ... ... ...

13051 2023-11-24 13:16:00+05:30 1194.40 1194.50 1193.35 1193.95 2385

13052 2023-11-24 13:17:00+05:30 1193.95 1194.45 1193.55 1193.70 1695

13053 2023-11-24 13:18:00+05:30 1194.35 1195.00 1193.65 1195.00 5209

13054 2023-11-24 13:19:00+05:30 1195.00 1195.30 1194.05 1194.75 3679

13055 2023-11-24 13:20:00+05:30 1194.75 1194.75 1194.10 1194.10 84

13056 rows × 6 columns

print(rsi_values)

Output –

[nan,

nan,

nan,

nan,

nan,

nan,

nan,

nan,

nan,

nan,

nan,

nan,

...

...]

To calculate the Relative Strength Index (RSI) for a specific day, you require data from the previous 14 days. Therefore, you should create a separate function to calculate the RSI for each day, excluding the first 14 days where RSI cannot be calculated due to insufficient historical data. This function will compute the RSI values and return a list of RSI values for the remaining days in your dataset.

Here’s an example of how to create such a function and use it in your code.

def calculate_rsi_list(df):

rsi_period = 14

rsi_values = []

for i in range(len(df)):

if i < rsi_period:

rsi_values.append(None) # Cannot calculate RSI for the first 14 days

else:

chg = df["close"].diff(1)

gain = chg.where(chg > 0, 0)

loss = -chg.where(chg < 0, 0)

avg_gain = gain.iloc[i - rsi_period + 1:i + 1].mean()

avg_loss = loss.iloc[i - rsi_period + 1:i + 1].mean()

if avg_loss == 0:

rsi = 100

else:

rs = avg_gain / avg_loss

rsi = 100 - (100 / (1 + rs))

rsi_values.append(rsi)

return rsi_values

rsi_values = calculate_rsi_list(za)

print(rsi_values)

Output –

[None, None, None, None, None, None, None, None, None, None, None, None, None, None, 39.730639730639666, 30.078124999999943, 26.377952755905184, 27.459016393442283, 32.9457364341083, 39.50177935943041, 41.240875912409294, 43.840579710144745, 44.322344322344435, 43.999999999999666, 44.322344322344435, 38.43416370106739, 38.848920863308756, 21.513944223108012, 35.08771929824533, 38.84297520661151, 39.49579831932781, 41.409691629956676, 37.850467289719845, 37.26415094339563, 35.648148148146845, 39.0350877192979, 47.39130434782545, 56.476683937824085, 56.92307692307779, 55.778894472362374, 60.655737704918444, 71.33757961783407, 67.85714285714286, 61.83206106870202, 63.77952755905532, 71.05263157894643, 61.67664670658586, 55.24475524475518, 60.81081081081126, 52.63157894736933, 44.73684210526421, 50.0, 48.0314960629921, ...]

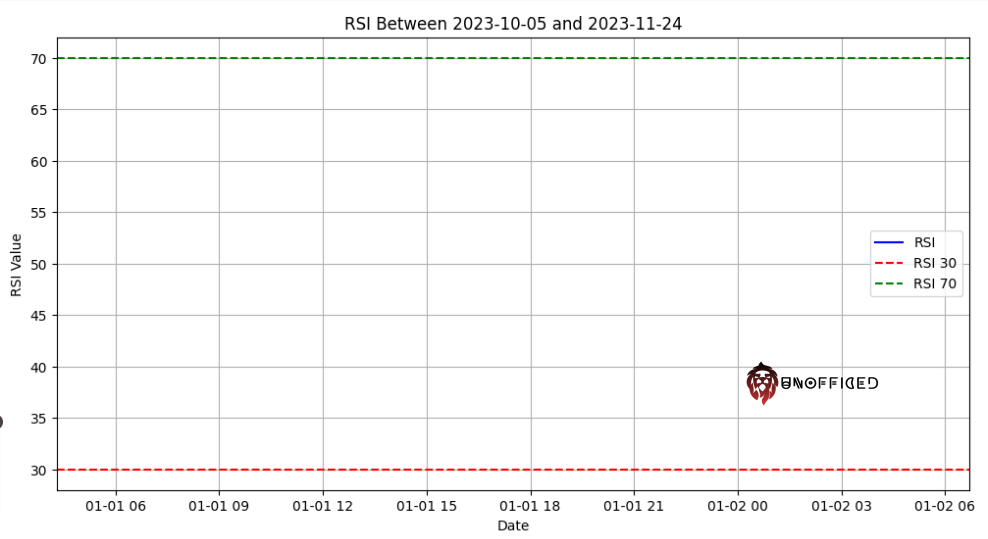

Plot RSI Graph Part II

So, Let’s plot this RSI data against dates.

import matplotlib.pyplot as plt

# Assuming you have already calculated the rsi_values using calculate_rsi_list

plt.figure(figsize=(12, 6))

plt.plot(za["date"],rsi_values, label="RSI", color='blue', linewidth=0.1)

plt.axhline(y=30, color='red', linestyle='--', label="RSI 30")

plt.axhline(y=70, color='green', linestyle='--', label="RSI 70")

plt.title("RSI Plot")

plt.xlabel("Date")

plt.ylabel("RSI Value")

plt.legend()

plt.grid(True)

plt.show()

Output –