Buddha is a scanner based on machine learning price prediction models which scan for F&O Stocks to short for day trading. You need 10 mins of your day because it shoots trade on 9:15-9:25 and won’t fire any trades rest of the day. It is perfect for office-goers who can not day trade but want to as day trading gives leverage.

The Scanner is currently discounted and available only for proprietary benefits. Please refer to the current model here.

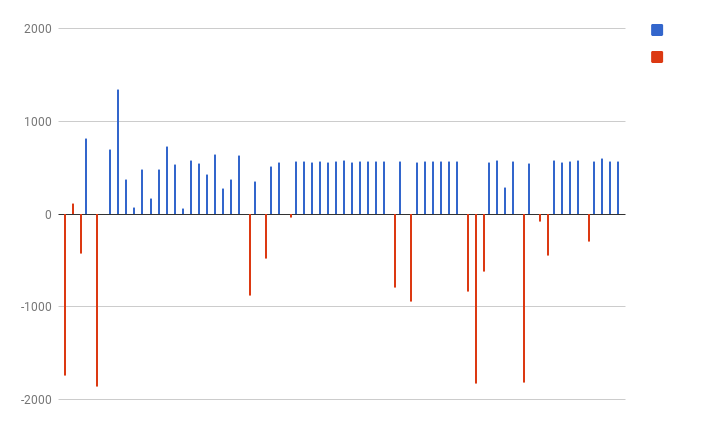

Here is the past performance –

Here is live performance updated by fellow slacks on a 20K quant with 1:3 leverage. It means we short 60K worth of a certain stock (thanks to margin given by majority brokers) with 20k as a margin.

Period of trade –

Trade doesn’t happen each day. From 2nd March 17 to today, there have been only 49 trades. So don’t expect trades every day. It shoots trade only if the initial condition is satisfied. It mostly prefers low VIX environment.

Risk: Reward –

We follow the setup of 0.95% Target Price and 3.1% Stop Loss. Every stock is from FnO Segment which means enough liquidity. Our consistent winning offsets our loss as you can see the below graph of daily P/L-

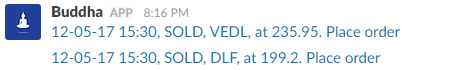

After the payment, You shall be added to a private channel in our slack group where our bot with bump whenever it spots a trade like this –

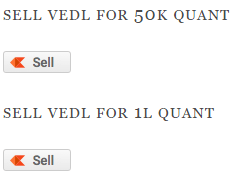

You can click on that text which will open a new window connected with KITE API. There you can choose according to your quant. Currently, it shows for 50K and 1L as you can see here –

So suppose you choose 1L quant. It means it will show you the number of stocks = 1,00,000 / CMP of the stock. ( CMP means Current Market Price. )

Putting the number of shares in this way will help in reducing latency to a huge margin.

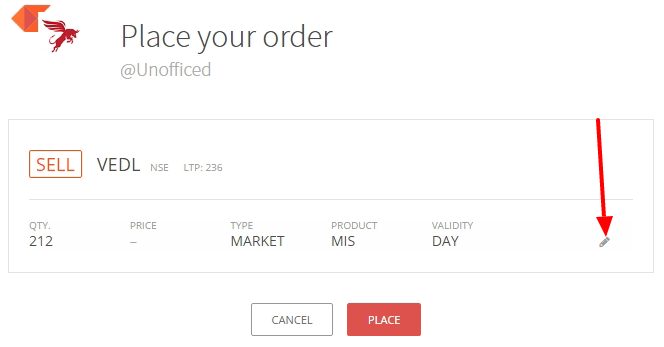

However, you can click on anyone and change your number of shares to be shorted in the next window as shown above.

But you can close manually too as well whenever you want but it is not recommended to close any other price than target price or stop loss. So you can keep a track here. As we can not see everyone’s executed price.

It will assume CMP of the time of sharing as the executed price to show close orders at the time of approach towards target price or stop loss. You will also see ‘Execute Trade’ button. When clicked, 3 orders will be placed instead of one. Entry, Pending Target, Pending SL because more than half people will make the mistake of calculating 0.95% and 3.1% of the price.

The performance sheet has many trades which were closed before reaching 0.95% or -3.1%. Were they closed at day’s closing ?

Sometimes our trades don’t hit the target price of 0.95% but as we follow MIS i.e day trading system. We close our position always at EOD.