From this week, I shall be writing my theta trades with rationale here as per suggestion of my community members.

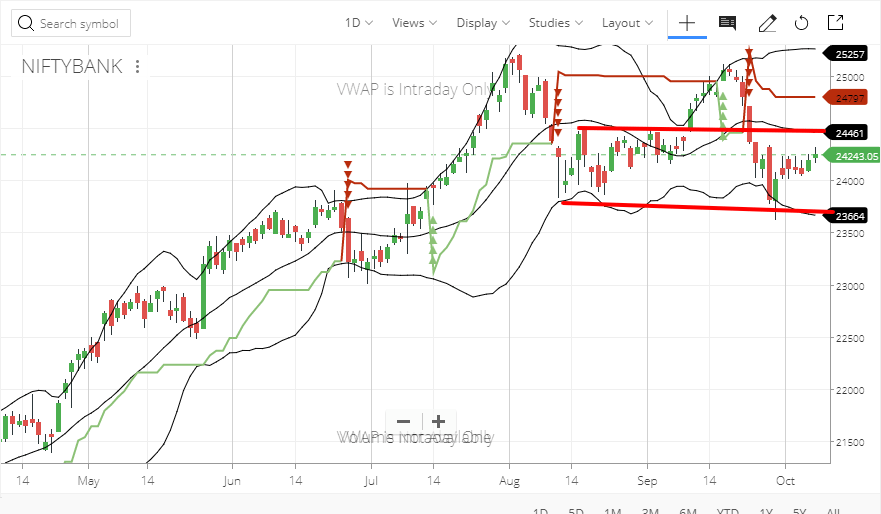

There is no significant market driver this time, so neither a fall nor a rise is expected. I am hence expecting BankNIFTY to hover around 24000 (which is a major support) and 24500 (which is a major short term resistance).

Trade Setup

Hence my trade setup for a 1.5L quant is –

- Short BankNIFTY 12 Oct 24300 CE at 87.75

- Short BankNIFTY 12 Oct 24300 PE at 177.9

This is called Option Short Straddle Strategy. I use this mostly on high implied volatility scenarios to get maximum premium like now. As the market is in indecision; our IV is high giving hefty premiums for our theta to slaughter it.

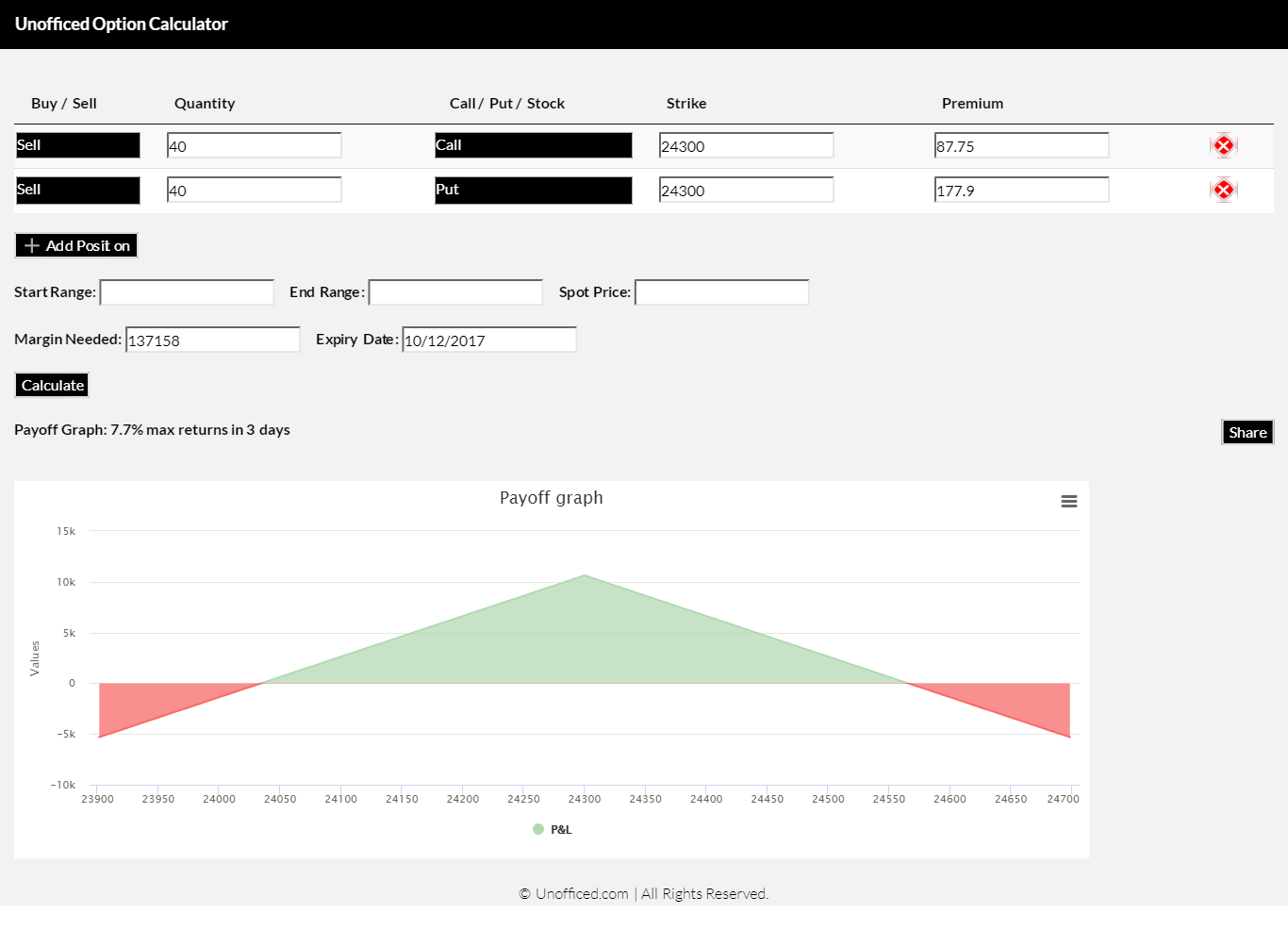

Payoff Graph

If you have short, your price should be slightly different than mine because the market is always moving. Use our Option calculator to calculate your breakeven points in case you sell later. Calculate your margin needed using Zerodha Brokerage Calculator or Upstox Brokerage Calculator and write there to calculate the maximum profit.

Our breakevens are 24037 and 24562 which is a quite decent range with a maximum profit of 7.7% if BankNIFTY expires on 24300.

If you’re a newbie in options, read up on how to trade options in the stock market here. It will give you a comprehensive overview.

Update: BankNIFTY ended at 24361.25 and this setup went to profit. Though BankNIFTY made quite a dance as usual and we did some more trades along with it. It was a profitable week.